Five Frugal Things -- Utter Gutter Mayhem!

-

Portland remembered who she was today with a full deluge of rain, which resulted in utter gutter mayhem. My neighbor texted me the above photo, pointing out that "Your gutter was not happy about the downpour." Luckily I have a handy husband, who was able to repair the entire situation using supplies we already owned. I can only imagine how much money it would've cost to hire out this job. A million dollars? More? Probably more.

-

I met up with Angela and Regina from Women's Personal Finance for a follower meetup at a local cafe. It had been scheduled at a local park, but the heavy rain put a wrench in that plan. Luckily they had a backup plan to keep us dry.

I ended up having enjoyable conversations with a couple financially savvy women and picked their brains about whether my husband and I should pay off our mortgage. The answer was straight up "it really depends," which is the same frustratingly fuzzy answer I got when I asked a few different financial professionals last week. I'm so happy that I made the effort to emerge from my cozy dry home.

-

Kristen left a few items behind, specifically a small red pepper, which I added to a Mexi-bowl for tonight's dinner. (No food waste on my watch!) I need to point out that I cooked the bulk purchased pinto beans in my Instant Pot, which makes this an extra frugal meal!

-

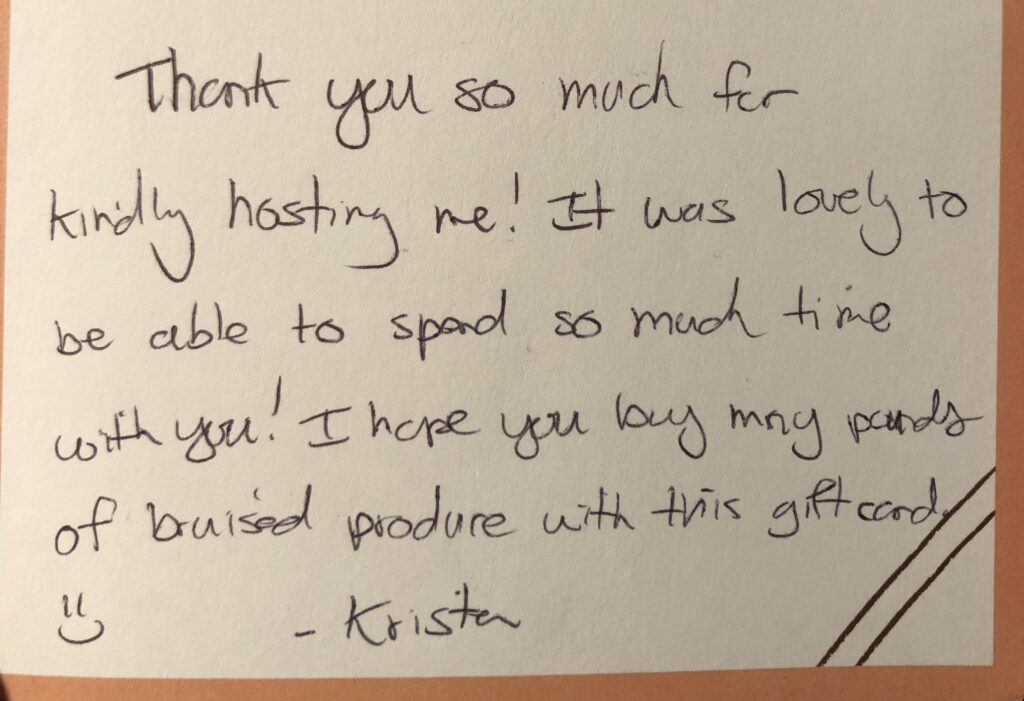

I'm now the recipient of a Fred Meyer gift card, which Kristen tucked into a thank you card. I find it hilarious that my last two house guests have gifted me pilfered hotel tea bags and now a gift card that's specifically for "Many pounds of bruised produce!" It's nice when your friends really get you. Sniff . . . .

-

My step-mother went through her collection of random tea bags and gave me everything that didn't meet her high standards. I'm happy to take her offcasts and future guests can now look forward to a plethora of choices.

1. Received a class action settlement $37.47

2. Met friend in from Florida in the city for coffee. Parking $4

She treated me to coffee

3. Shipped a couple of sakes

4. Listed a couple of items

5. Late to the tea party..starting watching Downton Abbey season 1 on Amazon prime

I loved Downton Abbey. Better late then never.

I loved Downton Abby. After you finish season 6 and the first two movies…the last movie (The Grand Finale) will wrap it up! It just came out last week. I’m going to see it next week at the discounted matinee showing.

@Kathy - I am late the same party! I started watching the Downton the beginning of August when I was down with Covid and going stir crazy at home! I love it so much! Almost finished and now to watch the movies that are already out so I can see the new one!

Sounds like you had a great time at FinCon. I love when people give me practical gifts.

1. I've been cleaning out my garage. I listed the items I didn't need and my kids didn't want on Marketplace and sold them in a couple days. Crap out, money in. My kids are taking several items including their own sports equipment and I'm giving away some things to other family members who want them.

2. My oldest is visiting. We took dinner to my MIL's house and delivered and set up a robot vacuum for my mom. My daughter had given it to me but I didn't really need it.

3. My daughter gave me her extra flat iron. Mine is old and the plates are chipped so it was pulling our hair.

4. I shared food leftover from a family getaway the weekend before. We made breakfasts and lunches at our cabin and the savings for a group of seven was huge. Whatever was leftover was split between the kids.

5. I received 10% back on my credit card for groceries purchased at Kroger while on vacation.

1. Good news: Although I put $41 in gas in the car (down to 1/4 tank and I don't usually let it get that low), I saved $.10/gallon with my sister's supermarket loyalty card. Bad news: Car is taking a "daycation" in the garage on.Wednesday to the tune of about $500. Good news: Since the car will be on "daycation," that $41 in gas will last all week.

2. I'm pulling into.the home stretch on the afghan I've been working on to enter in the fair. I have to take it to the fair office by Thursday. First place is only $10, but I hope to be able to sell it for a good price. It weighs a ton (will have to be washed and dried in a commercial (front loading) washer/dryer. When finished, it will cover a king-size bed with overhang down to the bottom of the box springs on both sides and at the foot of the bed. I'm thinking of an asking price of $400, but am willing to negotiate. Thoughts? Too high? There's a little over $100 worth of yarn and countless hours in it. I think it has a competitive edge in that it's not a typical chevron stripe pattern where all the chevron's are the same size. There are 11 DIFFERENT sized chevrons and looks more like an EKG printout. I'll be anxious to see what the judges think.

3. Once I get the afghan finished, my next "big" project is to fix and painting the rack that sits above/around our toilet. There's places where it is rusted. I plan to clean it, put black duct tape over the rusty areas, and spray paint black. My husband keeps saying "just buy a new one." I want to save the $.

4. DH and I gave each other buzz cuts yesterday on our front porch.

5. I don't have Facebook, but DH still does. Listed 3 pieces of vintage Pyrex containers with lids. Two hold 16 oz and the other one holds 8 oz. I cheaped them out for $25 for the 3 because the 2 larger lids each have a small chip in the glass. $25 in my pocket, 3 less items taking up real estate in my cabinets.

Melissa N.,

Your #3 is a lot like what I've done. I once lived in an apartment that had a missing toilet paper holder. The rule was, if you fastened something to the wall, it was theirs. So I didn't spend my money on furnishing their bathroom. Instead, I went to Walmart and bought one of those toilet paper holder stands that sets on the floor. It was a bright shiny gold finish. (Guess Trump would've liked it, LOL.) I took it with me when I moved. Over the years, the cheap gold finish tarnished and looked tacky. So I spray-painted it a neutral beige in a flat finish. It has lasted for years. (Yes, I know it would've been more non-consumer and frugal to just set the roll of tissue on the back of the toilet, but this was my home and I didn't want to do that!)

I also had a wooden "space saver" -- a cabinet/shelf unit with legs that fit over the toilet tank. I moved that with me as well. It was made of particle board and over time, the legs bowed out. When I moved into the house I bought, we removed the legs and fastened the cabinet/shelf part to the wall of the half-bathroom, which badly needed some storage. It looks just like a built-in cabinet. Much better than buying another space saver!

You know I love a spray paint update!

Being handy is definitely frugal. We are not and a gutter repair that means being on a ladder is not where I plan to start! Because of that I need to be frugal elsewhere to save up a million for gutter repairs! Thankfully we don't usually get crazy weather here.

We did not choose to pay off our mortgage because that interest rate is lower than savings is paying. However, I will be paying off a loan for some house repairs where the interest rate increased. Paying interest makes it hard to get ahead.

Stacked coupons and sales to buy ingredients for a lovely salmon dinner last night. We always try to have something fancier for Sunday dinner. Salmon cooked at home is less expensive than a chicken dinner at a restaurant!

Helped my sister pick out the nicest sale tiles for her bathroom renovation. She had leaks and some other damage so the job was necessary, but no need to buy the most expensive tile!

I recently gave away the last of my stash of interesting tea bags. We weren't drinking them and guests weren't either. No need to keep them until they turned to dust. Now everyone just gets ordinary lipton at my house. I did find Tim Hortons coffee on sale so that was a win. I had started to think we'd need to stop drinking coffee. We may still aftwr this bag is done. Tea is expensive, but coffee is worse!

Harvested chickens for our freezer. Double bagged in bread sacks I bought n.i.b. many, many years ago at a farm sale. We should have enough chicken for the year. Composted all of the inedible parts.

Defrosting a couple ham hocks that will be added to cabbage for a cheapo future meals.

Made an Aldis run, spent $37.

Hung out the laundry.

A coworker.gave me a chain saw. He doesn't like running a saw and wasn't able to start it. It runs like a dream, is super light, and very sharp!!! I love it. I am going to check back in with him and make double sure he doesn't want it. I think they're $250 new.

Worked a gig for a friend teaching high school kids about food safety. Earned $360. It will go against our farm loan.

Dh and I bought a new couch. I was hesitant to buy used because of pets, fleas, and bed bugs (NO thank you!!!) Labor day sale made it 40% off. The day bed we were using wasn't all that comfortable. My Mom has a sturdy cabinet that we can use to store all of the items we had under the day bed. It's just a cheapo couch but we were sick and tired of our former situation. We are so looking forward to sitting in comfort (kind of ridiculous but true! I guess it's the little things!) This is only the third piece of new furniture we've bought.

Having comfort in your home is worth every penny.

Sue, I'm with you on the gutter repairs. I'm glad that Mr. NCA could do this, but no way am I either getting up on a ladder myself to deal with a continuing gutter issue I'm having, or asking my friend Mr. Fix-It (who is no spring chicken either) to do so.

"Up on a ladder" is his least favorite place to be, but sometimes you have no choice.

* Got a pair of brand-new looking Adidas running shoes from my Buy Nothing group. Cleaned the inside with my industrial cleaner at work.

* Got 10 family size cereals boxes for 20$ from a guy on FB marketplace. (Yes it's weird. No, I'm not worried about it)

* Mom's birthday diner at my place. On the menu : tacos and a specialty donut just for her (as a b-day ). Gift : a box of cookies and a pack of 9 kleenex boxes. Hubby and kids thought my choice was weird, but my mom is super hard to shop for, she's not materialistic and not an "experiences" type of person, so I'm happy with the gift and so was she.

* Picked up an extra shift this week

* Still using my public library for all my reading needs

Woo hoo for free shoes!

That's a perfect (and funny) gift from Kristen!

1. Went out to breakfast with my husband on my birthday. Learned at the end of the meal that the restaurant offers three free pancakes to the birthday celebrant. It doesn't have to be on the exact day, just whenever one is celebrating, so we'll take advantage of the offer next time.

2. Friend came over for a baking session since her oven is broken. We made sandwich bread, carrot-raisin muffins and peach bars. She is a phenomenal baker and I learned several tips/tricks for making bread.

3. Same friend gave me a birthday gift of olive oil and champagne vinegar. She knows me well.

4. Renewed my membership in Friends of the Library and received a coupon for $5 off a purchase at the library's used bookstore.

5. Drove my husband to the airport to avoid parking fees. Shopped at the natural foods co-op that was nearby.

And a most happy birthday to you, MB!

Thank you, Heidi Louise! I'm grateful to be 66 and still here.

Hi MB-- are you willing to share any of the tips your friend gave you for bread-making?

Michelle, I'm happy to! We made Ina Garten's Honey White Bread together: https://www.foodnetwork.com/recipes/ina-garten/honey-white-bread-recipe-1925035

My friend had us:

1) use the regular paddle of the electric mixer rather than the dough hook to mix the ingredients,

2) hand-knead the dough for about 5 minutes rather than let the mixer do that step,

3) use a ¼ cup flour on the kneading board and don't hesitate to add more as needed,

4) generously grease the rising bowl with butter,

5) make sure the entire tea towel is wet/damp, and

6) after rolling each half of the dough into a loaf shape, pinch shut any openings in the dough before placing seam side down in the loaf pan.

Okay, I think I need to make this bread!

And yet my actual family members complain that I'm "hard to shop for!"

I don't know why they don't buy you a gift card for bruised produce too. It is the obvious choice. 😉

Indeed it is.

Happy Birthday MB!!

Enjoy being 66!!

Sugar Cat Farm, thanks so much!

Happy Birthday, MB!

Thank you, BGF!

1. After putting up my $10 curtain rod (from a previous comment), I went to my bin of saved curtains and chose a pair to put up. They are absolutely lovely and entirely free. I get joy from them every day

2. Sold nother couple items on FB marketplace and gave away 2 on buy nothing. I had asked for shirts for our grown son (at his request) from our buy nothing group and have received 5 that he likes. He went from college to the military to grad school and is trying to outfit a business casual wardrobe for as little money as possible. He's a minimalist at heart, he wears the exact same jeans and T-shirt to grad school every single day.

3. Made a sturdy backer out of a found piece of cardboard for a picture that was flopping in a picture frame. I do love the little improvements that give a lot of satisfaction.

4. Waiting for the free-gods to smile on me and bring a pair of nightstands. We're in our 50's and just now making our home look not-a-college-dorm. I can be patient.

5. Deconstructed another men's dress shirt to make into a pajama top. I use Grainline's Scout tee pattern as it's designed for woven fabric rather than knit. And it's super simple.

Kara,

If you are in a college town, wait until the end of the semester and go cruising around the neighborhoods near campus. (Best to go in a pickup truck, van or SUV.) Lots of times, kids are moving and can't take things, such as nightstands, with them in their little compact cars. They may donate them to Goodwill, but most often they'll just leave 'em at the curb. (One of my coworkers said she never had to buy a bicycle or a Xmas tree bc she always did this each December.)

Check Craigslist to see if anyone is offering them up. (I got an IKEA king-sized bed headboard, footboard + box spring from a grad student this way, he didn't want to pay to move them clear across the country. He said it was cheaper to buy the exact same items new.) You might even post in Craigslist or Nextdoor saying you need nightstands.

Also, visit apartment complexes during the last weekend of the month and search around the dumpsters. Tenants who are moving often ditch items and maybe, just maybe, you'll find some nightstands there.

Also, I once found a box of perfectly good clothes in a box near our apartment dumpster-- I wear some of them today! If you luck out, maybe you'll find some biz casual work shirts for your son....

RE: Your #3, I totally understand the satisfaction in having one less thing that's not quite right in the house!

Change in employment status edition. Bye-bye, substitute teaching!

1. Gathered up all the items I've been using for taking my lunch to school. I am giving the ketchup and mustard packets, plastic forks (some still wrapped in plastic) and other misc. items to my friend who sells snacks to kids in her apt. complex. She sometimes cooks/sells hotdogs, burgers and other foods (including BBQ beans). So the forks and condiments will come in handy. Unclutters my kitchen and frugal for her.

2. Found the two brand new school spirit T-shirts I bought at Walgreens. (Had planned to wear them on game days this year.) Fortunately, they still have their tags on. Will take them in to see if I can get a refund or store credit.

3. Gathering up my large collection of travel mugs/off-brand "Stanley cups" (most bought at Goodwill), teacher T-shirts and other items. Planning a garage sale. This goes in the pile. (Will keep a couple of those mugs, but I don't need a dozen.)

4. Over the summer, I always collect my soda pop cans to take to one of the schools for recycling. Luckily, I had not yet gone to the campus that has the recycling bin. Therefore, I have a large contractor bag full! Will call the metal recycling place to see what the going rate is, and take it in myself -- I can use the cash! Will wait until they're paying a goodly amount, which is probably the case (or soon will be) since tariffs are slapped on metals, as well. Will walk the dog and pick up cans tossed out the car windows, too.

5. Calling Area Agency on Aging, Goodwill and other human service agencies about jobs for seniors and/or programs geared for my age group. Asking the store manager to increase my hours.

I love your energy, although don't love your awful substitute teaching experience that prompted it.

Fru-gal Lisa,

If you're a member of AARP, check out their website. I know they have info about looking for a job "after 50".

Yesterday I went to start my car and it made a terrible clicking sound and the engine wouldn't turn over. I summoned a tow truck through my insurance for free, and the tow driver said, let me see your keys. He assessed my battery was dead, looked at it and pointed out it was set to expire in 2022.....he suggested he give it a charge, I drive directly to Autozone, buy the battery and have them install it at no charge and save a bit of money over having it towed to Pepboys where they would hold it over night, charge an assessment fee, and also labor for about $120 an hour.

I went directly to Autozone where the gentlemen tested and found the battery to be dead upon arrival. I bought a four year battery for $285, and probably saved $1-200 and got my car back on the road within half an hour. Thankful for the nice tow guy and young man at Autozone. My car seems to be starting much steadier now too!!!

I love this story! That tow truck driver did you a huge favor!

That tow truck driver deserves a huge round of applause. I love it when someone who KNOWS things takes a moment to help someone who doesn't. Such a kind and generous thing to do.

There have been a few folk on here who have had dead batteries. I think we had better take the time to look at the ones under our car hoods, and at least ask our car people to check the battery next time we have the car in for service..

I love that your tow truck driver help you out and I love the service at Auto Zone.

It restores just a touch of faith in humanity when people do nice things just because they can

I am no financial advisor, but I am a retired single woman who paid off my mortgage. I can testify that there is enormous peace of mind and a considerable cash flow benefit to not having a mortgage in retirement. Even with just a modestly comfortable pension, I am not strapped for cash, I have enough margin to cover the basics, save some, and (carefully) spend some, which would be much harder if I had to make a large mortgage payment each month. But it does “depend” — is this the house and location you want to grow old in? If not, then wait until you are in that home and pay that home off.

I'm with Holly on this one. It's true that you want to be in your dream home before deciding to pay off the mortgage. But DH and I were, and we did, and it's been an enormous relief to me.

I'm looking forward to putting our old mortgage amount into savings and see how long it takes to build it back up.

I couldn't believe the release of un-identified tension in my body that occurred when I paid off my mortgage. As a single retired woman looking at the mortgages of two of my three kids with shock, I continue to be grateful that I am not having to fork out those kinds of dollars every month.

One time I had a House Equity line of credit that we used to do a necessary and large renovation/addition on the last house. Once all the work was done, I looked at that HELOC with annoyance, and threw every spare penny I could find at it, paying it off much faster than I could have believed. The mortgage was less 'attackable' at that time, but the HELOC was a monster I could manage to defeat.

A few frugal, and some not so frugal things.

Had the A/C company come out for "post summer" maintenance (I do this in the spring also) -- needed a new thermostat, so my $89 bill jumped to $240. BUT..it is frugal to keep my A/C in good running order as I live in Florida and it gets a LOT of use.

Took my car in for 30k mile service - needed fuel induction cleaning - all in was close to $400. I did go to dealer as though I bought used, she is still under warranty just in case there is something that they would have to cover. Frugal to keep ones car maintained! While I waited I read my book, watched a show on my phone... drank the water I brought and ate a granola bar I brought. I am never tempted by vending machines!

Found a penny on ground at gas station.

A friend made soup and brought me enough for 2 servings.

How wonderful to have a friend who brings soup!

To me, soup is love in liquid form.

FFT, "Better Than a Poke in the Eye with a Sharp Stick" Edition (this phrase was a favorite of DH's):

(1) The Bestest Neighbors' next-door neighbors to the south--with whom DH and I had a few skirmishes during our early years on the street, but who have become better friends more recently--presented me with a $50 Ollie's gift card, for no particular reason. Maybe it was my recent birthday, or maybe it's because I haul in their trash and recycling carts for them each week (they're both in their mid-80s). Anyway, I took them some homemade basil vinegar, some lettuce from my Easy Washer planter, and some cucumbers from the big batch that another neighbor gifted me, and harmony and joy prevail.

(2) The package of salmon scraps ($2.99/lb.) I bought at Wegmans on Saturday included several pieces so large and meaty that I've treated them like regular salmon and sauteed them with the last of my dill. Some of these will be going into the salad I'm making tonight with some of the aforementioned lettuce and some of my cherry tomatoes.

(3) I went to LensCrafters this morning to order the new pair of glasses I've been prescribed, and caught an exceptionally good deal: 60% off both lenses and frames if you order "designer frames" (and the "designer frames" I chose were a modest pair of Ralph Lauren Polos that actually cost less out of the gate than some of the no-name frames I was looking at). So I got out of there under $400, which is much less than I usually spend, given my crazy prescription. (Believe me, I can't expect to order glasses online and get away with it.)

(4) I'm finishing up two complete sets of my homegrown dried herbs: one for Grad School BFF (who is arriving for a visit on Thursday), and one for another grad school friend and his wife, with whom I'll be staying before and after the JASNA Annual General Meeting in Baltimore next month.

(5) And the weather here has been so heavenly for the last week that I've had no reason to turn on either the AC or the heat. The less money I'm sending to National Grid, the better.

We get so little rain here in southern Colorado that we're thrilled when we get a deluge! Luckily, we have, for the past few days. Unluckily, the potato harvest is getting ready to start -- when dry weather helps a lot. So go figure.

We got the same conflicting advice about paying off our mortgage. That was right when the stock market was booming, too -- 'so put your money in stocks, it's a LOT more than the interest you're paying.' We heard that over and over.

We decided to pay off the mortgage, anyways, thanks to some inheritance money from MIL's estate.

And in six months, the market crashed. Had we invested everything in the stock market, we would have lost a good-sized chunk of our principal.

So -- I would say --

Pay off your mortgage.

For one thing, you KNOW that you saved X amount of interest. For certain. (Whatever your mortgage rate was.)

For another, it is a real relief knowing that you don't have to come up with that mortgage payment every month. Instead, you stick it in savings!

And finally, whatever happens in the future -- you've got that part of your life covered. And that feels wonderful.

So few people can say their home is paid off. But it really does give you confidence, and help you continue to plan for retirement. (Yes, our current house is paid off, as well.)

I didn't know the numbers so looked them up-- 40% of US homes, or about 30 million, do not have mortgages.

I don't know if that is a big or a little number or how it breaks down by economic status. I hope it is a lot of peace of mind for those owners!

Home again after my weekend trip. On the way home I wasted $5 on coffee. It sounded good, but it wasn't very good. At least I didn't also buy food.

I went to Aldi for necessities and experienced some sticker shock. Even there, a bag of coffee is more than $6. Everything, it seemed, was more expensive than the last time.

Lunch at home was the last of my potatoes -- which I got free at the little free pantry.

Found quite a few receipts for Fetch and 3 pennies. One of my Fetch receipts was worth 2000 points!

On the last day of my visit, we drove around looking at old haunts and shared memories. Then we went to the new Downton Abbey movie. The senior ticket was more than $9. I can't get used to this. Loved the movie, though.

@Katy, I'd love to know some of the advice you received when asking about paying off your mortgage. I feel like it can be hard advice to give, but ultimately, if I had the money and no other ends to meet, I would pay it off for the peace of mind. We have 10 years left on a 15-year mortgage, but with 3 kids just one year apart in high school (twin freshmen and our sophomore), college savings is what's getting my extra cash these days. I know you're well past that phase of life, soI'm wondering how you and your husband are approaching this.

1. I went to the GW outlet a few days ago, found a few things to hopefully resell, and other miscellaneous things such as toys for my little guy (little people, love every, Melissa and Doug). I also found a brand new pack of reusable makeup remover pads I’m really excited for, bed sheet clips to keep your sheets on, books and a pair of smart wool socks for myself ! I find smart wool /bombas every time I am there and love having some high quality socks.

2. Bought 1,000 worth of gift cards to Home Depot at the grocery store for fuel perks. Was used to buy doors for our basement Reno. This project has been outrageously expensive and making me anxious financially but , cheaper than buying a bigger house with a higher rate . I’m

Also hoping to take on another kiddo here and there to babysit in this season of sahm life and having a newly finished play area will make that much more feasible .

3. Really trying to keep our grocery budget down but man , it’s hard out there. In my area , we pretty much only have 2 grocery stores (Safeway and King Soopers), as well as Whole Foods. Beyond those it’s Walmart, target and Costco. I did get some good clearance items today (marked down cereal, buns, and eggs). I also had the cashier price adjust raspberries that rang up 3.79, when they were marked 1.25, as they had forgotten to change the sign.

4. While my mom is in town, my husband and I had a nice date morning. We aren’t much for going out to eat, so we rented a ball machine at our rec center. Still paid a fee, but much cheaper than going out to eat, and the endorphin surge together does a lot for our relationship as new parents.

5. Picked up a brand new package of diapers from our BN group which should be at least 5 days worth of diapers.

I went to Fred Meyer this morning and saw that they had the gluten free cake mix, from yesterday’s post, on the clearance shelf. At my Fred Meyer, they were charging $3! I’d have passed on it at any price since I like my gluten, by it’s interesting how the prices are inconsistent. Recently, you bought some clearance barbecue sauce that was cheaper at my Fred Meyer. Go figure.

I paid off my mortgage 15 years ago, even though everyone told me not to, and I have no regrets. One argument people had against it is that I can’t put the money in the stock market. Hello? Do I really want to take that risk? I’m super proud of my “no mortgage” situation, and it’s something I aspired to do before I’d ever even bought a home! Do it!

We also paid off our mortgage against the advice of a financial advisor and have never regretted it. To me, the mortgage free house is the bird in the hand and stock values are the two in the bush that can fly off with your money if they tank. I told someone my financial advisor duked it out with my emotional advisor and the latter offered more emotional comfort so it won.

Good to hear, I think I'd enjoy this security.

Exactly. I figure that no matter how bad things get, I’ll never worry about whether I can afford my mortgage payment.

It's all random pricing when it comes to clearance.

Thanks for the mortgage advice!

I’ve been thinking about it, and I think homeowners are advised not to pay off their mortgages because it’s a means of forced savings. If you have a mortgage, then you make sure to set aside $X every month to pay the mortgage. Most people, when they don’t need to set the money aside, will fritter it away on silly things like fancy cocktails and avocado toast. We both know that we aren’t “most people” and we will save that money instead.

Reluctantly paid AUD$80 for a photo ID card at the DMV this am, as I don’t have a drivers license, and my passport has expired. Have to brag, tho, our Aussie DMV, according to my American friend, is waaay better than yours, 15 minutes arrival- exit, including queue, form filling and photo taking! Friend says US DMV is pretty much a “ take a packed lunch” situation!

@Coral Clarke, you might have missed me crowing about paying only $15 (CDN) for my Driver's license renewal - it didn't occur to me to also crow about how little time it took. I had an appointment, they called me up within 5 min of my appointed time, and most of the time spent at the desk was because we were joking and laughing about the 'deal' one gets in one's 65th year. I was able to get a secondary government issued ID card that is also my (free) Medical Services Plan ID card - so now I am set with government ID for 5 years.

However, I am reminded that I need to get to work on getting my passport renewed... eek

Our US state DMV is wonderful. But it is only a open two days a week, as they want everything to be done online if possible.

Unless paying off your mortgage lump sum leaves with less than 8 months emergency fund, pay it off. I won't take long to replenish. Being debt free except for what you charge each month (and pay off in full I suspect) puts you in the drivers seat. You have a lot of control over utilities, auto, groceries (which is not a new word), and clothing. As with paying off your vehicle, keep pumping the "payment" into savings. Auto-pilot out of paycheck is the easiest route.

To be clear, it won't take long as I won't be replenishing your savings.

Hi Katy - So glad you and Kristen had an opportunity to meet. I follow her blog as well.

Regarding the mortgage- if the interest rate on it is lower than what you can earn in a CD , savings or investment account, I would leave it alone.

This may not be news to anyone, however I went to the grocery store yesterday. My hubs wanted roast beef for his lunch today. At $15.99/lb THAT was not happening. They had bottom round roast on sale for $4.99/lb. I bought a 2 lb one and cooked it when I got home. Saved a ton of $ and there's enough for several sandwiches, meals etc.

I love TEA and it is becoming very expensive. Bought a 32 oz box of loose Tetley tea for just under $11.00 and am sure I have enough tea for a year.

Went to a flea market here in town and bought 2 gorgeous oak end tables for $5.. yes - $2.50 each.

Made a few soups with vegetables that were on their way out.

Maura

OK, I offer this with a little hesitation. Often when I think of something new to me, it turns out to already be generally known to everyone else. So ignore this if it's too obvious.

Piecing together my sandwich for lunch today, I was digging out the last mayo smears from the jar and I thought how hard it is to use the last of the mayo. Then I thought about a comment regarding Katy's Tea Towel Salad Dressing, pointing out that mustard is an emulsifier and it occurred to me that mayo must be too. So I made a jar of salad dressing in the mayo jar, shaking up the vinegar first to get the last mayo off the sides. The dressing is delicious--not enough mayo left after my scraping to really change the taste, but it did help cream-ify the dressing (along with the usual mustard).

So, FWIW...

Cynthia, I've made dressing/sauce with leftovers in mustard bottles and peanut butter jars, but never for mayo. Thanks for your tip!

I'm in the pay-the-mortgage-off group. We paid ours off nearly a year ago and am SO DANG HAPPY we did this. The security alone is worth taking the temporary hit to our savings. Instead of paying towards a mortgage, now I pay in to savings. So, my unsolicited advice, if you can - pay off the mortgage. 🙂

I stopped by to say the same thing. Paid ours off after 7 yrs. Best thing we ever did! "It depends"=more trouble than it's worth (to keep a mortgage.)

1. Picked up some Little Tykes toys from the roadside and sold them on Marketplace within the same day! (after a bit of cleanup)

2. Painted the trim on a bedroom "refresh" and found an older can in my supplies. A bit of shaking up and it worked great!

I am inspired by you commenters that have paid off your mortgages! 🙂