-

-

I continue to cook almost all our dinners from scratch while my adult nephew is visiting from NYC. (I did splurge on Olé Olé takeout burritos for the boys one night.) So far we’ve had Mexican chicken soup, chicken adobo, fried rice, green curry chicken with veggies, plus one night of leftovers. Tonight will be a burrito bar. The fried rice was a big ol’ hit as leftovers, so I threw together an extra batch for random cravings.

We took a day trip to a family cabin on Wednesday, so I brought a pan of twice baked potatoes from last week’s freeze-a-palooza. They were yummy, filling, warm and perfect to fuel the three hikes that we took that day.

-

I kept a scheduled dentist appointment, even though it was inconvenient timing. Nothing frugal about neglecting my teeth. And by the way — “Look ma, no cavities!”

-

I stopped at Safeway on my way home from the dentist’s office to pick up sale items. (Tillamook ice cream was $2.99 and chicken thighs were 99¢/pound!) I also scored six bags of clearance priced mixed frozen veggies and half-off matzoh. Four bags of groceries for $41.41, which ain’t too shabby these days.

-

• I baked another loaf of no knead artisan bread. Big bang, low bucks.

• I was chatting with my next door neighbor, who then took a call from her husband who was at the grocery store. I needed a head of garlic so she asked for him to pick one up for me. Saved me an errand and he wouldn’t accept any many as “you always do so much for us anyway!”

• My friend Lise picked up tea and cilantro for me as she was going to Winco. Thankfully she’ll accept reimbursement.

-

I didn’t pay any hush money, which my attorney can corroborate.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I made a loaf of no knead artisan bread to serve with breakfast. (Houseguest = fancier breakfast than normal.) So easy and all it took was three cups of flour, a half teaspoon of yeast, two teaspoons of salt and a cup-and-a-half of water. I still have some 99¢ flour from last November, which made this loaf literally cheaper than dirt!

-

I gorged on watched The Great Canadian Throw Down pottery competition show on YouTube, which made me nostalgic for the ceramics classes I took at Antioch College in the late 1980s. I kept just two items from that era, although a couple of my friends somehow held onto my pottery pieces, including this fun vessel that lives on at my friend Maura’s house.

There’s endless content on YouTube, (including entire movies) so you really could subscribe to zero paid streaming services and still find quality content to watch. Especially when you consider free apps like Freevee, Kanopy, Hoopla and Tubi. I then think back to my childhood of the four strikingly dull TV channels and it resets my perspective.

-

My son’s living room is poorly lit, so he asked if I could keep an eye out for a cheap or free floor lamp, so I was jazzed to come across this functional specimen while out on a walk. Not amazing, but also not bad in any way. Not everything needs to be a show stopper.

-

• I cut some dogwood branches from my mother’s tree to put together some floral bouquets. So gorgeous!

• I sold a thrifted $3 American Girl doll for $40.

• I made wacky carrot cake, (no eggs, no butter) and somehow omitted the oil, but we still ate it. The texture was dense and chewy, but it kind of grew on us.

-

I didn’t thrift any Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

My college age nephew arrives tonight for a week-and-a-half long visit from New York and my plan is to indulge him without breaking the bank. Mind you, I’ll spoil him silly, but that doesn’t mean I can’t do so on a tight budget. My husband and I only have one niece, one nephew so we go all out when they visit.

Here’s what I’ve done to prepare to be the hostess with the mostess.

-

He’ll sleep in my adult son’s old childhood bedroom, which I’ve slowly set back up with the help of my local Buy Nothing group and a dash of creativity. I had to start from scratch refurnishing this room as my son moved his old furniture to his own apartment after college. I otherwise used what I already owned to pull the room back together and didn’t use this occasion as an excuse to buy anything new, or even used.

-

We’ll be dining out here and there, (Portland has almost endless amazing restaurant choices!) but I want to make sure it’s deliberate and not just because our days get away from us. I prepared and froze a variety of meals and also have ingredients for multiple crowd pleaser dishes that are quick to throw together. I’ll end up hosting multiple extended family meals and don’t want to be tied to the kitchen on those days. I jotted down all the planned food on a post-it note and stuck it on the front of the fridge so I won’t space out on my best laid plans.

-

We’ll indulge in some outings that cost nothing more than the exorbitant price of gasoline. Think day trips to the Oregon coast, Mount Hood, The Columbia Gorge and around the Portland area. He’d originally planned on visiting in January and we’d even booked hotel rooms for a couple days in Seattle, but we took that off the table as better weather means more stuff to do around town.

-

I wanted to give my nephew a bit of pocket money and coincidentally sold a thrifted $3 American Girl doll through Facebook Marketplace for $40 last night. I even told the buyer that I preferred cash to save myself a trip to the ATM. Also, my daughter gave me a box of Pocky a couple days ago and I saved it for guest room amenities.

I’ve hosted out of town family too many times to count and I know it can get expensive, especially when it comes to food as we’ll be out and about and then don’t have the time (or bandwidth) to pull together our standard frugal dinners. These meals can be served on almost any day of my nephew’s trip and I think of them as a favor to my future self.

Future Katy is a very lucky woman!

Do you have tips and tricks to hosting without breaking the bank? I’d love it if you shared your ideas in the comments section below!

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I was able to score a free gluten-free Domino pizza using the points I’d earned from buying previous gluten-free pizzas for my daughter. This may sound like no big deal, but the free pizza using points is a medium and their gluten-free pizzas only come in size small. I accomplished this finicky feat by calling the actual location, (as opposed to their central number) and explaining that I was going to order a medium, but actually wanted the small.

If this sounds both boring and convoluted, I would agree. However, in the end I was able drop a free pizza off at my daughter’s apartment. To balance out the delivery of mail that keeps getting delivered at our house.

-

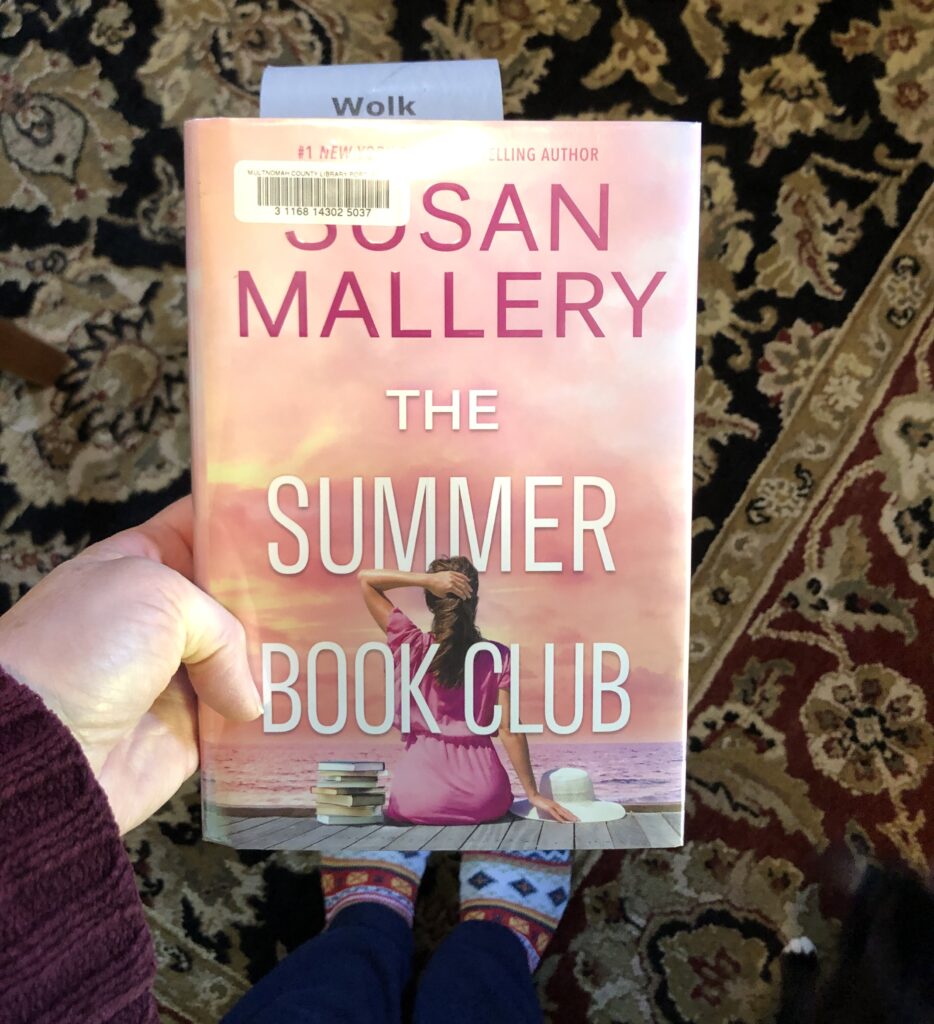

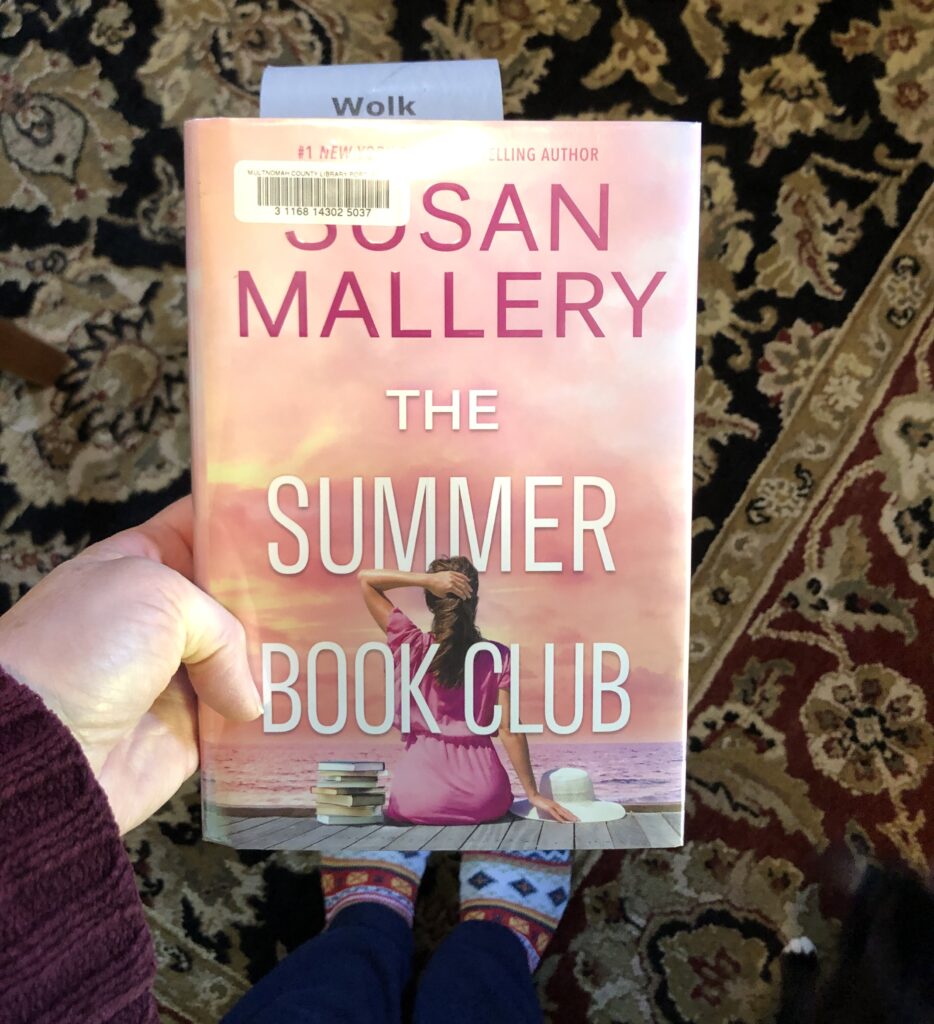

I picked up a library hold copy of The Summer Book Club, by Susan Mallery. This was extra frugal as the library was directly on my way home from running errands.

-

A woman in my Buy Nothing Group asked for volunteers for a free life coaching session, which she needed to renew her certification. I though this sounded interesting and an opportunity for introspection, so I raised my digital hand and made an appointment.

She came by the house this morning and we had an interesting and intense half hour of conversation and tea. It’s not normal to immediately share private thoughts with a complete stranger, but it was somehow freeing to step away from standard conversational boundaries. Even if it was just a one off.

My main takeaway is that there’s value to engaging in a healthy dose of self involvement. It made me think of this tired old joke:

“But enough about me, what do you think about me?”

-

I had a thrifted vintage flip clock that I tried to fix and then set aside as I realized that I had no idea what I was doing. I didn’t have the slightest idea how to put it back together, so I brought it to my favorite vintage store and gave it to an enthusiastic employee who might have better tinkering skills than I. I called it a “clock kit.”

To clarify, I gave it to him and do not want it back as I dismantled it at least four years ago. Tag, you’re it!

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I followed through on my plan to score enough free potting soil to fill my half-barrel planters through Fred Meyer’s Fuchsia Saturday event. You have to purchase plants for your containers, so I picked up a six-pack of lettuce starts. This may seem mercenary to spend as little as possible, but I hid nothing and was certainly not the only person in line with laughably big containers for small plants. The employees were perfectly lovely and didn’t bat an eye.

By the way, I did not schlep my heavy oak barrel planters to the store, instead bringing six big empty pots for my six tiny lettuce starts. I did need to add a fair amount of random fill, (broken bricks, concrete chunks and wintered over maple leaves) to the bottom of the barrels, which did the trick. I know it’ll shrink as the soil settles and the leaves decompose, but such is life.

-

I bought a single $3.99 pot of basil at Trader Joe’s to fill the second barrel planter, which is an amazing bargain. I do this every year, as there end up being at least twenty or so plants crowded in the pot. I’m deliberate with how I trim the basil as it grows, which encourages them to get nice and bushy. They’re droopy and thin at the moment, but time is on my side. I know I could plant them by seed, but this hack is too cheap and easy to bypass.

-

I friend of mine was mourning the loss of her uncle, so I cut some tulips, candytuft and blue bells from the garden and brought them to her in a thrifted vase. It didn’t cost me anything, (I already had the vase) but it gives her something beautiful to look at and a reminder that she has the love and support of her friends.

-

• I finished listening to Happy Place by Emily Henry through the library’s free Libby app. Such a good book!

• The “six-pack” of lettuce plants actually contained at least a dozen individual lettuce starts.

• I dug up a volunteer oregano plant from my driveway and planted it in a terra cotta pot for the back deck. Oregano sneaks over the property line from my neighbor’s garden, which makes this a lazy frugal hack.

• I only bought what was on my list at Trader Joe’s, (toilet paper, bananas, eggs and the afore mentioned basil plant) as I’m trying to support the company as little as possible. The company is union busting at the federal level, arguing that the National Labor Relations Board is unconstitutional. Billionaires such as Theo Albrecht Jr., (net worth 13 billion) arguing against living wages and worker rights are on my shit list! I used to shop there once a week or so, but I’ve taken it down to around once a month.

I should straight up boycott Trader Joe’s, but they’re the only place that sells 100% recycled content toilet paper at an affordable price. Why is it my responsibility to agonize over this ethical dilemma while a German business owner happily devotes his riches to decimating American rights? It’s so infuriating!

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

My son and his girlfriend were visiting and he mentioned that a $70 electronic device he’d bought on Amazon wasn’t working properly. I offered to manage the return and promptly took care of of it this afternoon as it’s easy enough for me to drop it at the UPS Store in my neighborhood. Bing, bang, done!

Don’t you wish your mama was productive like me? 🎶

-

I got together with an old work friend yesterday, so made sure to go online so I could take my time looking through the restaurant’s menu ahead of time. I always regret when I forget to do this, as I inevitably get distracted by conversation and end up overspending and/or ordering something I regret. I’d actually eaten a late breakfast, so I ordered a simple toasted bagel and a drip coffee.

I highly recommend this “frugal hack” for people who want to make sure they don’t inadvertently overspend when dining out.

-

I was about to buy bandaids when my husband reminded me that we have a fully stocked first aid kit in the car. Two band aids for my wallet and a half dozen or so for the medicine cabinet!

-

• I’m about a third of the way through the free Libby audiobook of Happy Place, by Emily Henry.

• I walked to the library to pick up my hold on The New Joys of Yiddish, by Leo Rosten.

• I clipped digital coupons for a pair of $6.49 loaves of Tillamook cheese at Safeway and had my husband pick them up as he was driving past the store.

• I forgot to use the Haagen Dazs coupon when I shopped at Fred Meyer last week, (see? I’m easily distracted!) so I took the receipt and the coupon to customer service where they refunded me the four dollars and change. I didn’t run an extra errand, I just waited until my next trip.

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

My husband and I lunched at IKEA on Friday to enjoy 50%-off adult entrees. My husband said “yes” when the worker asked if he wanted an extra side of macaroni and cheese, which was an extra $2.49. I pointed out that it was actually less expensive to buy it as a full entree rather than as a side, which doubled the portion and was 50¢ cheaper. My reward was half his macaroni.

-

I spent a couple of hours working on gardening, which meant planting rooted starts into outdoor flowerpots as well as transplanting a gifted indoor succulent into a larger flowerpot. Everything now looks fresh and tidy and I look forward to a pretty garden while spending almost no money.

I’m holding off on doing anything with my schwanky new half-barrel planters until next week, as I think can score free potting soil through Fred Meyer’s Fuchsia Saturday as long as I buy tomato starts. (Which I would be buying anyway.) I even have a variety of big lightweight pots all ready to get filled.

-

My husband and I spent an evening watching a single episode from each of the Star Trek shows, which was super fun. (Except Picard, because . . . blah.) It started with a need to rewatch The Chase episode from Star Trek: The Next Generation, as it sets up the newest season of Star Trek: Discovery.

This was super fun and will definitely be repeated, perhaps with a theme such as time travel, holodeck hijinks or identity crisis.

Here are the episodes we chose:

We did watch the last episode in bed, as we were losing steam. An entertaining night that cost nothing more than the $5.99/month that we’re already paying. I did threaten to cancel our Paramount + subscription a couple weeks ago and got an offer for two free months. I then put it in my calendar to reconsider the subscription before the price goes up again.

-

• I picked up a La Croix can outside IKEA to return for the 10¢ deposit.

• I read a library copy of Talk Bookish to Me, by Kate Bromely.

• I picked up a discarded receipt outside Winco and scanned it into the Fetch app.*

• I made a homemade pizza pie to make use of the 69¢ fresh mozzarella that I bought at the Dented Vegetable Store™ last week. Topped with sautéed yellow pepper slices, (Also from D.V.S.™) it was a a deliciously frugal hit. I used to make homemade pizza once a week or so when my kids were growing up, but I stopped when I learned my daughter shouldn’t eat gluten. She no longer lives with us, so it’s time to start this tradition back up again.

-

I didn’t buy a Lear Jet.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

* This is a referral link.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I noticed that there was an offer for a free “Chicken Cantina Taco” in the Taco Bell app, so I drove through for one while out running errands.

-

My friend Lise and I walked to Fred Meyer to grocery shop and take advantage of their 10%-off once-a-month senior discount day.

-

I scored three $1 bags of produce and now I have eight apples and three oranges, plus two $1.03 bags of spinach. I also loaded an e-coupon for a free Oikos yogurt and used a paper coupon for a free pint of ice cream. Lise nabbed the mushrooms.

-

I stopped at the Dented Vegetable Store™ and walked out with six enormous yellow peppers, three boxes of matzoh, a huge bag of sliced mushrooms, some jalapeño ranch dressing, fresh mozzarella and a package of Wensleydale cheese for eleven bucks.

-

I sliced and froze the peppers to use at a later date.

-

I earned enough Fetch points for a $25 Safeway gift card, which got spent on very exciting items like a case of canned cat food, milk and asparagus.

-

I scanned my Safeway receipt into the Ibotta app,* which awarded $2 back on the cat food purchase.

-

I then grabbed some Safeway receipts that were sitting on top of a garbage scan to scan into the Fetch app.* I also scanned a couple of random receipts at my mom’s house, one of which was worth over 1000 points!

-

I had a half box of stale matzoh in the cupboard, so I set them in a warm oven for about ten minutes, which crisped them up perfectly.

-

Someone stabbed a steak knife into a neighborhood tree, so I brought it home, (the knife, not the tree) and scrubbed it up for my son.

-

My son needed a ladle and I noticed that my mother had three, so she let me pick one out for him.

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

* Referral links

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I was gifted an oak wine barrel through my Buy Nothing Group, which my husband was able to cut in half to create a nifty pair of garden planters. I’m very excited about them as I have multiple small/medium size planters, but precisely zero big ones. I’m not sure what to plant in them, but I’ll have fun figuring it out. Maybe tomatoes for one in the front yard and basil for the one in the backyard? Maybe a small tree?

-

I then looked around for something to offer up on Buy Nothing, (I like to balance my giving and receiving) and gave away a sturdy outdoor Rubbermaid tote that a neighbor gave us a couple years ago. Super handy, but I’d yet to put it to use, so off it went to someone who wanted it for “camping.”

I didn’t need it, she did. Perfect!

-

I took down my backyard canvas tarp to wash and mend. Back up it went and I once again have a modicum of privacy from the neighbors. Not that there’s anything specifically wrong with the neighbors, but the house is an AirBnb run by a slumlord and I’d rather not be on full display for a parade of random strangers.

Why a canvas tarp? A full wood fence would set us back at least a couple thousand dollars and the tarp was around $22. Plus I think it looks artsy and cute. Team tarp.

-

• The tenth season of Alone finally became available on the Roku History channel, so I binged it over a three day period. For someone who considers herself “indoorsy,” I sure do love this show about people who go alone into the harsh wilderness to show off their survival and bushcraft skills! They forage for berries, I forage for gardening supplies.

• I lent my covered casserole dish and insulated carrying case to a neighbor who filled it with lasagna and took it to Southern Oregon and back. Happy to share.

• I pulled five matching back frames with white mats from a different neighbor’s garbage. They were in perfect condition and three have already been claimed by my son for his apartment. This family is going through tough times and I don’t fault that she didn’t have the energy to find a better way to get rid of them.

• My husband had our son come over to help him change the oil and replace a couple bulbs on the Prius, (which we handed down to him.) He then washed the car inside and out and polished the headlight covers. Like a new car!

• My recent baking of a chocolate wacky cake reawakened the knowledge of how easy these cakes are, so I cobbled together a gluten-free carrot cake version and brought slabs to both my daughter and son.

-

I didn’t buy a Lear Jet.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

It’s been awhile, but it’s time for another Non-Consumer Mish-Mash blog post, where I shine a light on a couple items of random nonconsumerism.

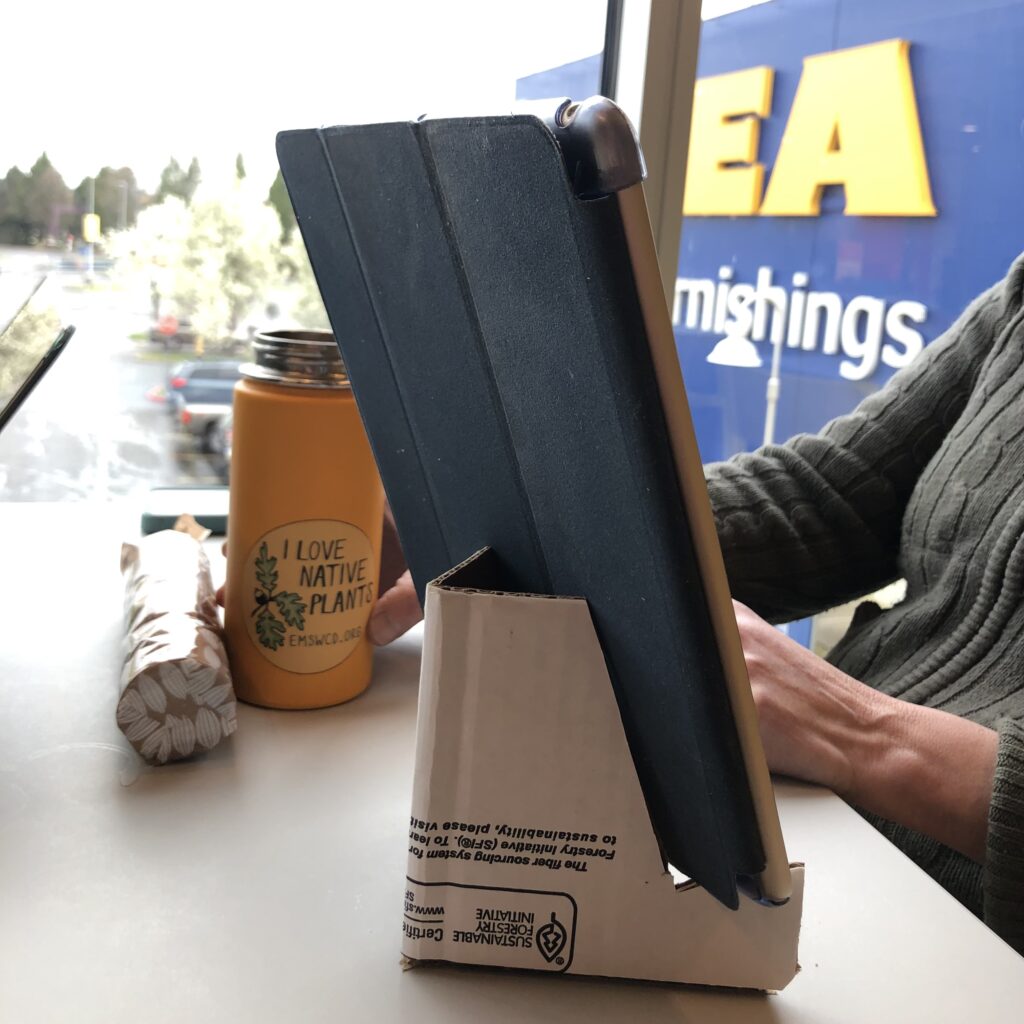

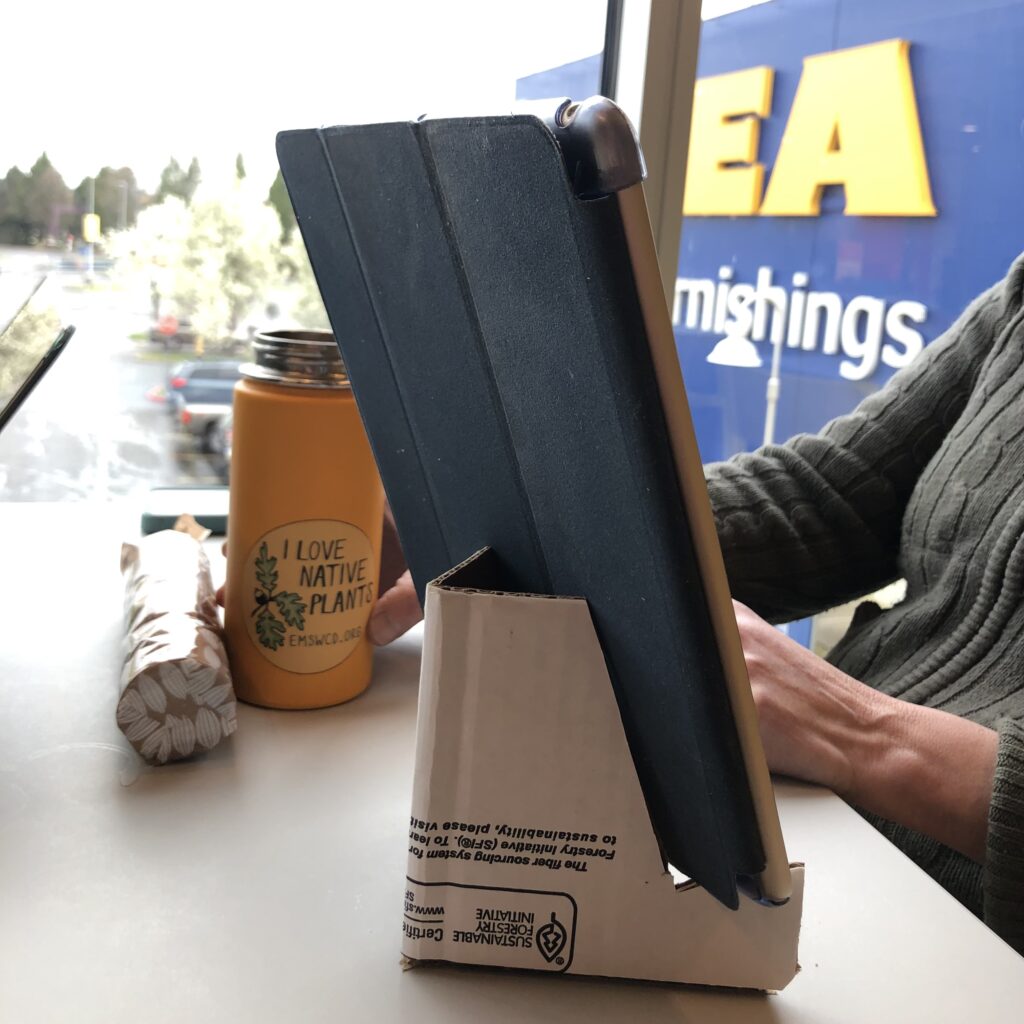

My friend Lise is a sustainability genius. You might think that I’m good when it comes to figuring out creative solutions to sustainability issues, but she regularly puts me to shame. Just today the two of us brought our laptops to IKEA to drink free coffee and work on individual projects, when she casually whips out this iPad stand. What?!

Of course I had to document. She did admit that she found the idea online, but still . . .

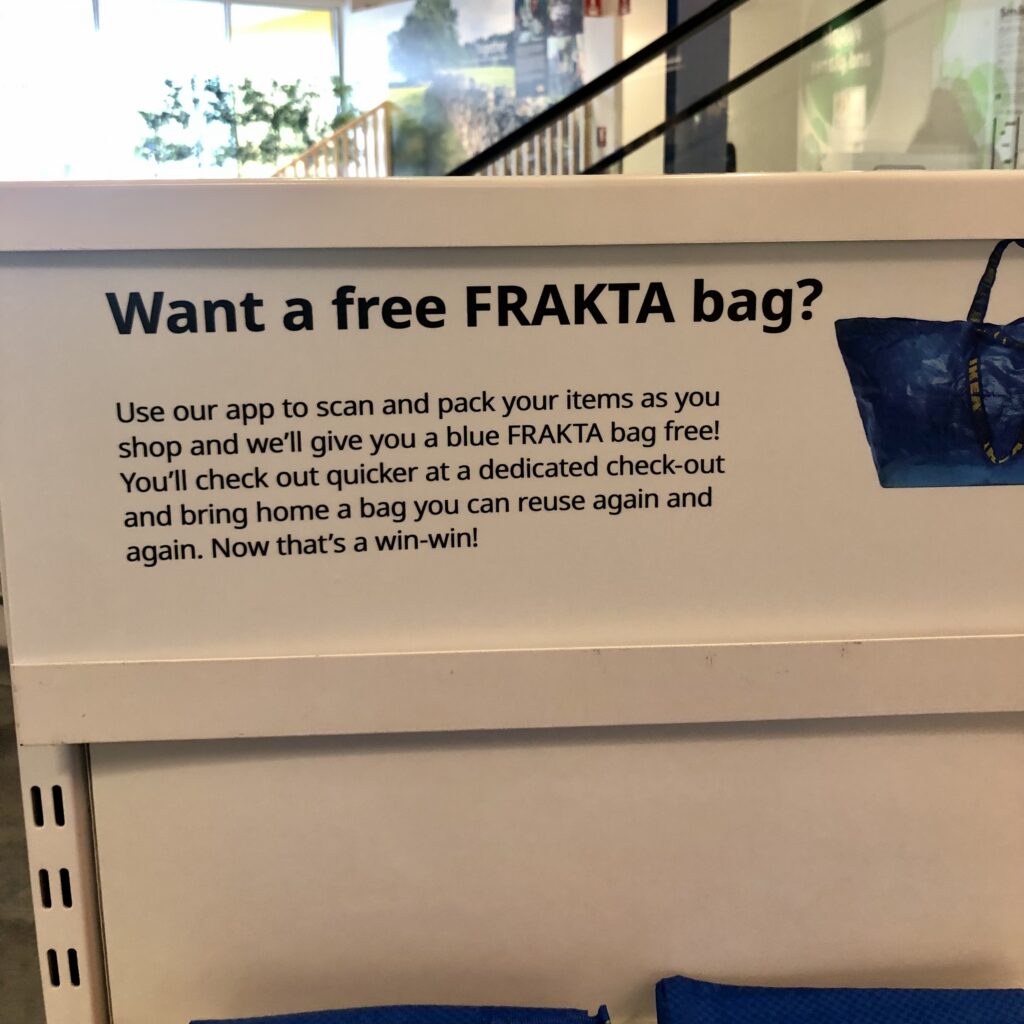

Then I came across this display explaining how to get a free Frakta bag. Of course I was there to drink the coffee not buy the things, so it didn’t pertain to me. Normally, I don’t mind jumping through a few hoops to get something for free. Especially a Frakta bag, which are indestructible and endlessly useful. I cannot even count the number of dorm rooms and college apartments my kids moved into and then out of with the assistance of these bags.

Plus it’s fun to say “Frakta” out loud. Like swearing.

P.S. I did get a 65¢ IKEA veggie dog.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...