When Extreme Frugality Goes From Fun to Necessary

The daily news cycle seems to get worse and worse, especially for people who are already living close to the poverty line. Cuts to Medicaid and SNAP benefits are right around the corner and even those of us who have wiggle room in our budgets are feeling the squeeze. I retired after 24 years as a labor and delivery nurse in 2019 and have supported that decision by cutting my family's budget to the bone, plus the small income that I make though blogging. My husband works full time as a paramedic, although I don't know of many others who support a family on that single income.

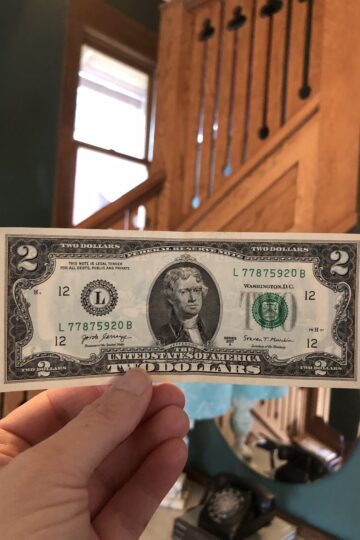

I have a 403b retirement fund that's taken a nosedive since the current administration took office, which scares the crap out of me. I wasn't planning on accessing it until much later, but I'd like to think that it could've supported me. It fun to save two dollars here or ten dollars there, but when you see your retirement go down over $100,000 that frugality becomes more dire.

Things we do in the name of extreme frugality:

- Cook simple meals from scratch.

- Pack work lunches.

- Make full use of library services.

- Repair instead of replace.

- Thrift or garbage pick.

- Mooch off others, while conversely sharing our own stuff.

- Abstain from wanderlust. Our travel is simple and except for funerals -- mostly close to home.

- Be content with whatever the opposite of "The Joneses" is. No one is trying to keep up with us!

- Drive a twenty-year-old minivan and have furnished the house with cute, but thrifted furniture.

- We're not ashamed to appear "cheap."

You forgot to mention good health, which is a biggie.

I'm so shocked by grocery store prices lately I am trying to make cheaper meals and some of them meatless. While I would like a four-wheel-drive SUV for various reasons (I could then haul our trash to the dump, which I can't in a Camry, necessitating $125 for weekly trash service), I am holding off and sticking to my Camry for now. I am thinking about selling excess belongings, which I am astonished by, rather than giving them away as usual. I haven't purchased any new clothes although I am starting to look a bit ragged.

I am in the same boat with regards to clothing. I, too, am starting to look a bit ragged, threadbare and frayed. Perhaps I feel it too.

@Rose I'm sure you're not the only one thinking about selling excess belongings. Perhaps better now than later - face it the "base" believes every lie and does no fact checking. Most of the "base" will get nailed by all these cuts. Let me put it this way - I have no empathy or sympathy for you if you voted for presidementia donny-boy.

Even my thick skull is slowly beginning to realize that since I have not enough places to put my stuff now, the downsizing I would like to happen is gonna be worse. Duh.

@Rose - we may sell and make a few bucks OR re-home and space is our payment.

Do you happen to live in an area where you could possibly utilize a burn barrel to dispose of your trash?

Nope. Though it sounds awfully fun. I like playing with fire.

Wondering if you could barter something with someone who is able to take the trash to the dump? Maybe when they take their own trash?

Good idea. I'll ask around.

I used to love going to the dump as a kid. In the 70s, you just flung bags of garbage over a cliff and then the local gulls would dig through it. Now, it's all various recycling bins and you better make sure all carboard is flattened, etc. I miss the carefree cliff days.

I have gotten very lucky with my neighborhood Facebook group for clothes. Ladies will give away clothes and list the general size. Might be worth looking into. Ours is great with curb alerts and more.

I am growing most of my garden plants from seed rather than buying started plants. I do more but this has been my focus this spring.

Some of our more recent changes that come to mind:

1. Doing the bulk of our grocery shopping at Aldi.

2. Selling more items rather than bringing them to the thrift store or posting them on Buy Nothing.

3. Saving as much water as possible.

4. Cancelling almost all of our subscriptions.

5. Reining in some gift giving and donations, while increasing our time spent helping others.

6. Getting buzz cuts to reduce the number of hair salon visits.

7. Providing our dog with socializing and enrichment activities at home rather than taking her to doggy day care.

8. Reducing restaurant spending.

We are have cut back on groceries, just the fun stuff, not essentials. I have not purchased any baking supplies. Raisins, crasins, chocolate chips and nuts are astronomical prices (I am in Canada). Eating more bananas as quick snack. I am making everything from scratch.

My entire family has agreed to a "Hippy Christmas" We have all agreed not to purchase any gifts from a store this year. We are only giving handmade, homemade, thrifted, items you may already own or trash picked items. We try to make the gifts fun, with a slight competition on the creative side. The focus is more on fun. My children are young adults now so this works at this stage in our lives.

I am fortunate to belong to a generous Buy nothing group and this has been amazing. I find if I am patient, most items I need or want will become available. I also put many items in our group for re-distribution.

I am trying to be grateful for everything I already have. We are not even close to the Jones's. Love the stuff you are with!

Appreciate this website and everyone who comments, thanks to all

I *love* the idea of Hippy Christmas! Who doesn't adore a theme? And the opportunity is nice to be able to teach a skill as well as give a gift. I'd much more appreciate my Auntie teaching me to knit than have a blanket bought from Target. Great idea!

I made sure I was sitting down and had a glass of wine in my hand before I opened my investment account statements for the month of April. The hemorrhaging wasn't as bad as I'd feared it might be, but it still wasn't pleasant. May the fleas of a thousand camels infest DJT's Qatari Palace in the Sky jet.

Meanwhile, I can't think of anything I'm doing particularly differently, except making more of an effort to clean out the pantry and freezers. That food is "sunk cost," and I'm focusing on using it up within at least a reasonable time after its sell-by dates before I restock.

Everything else--cooking at home from scratch, rack-drying laundry, keeping ol' Nellybelle (my 2010 Honda Element) on the road, batching errands, etc., etc.--is second nature by now. I've probably referenced this before, but I'll do it again: On one episode of the classic 1970s series All in the Family, Archie Bunker (Carroll O'Connor) and his son-in-law the Meathead (Rob Reiner) are having an argument about religion. The Meathead says, "Archie, you don't even practice your religion any more!" Archie replies, "I don't hafta practice my religion 'cause I already know it by heart." That's sort of the way I feel about frugality.

I don't have "seasonable" wardrobes. I have one wardrobe that I wear 365 days a year. I have clothes that I've had since as far back as 2007. My daughter bought me 12 pair of socks for Christmas 2022. I only open a couple pair at a time and I'm still wearing them despite a few holes, AND I still have a few unopened pair.

I am crocheting my own dishcloths.

PurAqua sparkling water at Aldi's is a great alternative to sugar-free soda and, at my Aldi's, it's only 67 cents for a 33.8 oz bottle you can buy 4 of these for less than the price of 1 (20 oz) bottle of soda in my area.

Making treats (cakes, cookies, etc) at home from scratch rather than buying at the store.

There are only a very few products that I am "brand loyal" to. Most of what we buy is store brand.

One more thing...please pray for the family of one of my 9th grade students that rides the school van I drive. Their house caught fire this morning. The family made it out ok, but they lost EVERYTHING. They just bought the house last fall and moved here from a neighboring town about an hour away. I am in the process of gathering my excess (bath and kitchen towels, a few kitchen utensils, some dishes, etc) to give to them when they are ready to get re-established.

Melissa N.,

Oh no! I feel for that family. If they live in the U.S., contact the American Red Cross. Its disaster services help people who are homeless due to house fires; it considers that kind of a fire just as much a disaster as, say, a hurricane, tornado, flood or wildfire. After all, it IS a disaster to that one family! The Red Cross in my city provides house fire victims with motel/hotel rooms and vouchers with which to buy clothing and necessities. Agencies such as the Salvation Army, Catholic Charities or United Way may also be able to help. Their insurance company will also provide assistance, depending on what's included in their homeowner policy.

One more thing. I have limited cupboard space and no pantry. I removed all non-perishables from the cupboards, wrote the "use by" dates on the packaging in black permanent marker, then restocked the cupboards in chronological order so that we use what's going to expire soon first. Won't work for everyone, but we are a household of 2. Works for us.

We are spending a lot less, and I haven’t bought anything “new” since “Orange Scourge 2.0” hit our nation in January. I want his economy to fail.

BUT… I recognize that I’m coming from a place of privilege. Not only do I have a nice cushion of savings to fall back on, but also that cushion is the result of years of scrimping and saving and being super frugal. I guess I’m saying that this is a skill, and I feel bad for people who are forced into it. I think it isn’t easy for some people to get into the mindset.

I’m also privileged to have saved like crazy during the good years, when people were able to get decent jobs. I feel terrible for young people who are just starting their careers, but are finding that a lot of the entry-level jobs, like those in the federal government, are disappearing. They may end up being frugal, not to save, but rather to survive. Life isn’t fair.

I have been frugalling for so long that it's become standard operating procedure. While I mostly do small things that consistently save a few bucks, my husband excels at price comparisons for services, like banking and insurance, that save us a lot of money.

Love "frugalling"! The minute I saw that I thought of the "Caroling caroling" Christmas song. "Caroling, caroling now we go, Christmas bells are ringing..." Puts a cheerful soundtrack to "Frugalling, frugalling now we go..."

Here's another one, a take-off on "Here We Come a-Wassailing": "Here we come a-frugalling, among the leaves so green/Thrifty gifts and goodies, so fair to be seen..."

I am loving the frugal carols. Y'all are so clever!

You gave us the inspiration, Ruby!

I too thank Ruby for the idea. And I think we ought to revive it in December.

Carol of the Bells ideas?

Or Twelve Days of Frugality?

Sing to the tune of Carol of the Bells (sort of)

Hark, how we save

See how we save

Reduce and reuse

Less money we lose

We will not fail

Always buying on sale

Canned goods on clearance

Leftovers make a reappearance

Mending our pants

Propagating our plants

Scrounging free piles

Gives us big smiles

We are saving lots of money

We are saving lots of money

It’s smart to be frugal

Frugal.

Well written, Julia!

We have changed how we cook. I was already meal prepping but I have worked to get better at it. We split a pig with my family and got 60+ lbs of pork for about $2/lb. We started halving the amount of meat in most recipes and adding in more veggies, beans, etc. we started gardening again also. I took a few years off when I was pregnant and my son was a baby but now that he's a toddler he's happy to help in the garden. We are taking advantage of free summer activities for our kids this year but did splurge on Black Friday for season passes to the water park. our season tickets (whole season for day pass price) are actually less than half the price of summer pool passes and will be a lot more entertaining.

I'm going back into crisis mode with the frugality stuff and no wonder! The news brings more bad tidings every day. I haven't been getting Social Security until lately and I had hoped the lean times were over for me. But now, I hold my breath each month; I am afraid that all of the sudden, the SS direct deposits will stop. (Yes, I know what Trump said, but I don't trust him to keep his promises. ) I have mutual funds, some just regular and some in a retirement account and I'm like you, Katy: it's watching a (financial) train wreck in slow motion.

I'd wanted to quit working my store cashier job but I'm afraid to. What if SS ends?

They've hiked my property tax yet again -- so much for Gov. Abbott's promise to cut them -- and I'm gearing for battle trying to argue with the county tax guys yet again.

We've had some really bad windstorms (no tornadoes, thank God) and there are shingles missing off my 15+ y.o. roof. So I gotta get another roof -- when it rains it pours! -- and it ain't gonna be cheap.

Last night, Snuggles shredded the carpet in my bedroom, which I'd planned on replacing next year, anyway. Looks like Mr. Snuggly-Wuggly Dog is going to have to be crate trained; the animal rescue group may be able to help me with that. Meanwhile, it's yet one more flooring repair I didn't plan on doing yet, as I don't think duct tape is going to work.

Another needed repair: I'll just board up a messed-up bathroom window instead of replacing it. It faces the backyard; the city won't catch me.

I found out that the dadgum broadleaf weeds in my front yard are actually a (very aggressive native) ground cover called Horse Herb. It's choked out the English ivy and the St. Augustine grass, it's taken over the whole space, and it's a losing battle. The nursey pros say some people like it bc it doesn't need water. So I think I will let it stay and just mow it. I can't afford much landscaping this year, sorry, neighbors! I'll just water the oaks and let it be.

We're not even half way through May and already the forecast is for 100 degrees F. this week. Per someone's post, I'm going to get out the great big watering can and put it in my shower stall so I can catch the water while I wait for it to warm up. Can't let all that water go down the drain! I already dump the dishpan water outside, after handwashing the dishes.

I feel for you. My adorable cat managed to dig a hole in our wall-to-wall carpet. Ugh!

Lisa, there is no way in hell SS is going to end. As I said before, seniors vote. Plus there would be rebellion if the fascist ended it, as we all know, we have paid into it.

I'm not saying go ahead and quit your job, but I wouldn't be kept up nights worrying about Social Security either. That's the third rail of politics.

I agree with Rose about SS. Even if an ending was called for, first, it couldn't end instantly. Second, look at how many recent government moves have been announced and later at least toned down, if not reversed, (even though the panic and pain they caused continues). Third, it isn't just seniors who want SS to continue: How many people would have to take in their parents/ grandparents/ other relatives? They wouldn't support the cut, either.

Oh, sweetie, you're (temporarily) living in the Land of One Darn Thing After Another. It happens. Been there. Crawled back out. Take a deep breath. Snuggle with Snuggles. This is a great place to vent. Someone (I dare say everyone?) will be going through the same thing(s). You are not alone!

Whenever I run water to get warm, I save it. Also often heat a little water in my hot pot and pour that on my washcloth.

Fru-gal Lisa, would you be able to replace your roof with a metal one? In most cases, they can just lay it over your existing roof and it's typically (at least it use to be) cheaper than shingles and usually comes with a 20 year guarantee.

A metal roof is definitely not cheaper and you pay a premium price for it. Check out the pricing and be sure you understand the cost/benefits of how the seams are constructed. A metal roof or a new roof should get you a break on your home insurance. Research that as well.

A church member who has a small farm recently turned it into a non-profit with the goal being to teach and encourage people to grow their own food. Individuals or groups can plant a large row of vegetables about 4’ x 75’ and is requested to contribute $25-50 toward irrigation. You can grow for yourself and/or the local food bank. Our family is growing corn, beans, carrots and peas for ourselves and the food bank. Besides being a place to garden, it’s also a wonderful social experience of everyone working together and sharing skills, seeds and conversation.

Cathy, what a wonderful idea. I love that you have this in your community.

We have a community garden here, too. In this case, volunteers tend the garden, both vegetable and flower, and sell them on weekends. All proceeds go to the local food pantry.

We are pretty thrifty already so mostly we have been taking on more mystery shops, doing a few a week. We concentrate on the grocery store and restaurant ones, and the gas station ones. We also took on an oil change shop this week---it has been more than a decade since we paid for either of our vehicles to have oil changes or car washes. I also volunteer at the food bank, where we are offered extra vegetables or fruits that won't last the weekend for distribution on Monday. Between shops and the food bank, we are spending less than $50 a month on food for the two of us. If it were not for milk and coffee, we'd spend even less than that. We are also putting in a large garden concentrating on things that store well, like carrots and potatoes and cabbages, just in case things get dire this winter. We are at the end of the food chain and this past winter, for example, a food barge issue meant weeks with some shortages. One way we are very fortunate is that we have lots of opportunities for free moose, caribou and salmon, so could eat soups and chilis to stretch those if we needed to. (We also have permits to fish so have sometimes gone salmon fishing with younger friends who help pull in the fish and we do more of the gutting and cleaning to compensate for less of the other physical. Our best salmon fishing area is dangerous, you have to tie yourself to a tree or risk being swept away because you are standing in hip deep water in waders that can fill with water and upend you, which happened to a neighbor years ago; they never did find his body.) I read here about folks cutting back on meats to extend their dollars; we are in the opposite situation, meats and fish being so plentiful that we cut back on produce.

Lindsey, this is fascinating. Could you remind me/us of the mystery shop organization that you work with?

Lindsey, I really think a memoir about your life in Alaska would be a bestseller. It seems like such a different way of life than here in the lower 48. I would be your first customer! I love memoirs and love reading books set in Alaska.

I've been urging Lindsey to start writing books for some time now: a memoir of her and the husband's Alaska village life, a biography of her remarkable father, and "The Adventures of Houndini and Clobber Paws."

I agree a book would be fab!

I was looking at YouTube videos like “45 meals for 20 dollars”. There is a lot of info on YouTube and some of it recent grocery prices.

Two good tips from NCA. 4 pound cabbage for $1.99 from Trader Joe’s. 75 cents a pound pinto beans from winco bins.

I love Amy’s gluten free frozen burritos and found a recipe that makes pretty easy gluten free tortillas. I just make a batch of burritos and freeze them like I saw on a YouTube video.

I’ve been doing door dash with a friend and it’s really interesting seeing what people order. Ice cream in a dish in 90 degree weather? lol. And kids in school have food delivered to school. The schools even have a special area to drop orders so it must be pretty common.

We are spending locally more than we were before. It is not cheaper but it better reflects our values.

We have been doing more cooking at home when family comes over instead of going out or getting takeout. It is both because it is healthier and cheaper.

I am working on using food from the "pantry". I am also snacking on oatmeal with fruit instead of a bar when I am home. It's cheaper, there is less packaging, and hopefully healthier.

The market is back up but the damage wrought will not be reversed.

I have been drastically cutting back on everything since last November because I "heard" him the first time.

I am trying to maintain and not improve on house things. I don't eat out, and we as a family have get togethers as its just too pricy to go to a restaurant and there are so many of us it is not comfortable to try to visit while out.

Growing big gardens, and we will share and process all of it together .

I am not looking at my money accounts, I prefer the " head in the sand" method at this point.

JC

We have been cutting like crazy since November as well. I feel anxious at the grocery store. I have cut anything extra - like a pedicure, massage or salon treatment that would have been fun and a small luxury. We do not shop for fun. I started a side gig selling on eBay et al. I am much more anxious than ever before, and I used to think we'd be fine but now I am not so sure.

Fortunately, I never find shopping fun...except bookstores. I am on a "book diet' now. Using the library, sharing and going to Little Free Libraries even more. I do enjoy the game of comparing prices though. For example, Aldi tuna is basically the same cost as Costco. Costco's over the counter meds are literally 1/4 fom my allergy meds. AND THEY WILL MAIL THEM.

Hi.

Wanted to say thank you for all the help and great ideas. My husband is employed for now but listening to all of you makes thing seem possible.

I just taught myself to iron his work shirts.

4 hours and a backache later all 22 were done. And I did a pretty good job.

Only burnt myself!

Congratulations on your new ironing skills! It gets easier, and the next time the shirts are washed, a little of the smoothness will still be there. Promptly taking things out of the dryer, and smoothing them down when they are hung, also helps get rid of some wrinkles.

Does he take his jacket off, so he can get by with only ironing the parts that show?

Absolutely - if the back of the shirt is under a jacket (or will be wrinkled anyway from a commute) skip that step! I listen to a podcast or audiobook when ironing, and it really helps pass the time.

We're pretty thrifty already, but we've become more consistent over the past months.

* Making all breadstuffs -- loaves, sweet treats, tortillas, crackers, etc. Once we run out of the current dried pasta in the pantry, we'll be making that as well.

* My wardrobe, work and everyday, needs refreshing but instead of buying I am refashioning items I don't like or that no longer fit correctly, and sewing my own from fabric I already have. Currently I am working on new overalls for work. (I work in a plant nursery.)

* We were going to get a second car now that we live in the boonies, as one car wasn't working out for four adults anymore. Instead, my partner purchased a $200 electric moped-scooter that needed about $100 in repairs, which she did herself. It doesn't go over 35 mph, but it's perfect for running errands. A Prius, the scooter, and electric bike makes it doable and everyone can get to work or school now.

* My partner is self employed, and her income has taken a nose-dive. My job is seasonal, although I do write for spare cash in the winter months. I'm working on a business plan right now for a side business that can expand to full time if need be. It will be a local service business (gardening), because I feel more secure being self employed rather than depending on my employer not to lay me off if things get really bad.

* We expect Medicaid cuts, so we have been making sure everyone in the house is up to date on all medical and dental needs.

* Life needs fun, so we have implemented "fun" Saturday nights at home. Weather depending, we are doing evening barbecues, game nights, darts and beer nights, movie nights, that sort of thing. All four of us look forward to it, and everyone is encouraged to invite friends.

* In order to make all this increased frugal activity fit into our already packed schedules, we have gone back to the old way of a task per day. Baking on Tuesdays, sewing on Wednesdays, cleaning on Fridays, market on Saturdays... Hey, it works!

Jenny, all of these are great and I especially love your Saturday night tradition.

Great proactive thinking on keeping up with medical and dental needs with the threat of Medicaid cuts.

My life was much more organized back in the day when I also did “a task a day” on a regular routine.I am gonna try to get back to that!

Your weekends sound awesome and happy.

We are making more effort to maintain our house and cars (and we made good effort before), since replacing things is more expensive.

We have cut back on our already low car use.

We've always been super frugal but I think that we've been more watchful in absolutely every area of our lives. My husband is 5 years from retirement and we've talked about variations on that if needed. The district where he teaches still offers a deal where a teacher can teach half time and get full time benefits and credit for a full year of retirement. It's a nice option.

We're making much more of a point to batch errands and keep the speedometer low. DH and I still share one car. The prices at the least expensive grocery store, Market Basket, are even creeping up to the point that convenience food is not making its way into my shopping cart. Scratch food is healthier anyway although I miss just throwing a store bought chicken pot pie into the oven when I'm tired. We've been hanging laundry on the line since March which has dramatically cut the electric bill. Thos will continue through November, when the clocks fall back and the snow makes a comeback. We don't go out to eat. DS took me out for Mothers Day and it was a real special treat. I found some marigold seeds in the shed I saved from last fall so those will be my annuals for this year. I grow them in pots and they always do well. The library is my main source of entertainment, be it books, magazines or programs it offers. I did get an Eastern Red Bud sapling from the library which I'll plant somewhere in the yard. That and the marigold seeds are my new plants for this year. No new clothes. We're attending our grandson's college graduation at the end of this month and wearing what we already own. Mostly trying to look at life from a different perspective and preparing to make do with less.

I would never second guess someone's financial standing unless they outright offered me numbers. Katy's post was about ways we are reducing spending due to the current economics in our country. Not buying convenience foods which I consider frozen chicken pot pie to be is one way I am staying within budget.

There's a classification for people like yourself. It's called being tacky. Your mother didn't do a very good job with you, dear.

I had to stock my freezer before a hip surgery I had coming up.. my husband just doesn’t cook and I did not want a week of awful expensive overly salty fatty take out food. A $12 Marie Callendar pot pie fed us THREE TIMES! ANd it was soo yum!!

A $7 lasagna from Trader Joe fed us 2.5 times, not too bad.

A couple of bagged salads. Applesauce. Canned soups.

The Mandarin Orange chicken from TJ was not to my liking,would not buy again but it fed us one night with a pot of rice on side and some fruit.

I am on the mend and back to home cooking but I may put that POT PIE into my rotation!!! (My next door neighbor buys $20 pot pies at Costco:too pricey for me!!)

We continue to buy bulk items at Costco (dog foods, detergents, TP, frozen veggies , chicken, etc) Our pantry is just rice, cereals, olive oil, etc

We only eat two bonafide meals a day. Snacks may be cheese/crackers, apple, banana

We have the apps to reduce gasoline when we buy it.

Our gift list has become very pared.

I listed more items online and reduced prices on those listed. I’m reevaluating how many vitamins/supplements I actually need

Kathy-- You mentioned only eating two "meals". One way to save, as you are, is to rethink how much nutrition you actually need and when. The older I get, the less food I want later in the day.

Update: the animal rescue folks are going to bring Snuggles a snuggly crate (secondhand, but free). He can still sleep on the floor of my bedroom but when I leave the house he's going to get a chew bone and go into "lock up." That'll keep him out of mischief. The rescue lady said his tearing up the carpet was probably "separation anxiety" because he may have thought I was leaving him forever. She has instructions as to how to crate train Snug.

That's great news. I'm glad the rescue organization is so helpful.

Hmmm, I've been thrifty a long time. What has changed?

I no longer buy clothes, not even at Goodwill. I have enough.

I have set a strict limit on groceries. I do whatever I have to do to stay under that set amount.

I turn off the lights more.

I use my ride-free card on public transit, even when I would rather drive. And I walk more.

I scrupulously repurpose every leftover.

I have let go of any home improvement projects, or any thoughts of new furnishings.

I am cutting back on gifts. This hurts.

I feel very grateful for an active and generous Buy Nothimg group in our area. Just yesterday I picked up an almost full Costco-sized box of frozen organic burritos from a gifter who disliked the one she tried. Today, a very savvy former-grocery store worker who regularly “rescues” food that will be thrown away by Whole Foods gifted me several loaves of artisanal bread, 2 containers of fresh salsa, a spicy guacamole, and some precut fruit plus a bit of produce. All very high quality! I froze all of the bread immediately and then sliced up the ripe bananas to toss in the freezer for smoothies. Mushrooms went into an omelet for lunch and we had the salsa and guacamole with our fajitas for dinner. With 3 teenage sons, the food is well appreciated gift. I also received a $3 coupon from Tillamook today for a tub of their ice cream and found the cheapest place to redeem it was target. I went in and bought only the ice cream for $3.26.

An unorthodox way I’m “saving” is by joining a local ski club. I don’t ski anymore but this is a 4 seasons club for outdoorsy folks and includes access to a home in the Sierra Nevada mountains year round. It’s a lengthy process to join and I’ve been working on it for about 18 months on and off. I had no idea these community groups/clubs existed until a friend told me about this one a couple of years ago. Unlike Katy, wanderlust could be my middle name, so this scratches that itch. I’m also liking for like-minded

Disregard that last fragment of a sentence!

Here in Brisbane Australia, and feeling your pain. We, like the rest of the world, are feeling the effects of Dark Donnie on things like superannuation, pension plans etc, as the world goes into “ what will he do next” mode. His unpredictability discourages the home grown production he claims to promote, which requires massive initial investment, trained labour, and years from inception to fruition! Like many of you, I’m a senior citizen (77), and I’m living in my own 500 square foot, 1 bedroom unit, in a vertical inner city retirement village. Those, on a pension( equivalent to to your Social Security) and renting are in pain as a housing shortage has caused major rent increases. Many are calling for a cutback on overseas students, whose fees are an important part of our economy, and cut backs on immigration ( essential and often highly skilled labour) to free up housing. Minimum standards for housing for many years now affect things like minimum size, making them more costly than emphasis purely on safe building would require. Tiny homes are difficult to find approved locations for, and in law units/ granny flats, have been surrounded by bureaucratic bunkum. Free health care is our saving grace, and, here in Queensland ( our state) 50 c public transport( buses, trains, ferries) make a car free life practical for city dwellers. I guess , wherever you live , the future holds an increasing reliance on learning how to live, joyfully , on less!

Both disillusion and *dissolution of our safety nets… 🙁

Oops . . .

Bought my grandson his Christmas gift at Marshall's as well as an outfit for his birthday this summer. Before the tarrifs.

Neither DH or I are working (both laid off from the same company, but a year apart). I've been looking for a job for ~6 months, and he's just starting. We are super lucky, in that we got a decent severance, and already had quite a good savings account. However, it's no fun to burn through your savings account by paying for health care, so we've definitely tightened things up.

1) Additional scrutiny on all of our spending

2) Prioritizing the cost of senior year for DS18. We want to make it special, but only spend on the things he cares about. It's a very expensive season!

3) Both DS18 & DS19 have jobs, to cover some of their expenses.

4) Menu planning, eating leftovers, making the most of the money we have.

5) Sharing with others through BN, continuing to handle all financial day to day management for my special needs aunt, etc. If her safety net collapses, things will get incredibly difficult all around. She worked her entire life to pay into social security, but it was at a low income job (dishwasher) based on her capabilities. She can currently live on her own, but it's very tight. Any cut to social programs will be very challenging for her.

1. While dried beans have always been on my menu, I have upped my game in having them to four days a week. This week I have had red beans and rice, twice, with red and yellow peppers and mushrooms instead of meat. I also upped my Louisiana spices. I also put the beans in a soft taco, twice, with sour cream and sauce. I had a can of chicken and made Dolly Parten's Chicken casserole and subbed regular crackers. It is oatmeal or boiled eggs, for breakfast, and pbj sandwich every day for lunch. Tuna fish sandwiches are also on the menu twice a week.

2. I don't turn on the air conditioning (which I had recently installed) unless the temp reaches 90 outside. I have thick blackout curtains which keep it cooler in my living room. I am also having new energy efficient windows installed this week with screens. While that is an upfront cost, I believe it will save on my energy bill overall.

3. I am also not planning on retiring anytime soon and I am now traditional Medicare age. I have stayed on my employee's regular health insurance and dental plan because it pays more than Medicare does. Really, I don't think I can even consider retiring until I am 70, and probably 75.

4. I fly once a year now to see my grandchildren, instead of two to three times a year. Flying is just too expensive. That is my vacation, other than a work conference, which is paid for.

5. I still don't have anything but Iphone at my house because I am too cheap to pay for the electricity for a TV or computer.

Dear Katy,

I feel the need to gently dish up a serving of tough (but tender) love. Unless you sell in a panic, your 403b has lost NOTHING! The market goes up, the market goes down, the market goes up, ad infinitum.

Even if you were forced to make a withdrawal, you wouldn't be taking the entire amount, you'd just be removing a small percentage and the remaining balance would still have plenty of time to grow.

Just for fun, scroll back in your statements to the last time your account balance matches the current one. How did you feel then? Probably at least okay.

For this reason, I try to avoid checking our account balances. DH has strict orders not to tell me. Why? Because we're not going to change anything. In fact, panic selling now would just help out the Cheat-oh and his friends.

Keep calm and carry on.

To respond to the rest of your question, I'll tell a story of recent events. We used our (old, purchased used, paid-for, small (<25') fancy-pants RV to visit our grandkids and their parents in their chi-chi Colorado mountain town. While we were there, we checked out the town thrift store and made two trips to the town dump. They have a store called the Motherlode Mercantile, which I can't recommend highly enough. (It's in Pitkin County, CO, if you're ever in the area.) We camped free on the way and parked in their driveway for the rest of the trip.

While we were there, the many news reports predicting food shortages and soaring prices made me very nervous. For the past year, I've been working through my pantr(ies). I'm low on many staples, and that made me feel On Edge.

DH and I decided to extend our trip by a day so we could make several stops along the way home.

We drove to Winco in Orem, UT and stocked up on bulk items. It was late, so we asked if we could park overnight, and were given permission. The next day, we continued on to the Costco in Salt Lake City, which happens to be the largest Costco in the world. They carry staples that a lot of other Costco warehouses do not. (Orville Redenbacher popcorn kernels for the win!) I loaded up on more staples. In between, we stopped at a couple of thrift stores, including a large Deseret Industries (aka DI) store that was clean, well stocked and reasonably priced. We found some things we'd been looking for for our granddaughter, so we popped them in the mail in SLC before continuing on our journey home. We stopped overnight at a free rest stop, then headed home.

Tonight, we are making a Costco run for the things we didn't buy in SLC, because space was at a premium and we knew we could get them at home. I'll load up on some fresh foods and frozen vegetables and we will be DONE. After that, I'll have done all that I reasonably can, so I'm going to tell myself to Stop Worrying. Wish me luck.

The things you outline as doing for extreme frugality are things I see as perfectly normal. My parents are boomers brought up during rationing during the second world war. They had it extreme. Most people these days are highly pampered. Good luck on your journey, wishing you well.

Dear Katy & Community,

Aloha from Hawaii! We have far fewer options for groceries and such out here, but I would love to highlight a resource that is nationwide and wonderful: Dress for Success. I volunteer with this organization, which helps women enter/return to the workforce with confidence. This includes styling appropriate work outfits (free, quality clothing!), financial literacy classes, job coaching, professional networking dinners -- all free and available by appointment. So if you are looking for a job (or another job) or about to get promoted (or...demoted) and need a refresher on your wardrobe or life skills, please check it out. There are often clearance sales, too, which beat the pants off my Goodwill options. It's meant to specifically lift women up, and I personally believe it does with every appointment. https://dressforsuccess.org/

Mahalo (thanks) for all the community tips and tricks!