Five Frugal Things

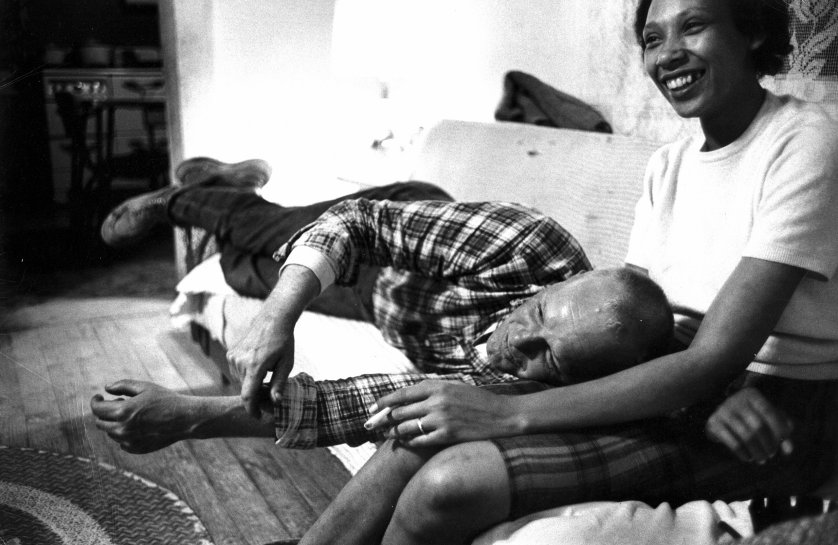

- My husband and I went to see a movie on Valentine's Day, and because we chose a second run movie, (and it happened to be two-for-one Tuesday) we paid a mere $4 for the two of us! By the way, saw the movie Loving, based on the true story of the couple whose 1967 Supreme Court case legalized interracial marriage throughout the entire United States. Great movie, catch it while it's still in theaters!

- The restaurant that we'd planned on going to on Valentine's Day wasn't doing their normal happy hour menu, so we opted to go to an old British style pub and split a $17 order of fish and chips. Of course we ordered extra French fries, as no marriage is strong enough to share a single order of fries. Even on Valentine's Day.

- I'd been craving biscuits since seeing Loving, so I combined homemade biscuits with the last of some leftover hamburger to create yummy little sliders. Needless to say, they were delicious!

- I spent the day puttering around the house and ticking off little tasks from a to-do list. Very satisfying and certainly very frugal. So now I no longer have potting soil spread over my porch from a knocked over plant, the passenger seat of my Prius is refreshingly free from coffee stains and the jumble of entryway shoes has been relegated to people's closets.

- I didn't buy a Lear Jet or a vulgar gold-plated apartment in the sky.

Now your turn. What frugal things have you been up to?

Katy Wolk-Stanley

"Use it up, wear it out, make it do or do without."

Click HERE to follow The Non-Consumer Advocate on Twitter.

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Click HERE to follow The Non-Consumer Advocate on Pinterest.

1. We took a trip to the coast for my birthday. We booked mid-week to avoid a holiday weekend rates and traffic, took our dog as he loves the beach and they allow dogs for a one-time fee, much cheaper than boarding! We got our bottle of wine comped due to some extremely loud people above us causing us to change rooms, and they hinted they might comp is more tomorrow AM. I hate to complain, but it was 6 hours of dropping very large things...or something...

2. Shared our booking on social media and received 2 free pints of beer at the restaurant on site, which was great!

3. Went to our local bakery to buy breakfast and lunch items before heading to the coast. There are very limited dining options in the winter, and it saved us around $50.

4. Drank the free yummy coffee from the hotel lobby and took the dog on a walk. Read and did a puzzle. Caught up on our guilty pleasure, HGTV. We are so thrilled to be decompressing from work.

5. Booked a free Barre3 class for Saturday, used my birthday reward at Starbucks to get a Venti latte and shared it with my husband. Wrote to Starbucks about a recent experience and they refunded me AND comped me a new drink. Turned disappointment with my neighbors into action and emailed my councilwoman about my support for our residential upzoning and affordable housing plans. Did some crosswords. Lot of little things this week.

I love crossword puzzles too, especially the ones with a clever theme. They are a form of inexpensive entertainment for me.

1. I cancelled some insurance plans I deemed unnecessary...$163 more in my pocket every month. 2. I am still eating on the leftover soup concoction of free pumpkin, tomato, chicken, and some cheese...it is still good, but I admit I am getting tired of it. Since it is cheap and filling, I will soldier on...lol. I also took my lunch to work and ate breakfast at home, so no meals out. 3. I will be coloring my hair this weekend. It cost $3.00. I have done it for years, ever since a local beautician turned my hair beet red (I kid you not), and I am blonde. It cost me over a hundred dollars to try to correct that disaster with another beautician. He did the best he could to fix it. I have been in paranoid about anyone touching my hair since. 4. I turn the heat off during the day, it has been warm enough to do so, and turn it to 66 at night. It cuts on some at night, but that is about as low as I can stand it. Props to Katy for her thermostat control! 5. Really, most of my savings are passive..somewhat. I do not pay for a gym, I walk for free. I do not pay for a housekeeper, I clean. I do not usually go out to eat, I fix my own unexciting meals. I only pay for a vacation about once every four or five years.....a train trip to see my daughter and the hotel.She comes to visit about once every two years. Otherwise, I just count required work conferences as vacations, since they are in nice areas. I do not clothes shop unless I really need something and then it is a consignment shop, usually. I do my own eyebrows and nails. So, number five, is I just do not "do"....

I like Cindy's #5 so much that I'm going to make my entire FFT this time things I don't do. Mine differ somewhat from hers, since we're different people in different places and different stages of life. Everyone else's mileage will vary as well. Anyway:

(1) Apart from soap, shampoo, and a couple of different lotions, I don't do *anything* by way of cosmetics/grooming. I even kind of like the postmenopausal curly hair and the gray streaks.

(2) I'm +1 with Cindy on not paying for a gym. I walk and garden when Upstate NY weather permits, and ride my stationary bicycle (acquired in trade for an old leather jacket of DH's and a pair of snowshoes I couldn't use) when I can't. I use some of DH's old scuba weights for upper-body workouts.

(3) Thanks to all the inspiration here on the NCA, DH and I have almost completely given up meals out. (Considering that we both came into this relationship 39 years ago with almost zero cooking skills, this is pretty good.)

(4) When it comes to clothing, I've been doing the Compact for years--and this gets even easier as we get older and less fashion-conscious. (Not that either of us seriously followed fashion to begin with.)

(5) OK, this one has been harder: Because of DH's increasing memory/cognitive problems, we will probably not be taking any more trips that involve more than a day's car travel from home, overnights in unfamiliar locations, or air travel. Some of this is an ouch. But I console myself with thoughts of the money we're saving.

Your #5 resonates with me. My husband "doesn't think it's that bad" but I definitely see signs of memory decline. This is the first winter in a few years that we haven't gone to Florida--lucky for us, the weather here has been mostly mild. I have spoken to our doctor but the next step is testing, and I don't want to force the issue if DH is unwilling. It must be very depressing to receive the dementia diagnosis when you are still "not that bad." Of course I see more than others, but I'm happy enough not to have gone to Florida this year--it was cold there quite a bit anyhow. I worry most about driving ability because I hate to fly. He can drive if I navigate, so far. I can drive but don't like to on trips because I fall asleep easily due to meds and I don't want to take chances. I don't go further than about half an hour from home by myself AND I pay special attention to staying alert. Careful is important to me!!

Back from remote and about to head back out. But I've managed a couple of things:

1. Took leftover pizza for lunch today

2. We are having a movie night with our youngest. I'm testing a data projector for work and we are watching Star Wars on our dining room wall. My daughter is delighted

That's about it really

1. Took the kids to the dentist for their 6 month cleaning. It cost me nothing out of pocket as we pay for it thru my husband's insurance. No cavities and they both came home with a bag of goodies: toothbrush, floss and toothpaste.

2. Cooked black beans in my crockpot and froze them in small portions for future use.

3. Knew in advance that Wednesday night was going to be crazy. Pulled out 3 containers of frozen soup so that we wouldn't need takeout.

4. Listed 10 more items on EBay and already have bids on 2 of them.

5. Took used boxes and packing material from work that would have gone in the garbage. I use it for my EBay sales. Why pay for it when I can get it for free.

1. Going out of town this weekend for daughter's volleyball tournament. She will stay in hotel with team and other players (paid for months back) we will avoid hotel costs by staying with my aunt and uncle and will have added pleasure of a visit with them.

2. Going to work dinner tonight, employer paying.

3. Ate "whatever" for dinner last two nights when too tired to cook, resisted urge to eat out.

4. Have still bought nothing (objects) since Jan. 1 except groceries, cleaning products and 1 b-day gift.

5. Sticking to budget and tracking expenses since Jan. 1, savings rate up significantly.

Frugal Fail(s) Yesterday: Had to drive to work yesterday (needed to go to far away meeting mid-morning) so $14 in parking. Had a lunch with a colleague who's going through a tough spot so I picked up tab, it was a nice restaurant so with tip about $35 even with no beverages. And it was my "turn" to buy starbucks after our run yesterday (only time I have Starbucks anymore) for almost $10 so spend almost $60 on non-necessities, ouch! At least it was payday...

We've been having "whatever" for dinner four nights running. As we limp to the end of leftovers and easy eats, I have to get our menu and grocery list back up and running. My parent-guilt is starting to react badly to the steady diet of "whatever".

Youngest and I were home alone yesterday. I popped a big bowl of popcorn for her afternoon snack - she had 200 pages of a book to finish by this morning - and about 6:30 we decided it had counted as dinner too. She knows where the peanut butter is. I'd say save your parent guilt for other things (like letting an 11-year old get 200 pages behind in her homework, oops.)

This week:

1. Mr. Picky Pincher and I didn't exchange gifts for Valentine's Day.

2. We cooked all of our meals at home this week.

3. I've had bad allergies all week, but thanks to my reusable homemade hankies, I haven't gone through a mountain of expensive tissues.

4. My thrift store is having a sale today and I plan to buy more cloth napkins on sale.

5. I'll try to make time to sew the rest of my dress this weekend. I'm making it out of a thrift store table cloth and a $2 dress pattern.

Loving was the best movie I have seen in some time.

Have you seen Hidden Figures, about the black female NASA super-brainiacs? Took my young niece to see it and was thrilled that she not only came away sensitized to some of what went on during segregation, but also said, "Wow, not everyone makes friends who help them try to get better jobs and keep trying for stuff!" I am always preaching that the friends you make can make or break you, so look for people who will help you be better than you are. To have her see it for herself made me feel this movie was money well spent.

1. I have been making a daily list, a la Katy. It helps to know that I'll have to put an unfinished task on the list for the next day if I don't get it done. It works much better for me than a list I keep adding to.

2. I have not bought new shoes for a few years (no I am not Imelda Marcos but I have hard to fit feet and I am trying to be more non-consumer). I have a Steri-Shoe that I bought on eBay to sanitize my shoes. I pulled it out the other day and only one of the two sanitizes work, so I just "zap" one shoe at a time. When I have time I will research what might be wrong with the second sanitizer.

3. I saw a crochet pattern for a Swoofer mop head (a washable replacement for a Swiffer). I have the materials needed so I will make one and see what I think. If I like it I'll make more for a fund raiser, where all proceeds go to charity.

4. I made a big pot of soup in the morning yesterday and two friends came for lunch. I also made grilled cheese sandwiches (it was a cold and windy day) and put out fruit and some sweets. No need to buy special food for real friends.

5. Remembering to feel grateful that I have not had to dodge snow and ice this winter. Life is so much easier and safer in that situation. I'm also feeling grateful for the increased daylight this time of year. My psyche is much happier.

1.Husband is out of town for 2 days, so I cobbled together a dinner out of leftovers in freezer.

2. Colored my hair with box color I got on sale for $5.99 vs. much more in a salon!! (I also got beet red hair a long time ago= no more beauty shop color for me!)

3. No gym fees. I walk, stream yoga videos and Tai Chi on the TV, and ride my bike with the dear husband. I also have a memorized 15 minute simple yoga routine I do in the mornings sometimes.

4. Library, library,library: language CD's, books,movies.Free!!

5. Always make my own coffee.Can't figure out how that $5.00 a cup coffee habit got started in this country!!!

4.

1. We are going to spend the first 3 nights of my daughter's winter break at a friend's ski house (getaway without the accommodations cost).

2. I am going to buy my metrocards for the year this month as my Chase credit card has 5% back on public transport

3. I have to go to the ATM today, and am going to make sure to go to my own bank rather than paying the $3 surcharge to use a different one.

4. We rent my daughter's skis for the season at a ski shop near our house, rather than renting on the mountain... less cost and less hassle.

1. I am carpooling to an out of town meeting today.

2. Yesterday I trash picked early and dropped stuff at the thrift store en route to a meeting to work on today's agenda. I was two minutes late to meeting and reported what I had found in trash. One person--whose birthday is today--was very excited about the dog steps I had donated. I went back to the donation drop off and asked to have them back. All the guys who take donations know me, so I got them back with a fair amount of teasing. Some women have personal shoppers at Saks--I have an in with the thrift shop staff.

3. Every morning Bill, the dogs, and I walk a mile to Whole Foods so Bill can get a cup of coffee. He brings his own mug which qualifies him for the $1 refill.

4. Total frugal fail--we adopted a second dog. An 11 year old cocker spaniel with high blood pressure who we'd been fostering since August. We had fostered Beau for 6 months five years ago-I'd always thought of him as "the one who got away." Frugal success--using Good Rx I've got his anti-hypertensive meds down to $12/ month.

5. Instead of high-priced pill pockets, I give Beau his twice daily meds in a little glob of pre-chewed garbonzo or a piece of baked squash.

Good for you on the doggie adoption! In the past we have adopted elderly dogs and they have repaid us with love and loyalty. Priceless.

I love that you take things from the trash to the thrift store. I do this too and get teased by my family and friends for it. However, I hate for perfectly good items to go into the landfill. Secondly, I am so glad you adopted Beau. I love cocker spaniels and have owned 3. My last spaniel died 2 years ago at 14 1/2 and I miss him every day. However, I having been looking into cocker spaniel rescue.

Beau is adorable--and the only one of my guys (husband and another dog) who is always up for cuddling on the couch. Bill and Cocker Spaniel Rescue are lucky that we've only adopted 2 of the 30 dogs we've fostered. (Oldies But Goodies).

What's not to love about picking through other people's trash? It has spoiled me for thrift shop prices, not to mention retail. It seems as though if I want something, the universe sends it to me.

Beau sounds like such a wonderful soul-dog. I am glad he found his way back in your life! <3

1. I don't color my hair and have just realized what a savings this is! I have ash-blond hair that seems to hide gray strands.

2. Have contracted another cold and missed a meeting at a coffee house. Feeling miserable but am glad to have saved $3 that I would have spent on tea.

3. Amish chicken was on sale at our local meat and produce market for 50c a pound. Purchased ten pounds. This was the lowest price I have seen in this area. Need to clean out our deep freezer to make room for these bargains when I run across them.

4. Had lunch with my college group at a restaurant that raised their prices. However, managed to take home leftovers for supper. I will count this as a neutral.

5. Goal: try to convince husband to share entrée when we go out for dinner. I will also have to adjust my tastes. Also, no purchase or even rental of gold plated anything.

The people in the picture look *so* happy! I'll look for Loving.

1. Made boxes for ebay books out of scrap cardboard, instead of buying boxes. Looked ok, and did the job. Still looking for used boxes for other sales.

2. Used unloved beans to make stove top casserole (is it a casserole if it doesn't go in the oven?). We even have leftovers, which is amazing with a teenage boy. We'll have lunches for today and the weekend.

3. Reused failed laundry detergent as general purpose cleaner. It worked well in the bathroom, and did not dissolve in the washer -- which made my clothes dirtier.

4. Expecting our biggest wind/rain storm in 10-20 years. I will spend the day cleaning up anything that might become wind-borne. I'll also clean out the drain that clogs with leaves and dirt so we don't get flooded.

5. Not frugal: buying new tires today. I limped home at 5 miles an hour yesterday because one of my tires was coming apart. My husband put the spare on. I did call around, and found tires for $10 less than my first choice, plus a $25 rebate for President's Day weekend.

See if Girl Scouts are selling cookies in your area, and ask for the empty cardboard cartons.

It has been a rather spendy week for me. A visit with my lovely sister is never inexpensive. However, having a generally frugal mindset makes these occasions possible. I am back home and getting my frugal groove back.

1) I stopped at the grocery to buy my favorite coffee on sale. Thanks to my "Tightwad Gazette" price book, I know that it is only this price once every quarter and plan accordingly. I also returned the cheese that I purchased that had been recalled ... Scary.

2) I went to the Theatre last night as the guest of my SIL I wore a sweater dress that I had purchased at the thrift store for $6 and shoes that I bought for $5.

3) I have set aside this morning to clean my own house. (Thank you Cindy from the South for reminding me that this is indeed frugal.)

4) I have 17 items currently listed on eBay. I sold only one item this week. February sales have been a bit slow. I still have a back log of items to list and continue to plug away at this.

5) Not frugal, but definitely NCA -- a reminder to renew, reduce, recycle, and upcycle. When driving to South Florida, I passed 5 - yes 5 - landfills. They rise like mountains from the flat terrain. Seeing these is always a sad reminder of what we are doing to the earth, and what has been done to my home state. As a girl in the 60s and 70s, there were miles and miles of untouched beaches, orange groves, marsh land, and dairy farms. My have things changed! In the 50+ years that I have been alive, Florida's population has increased 500%. We have lined the beach front with high-rise hotels and condos, built to the edge of the Everglades, and constructed 6 and 8 lane highways. Of course, Orlando the pretty little town where I was born has been changed forever. I know many save for years to visit Disney World, Epcot, and Universal studios. Some dream of retiring on a golf course or living in a state free of income tax. But it has come at a great cost. I find myself saying, " remember when ...."

Bee, I can totally relate to your #5. My Florida roots go pretty deep (to the extent that any roots in FL can go pretty deep), since my grandmother was born near present-day Melbourne in 1899, and my mother was born in West Palm Beach in 1921. I also had relatives in Orlando in pre-Disney days. I myself went to college in Sarasota in the 1970s, just as the slide toward overdevelopment was really starting to happen. (My first college boyfriend rounded up a bunch of us one weekend in 1973, and we all spent a happy but bittersweet afternoon at the last stretch of undeveloped beach on Longboat Key, not long before the condo builders moved in.) But I will probably never go back, for the reasons you describe. I'd rather just cherish my memories.

I feel the same way about Southern California, where I was born and raised. It was booming even then, but we still managed to live on a quiet little dirt road, across from a horse farm.

It's all endless rooftops now, and the last time I went "home" the landscape had changed so much it was hard to get my bearings.

In that moment I had a glimpse of what it must be like for people whose homes and communities are devastated by warfare.

As the Joni Mitchell sang -

Don't it always seem to go

That you don't know what you've got 'til it's gone

They've paved paradise

And put up a parking lot ....

I started a Tightwad-Gazette-style price book again last fall. When DH and I got married and set up our joint household almost 20 years ago, I was diligent at tracking grocery prices. Once kids came along, that fell by the wayside.

These days I keep my price list in Google Sheets instead of on paper. That way I can do the math for the unit costs right in the "book." And with so many grocery stores posting their sale flyers online now, I can update prices from the comfort of my couch.

5. Awe, I'm visiting the Orlando area soon so I am glad you brought this my attention. I naively never considered how the changes you have mentioned affected people that actually live there.

This topic hits home as NIMBYS protest every bit of housing that's proposed in my city. I believe that a city that's not growing at a reasonable pace is a city that's dying. Where are people supposed to live? Folks complain that their kids can't afford to live where they grew up and then fight new housing tooth and nail. They totally fail to see the correlation.

Sure, many temperate places have been overbuilt, but that's largely due to demand. The alternative is to start telling people where they must live. Who wants that?

Although I can be emotional about my home state, I am not anti-development or anti-growth. However, Florida has grown 500% in the last 50 years and is now the third most populous state in the country behind California and Texas. What's more, the state ranks 8th in the USA in population density surpassing both the aforementioned states in this area. This type of growth comes with a cost. It impacts the quality of life; destroys the environment; and stresses state, county and city services.

Diane, you are correct. It is not realistic or right to stop people from coming. However, it is realistic to encourage managed growth, to set aside land for public use and protect sensitive lands. It should be acceptable to ask both residents and visitors to treat the beaches and waterways with respect. It is reasonable to remind everyone to renew, reuse and recycle. Because when our natural resources are destroyed, sometimes it's forever.

1. For Valentine's Day, my husband took me to a restaurant that is not one of my favorites (but is his - so love wins out!). We did not have a good experience - our waiter was in a bad mood and our food was late. The manager gave us 50% off because of the issues (their perception - we did not complain). I wish I could say that appeased me, but I was having a hard time enjoying the expense until my husband said he wanted to do this for me and us. I have to remember that being frugal does not always come before expressions of love and this was his way of treating me in a special way.

2) Because we have already had our "night out",we will stay home tonight, eat leftovers and check out a movie from RedBox with our free code.

3). I go to a monthly luncheon with my retired co-workers across the state (held in a different location each month). My closest friend and I shop afterwards. I do not enjoy shopping but I do it to spend time with her and see the different towns. This time I convinced her to stop in a thrift store where I was able to score 3 items at an unbelievable price - and then when we checked out, I received the Senior discount which made them even cheaper. My friend then took me to another thrift store where I racked up again with 50% off sales and the Senior discount.

She is now a believer in thrifting so this may make these monthly trips a lot more interesting!! (BTW, the items purchased will be sold at an online auction for specific vintage items bringing me double or triple what I paid).

4. My mail carrier just brought me a box that I mailed to my son in Germany on September 23!! Not only did I spend about $50 on the items inside, it cost $34.50 to mail and was consequently "lost". I filed the paperwork and was send a notice that it could not and would not be found. Surprise!

5. We are working with a Certified Financial Planner as we transition to retirement. There is a fee, but I feel it is money well-spent as he is able to give us guidance on the many issues that come up and will save us the amount spent, many times over. In filling out our budget sheets, I am amazed at how many items we do not spend money on. It is so satisfying to list $0 in the many spaces!!

1. Husband cut his own hair, I'm not entirely sure we're getting better at this though.

2. Bought a large batch of 10 toothbrushes for £2 in B&M while we were passing. Didn't carry the bargain we were looking for but the toothbrushes were a nice find.

3. Found a big branch on the road after some windy weather so dragged it home (the kids are probably glad they don't live with me any more).

4. Bought a large 5l container of handwash for £5. This is only about 50p cheaper than Aldi's handwash but much less plastic waste.

5. Bought in last two bags of 20p potatoes from Aldi's special over christmas, some of them have started to sprout but they are all firm so I shall process the sprouted ones first and keep and eye on the rest, processing and freezing if necessary. That'll be about 3 months of potatoes for 80p

Sue, I love your sense of humor! Thanks for the no-cost laughs!

Aw thanks Vickey 🙂 What a nice thing to say.

I really like the idea of passive savings by choosing to do things yourself. The effort I put into cleaning house also counts as exercise, in my opinion. I work up a sweat scrubbing!

1. My darling boss took me out to lunch Tuesday while we were on an expedition to collect past due invoices from clients.

2. I used some paintable wall paper to spiff up a project at home. It came from a huge roll bought 15 years ago at Big Lots for $3. One of the best frugal purchases ever.

3. Did the usual of packing my lunch and drinks from home, wearing thrifted/secondhand outfits, and driving with a light foot.

4. Will go through husband and son's closets this weekend to put together job interview clothes for our son. He and his dad are close to the same size, and his dad no longer has to dress up much for work, so recycling for the win!

5. Am also going to talk to husband about changing cell service plans. Our current one is too high and their sales tactics are pissing me off.

1. Yesterday, it was over 60* in Iowa. In February. I turned off the furnace and opened the windows until almost 10 pm!

2. Today, the furnace is off and laundry is hanging outside! I'll get the windows open in a little bit. Expected high: 71*!

3. My husband is now working evenings so dinners for our 10 year old and I are simple and filling. We are going through the food in the freezer, pantry and fridge. At times, it's a hodgepodge, but we're not going hungry!

4. I reused the same gift bag for the last 5 years for my son's Valentine's gift.

5. Met a friend for coffee at her house yesterday, rather than Target or the coffee shop. Her littles get to play and we can talk in peace!

6. Working at the hospital this weekend so I will drink the mediocre coffee, fill up my RTIC cup with water and take my lunch both days!

1) I was late for a meeting and instead of parking a mile away where I am legally allowed to park (it is a university), I parked in two hour street parking. But I hoofed it back out there at two hours and moved my car to a legal spot avoiding a certain ticket.

2) I usually have turbo tax do our federal returns because they have gotten so complicated, but still do our state returns by hand for free because it is just a couple of steps more after federal is done. But I do let turbo tax figure our refund or payment first before I delete it from our order. Then I have a number to confirm when I do our state taxes. This year turbo tax somehow got us about $900 more back than I figured. So I happily paid the $36 for a higher return. Plus we'll get a refund back much faster by efiling and I won't have to assemble a packet for mailing.

3) The coffee shop where I met a couple of colleagues yesterday was full, so we just went back to our academic building to meet. It saved me the cost of a cup of tea.

4) Yesterday was one of those crazy days you can only have with small children. Instead of getting takeout for supper, I always have a few cheap and easy options ready. My husband made mac and cheese with peas and tuna for a fraction of the price of takeout. And who wants to get out of the car in the cold to get food anyway?

5) Lunch is leftovers, renting our house on airbnb this weekend while we are out of town, my husband informed me that he has started raising rates on new business, I'm applying for more grants and fellowships this weekend to support my research, our oldest goes to public school, got a bunch of books from the library yesterday, will go to another library today.

Our valentines celebration:

Costco steaks with red potatoes and green beans

Aldi's tulips

Chocolate from Christmas

Champagne from New Years

A beautiful fire in the fireplace.

Ahhh. Bliss

It's a long weekend, our youngest is home from college, so I'm planning on mostly staying put, although if we get the mega storm (for San Diego standards) that is being predicted, we may take in a movie - using Costco tickets, of course!

1. Have had a shoulder that's been pretty painful for a while now and kept putting off having it seen. Am overjoyed to report that after 2 PT sessions, it is 1000% better. Funny how long I put it off thinking it was something BIG and now I probably only need one more session. At $20 a pop, I recognize what a bargain this is.

2. I've gotten into the habit of getting together with a dear friend about once a week. We used to go out to lunch or for tea, but for the past many months now we have each other over at our homes, and I must say it's so much nicer! We usually serve a salad or soup, have a glass of wine, and spend some good time together. Such a nice frugal win 🙂

3. Just read about a capsule wardrobe and watched a video that was quite inspiring. I realize it get into shopping at thrift stores and bring home clothes and stuff I don't really love, so I'm working on decluttering.

4. We had some of a hillside come down last month and a friend who has a landscape company came by and suggested plants we could put at the base of the slope that would grow up. We thought we'd need a huge retaining wall and that feels like a great savings. Plus, we have lots of agave pups which are fairly good at erosion control that I'll pop in here and there to give this area more structure.

5. I bought postcard stamps . . . in anticipation of sending lots of mail to President (for now) Trump. Feels like a frugal win because I'll use postcards I have on hand, save a bit by using postcard stamps, and may even have friends over to feel like we're doing something.

Happy Friday everyone

Hello from someone else in San Diego! I hope you get through the rain ok! So far, so good here.

I'm seeing a PT for the same thing, and I'm sorry I didn't go sooner! Glad you feel better. 🙂

Feeling extra super broke this week, especially with another quarterly tuition payment due in 4 short weeks. Sometimes frugality feels like a game you're winning, sometimes like a slog through the mud. February is mud.

1) Sent middle daughter off to a college visit at the school her brother attends - she's sleeping on his couch, and he has enough guest vouchers on his meal plan to keep her fed. We paid for her transportation in advance and for the couple of groceries she's taking him, but spending money is her responsibility. She had $26 in her pocket (and not much more in her bank account) when she left for 4 days and it was all I could do not to hand her more $$. But I reminded myself that a) she knew the expectation and chose to spend her hard-earned babysitting $ on a few trips to the coffee shop and b) technology advances mean if she really does get stuck we can transfer to her bank account in a matter of seconds.

On the other hand, the coffee shop trips were with an adorable boy so at just-turned-18 I would have made the same choice . . .

2) Re French fries: late last night we got a text from the same daughter: "The French fries here are sooooo crispy and they have them every day! I have to go to this school." It's the cheapest of her options, so if fries are what tip the decision, I'm all for it. She and her brother get along beautifully . . . but not well enough to share a plate of fries.

3) Feeling poorly enough with tooth problems that I've barely touched the Valentine candy, which helps it last for kids' school lunches.

4) Really getting my money's worth from Netflix and Amazon Prime while laid up.

5) Still eating leftovers from the busy weekend, still working from home (and sitting under a blanket to keep the heat off during the day), will be cleaning my own house and cheering on the hubs as he shovels snow once I'm feeling better, and still no vulgar gold plated anything.

I 100% agree about frugality being an occasional slog through the mud. I'm feeling pretty sloggy lately.

Oh, your analogy about frugality is so spot on! 🙂

I'm so happy people admit to being sloggy. I feel pretty inadequate sometimes when I read these posts. I still do things other NSAers would never do.

One posting one this time but it's a big one: I continue to closely check EOBs from my insurance company.

They often screw things up so cross-checking their statement against the dr's bill, and applying some rationality (like realizing that I should pay $0 for a flu shot, not $15, or noticing that reimbursement this time was less than last time) has saved me more money than I can calculate over the years.

I have an elaborate process & spreadsheet that I've developed over the years that helps me keep track. The process is 100% a PITA and I hate doing it, but I love the money I get back and damned if I'll let the insurance company keep my money because they're jerks who assume that customers don't have the persistence to see the matter through.

Kudos. I actually help my employer do this with her insurance (she has 4 kids so it is a lot of paperwork). We devote a solid 90 minutes to this task each week. But after a year, we are finally in a good rhythm and she is determined to get to her deductible based on our calculations, sooner than the insurance company 'determines' its been met. I have learned a lot about the paperwork process. I don't know much about it as I have a small family and we (thank the lord) are never sick!

This is a source of a considerable amount of time spent for me also. We are both retired so we have Medicare A & B, and private insurance through my former employer. This is a nightmare, as somehow doctor's offices keep forgetting to bill the secondary insurance, or bill it first, and then have to rebill after billing Medicare. Sometimes the EOB says "already billed" when in fact, it wasn't PAID, but REJECTED. I read every single piece of paper that comes into the house, and I'd say that seldom does a month go by when I don't call some provider or other and ask them to rebill or re-code, or something similar. Very often they tell me the balance is my responsibility when in fact, they have not properly billed the insurances. I have done medical billing before and I'm pretty good at math--but I must believe that many many people are getting robbed blind though simple carelessness

of billing offices. If anyone is NOT double checking their medical bills, I urge them to start immediately!! Your insurance company can tell you what should be covered if you don't have a policy that tells you that. You will be amazed at the frequency of mistakes.

This is the additional inspiration I need to call our insurance next week. We were somehow billed $100 for a strep test done in DS's doctors office while insurance paid $26 of the $126 total. $100???? I could have gone to the ER for that price. UGH.

This sub-thread only strengthens my conviction that single-payer is the thriftiest way for a nation to go. Imagine how much time, money, ink, paper, electricity, and other resources would be saved by not having hundreds of intermediaries (insurance companies) that doctors have to modify billing practices to, and patients have to wrassle with, to (maybe) get covered or reimbursed.

Unfortunately, my congressman, who was also on Trump's transition team, made his fortune by collecting debts, primarily medical. (And his law firm continues to collect debt from the Congressman's constituents.) Not expecting him to see the light anytime soon.

Vickey: that would work only if the version of single payer doesn't have copays or deductables, and covers everything. I don't think anyone has suggested that in the US. In the versions I have seen, single payer = one insurance company, rather than "the one insurance company pays for everything."

@WilliamB (below?): I have seen single-payer used as a euphemism for national healthcare, similar to, say, what most European nations have. Or our neighbor to the north. I'm comfortable with "national healthcare" as a somewhat clearer term for government funded and administered coverage. In either case, one standard for doctors' offices to use in billing would still save time and costs. Just for starters.

1. I've been using lists...... thanks, Katy.... feel like I'm getting tons more done. Not sure if I am, but crossing stuff off feels good.

2. Sticking to my grocery budget. Really struggled in Sam's today.

3. Sold our little car. The car payment and insurance savings should be $300 a month.

4. Making chicken pot pie from some chicken from the freezer and a pie crust.

5. Making homemade brownies for dessert.

Sometimes you have to consume but can still practice non-consumerism in a crafty way. I love being able to do things for others even though I don't have much money these days.

1. Using multiple Kohls discounts I got a wonderful baby gift (onesie-outfit and donut stacking toy) for my neighbor's daughter for under $10. I ordered it online with store pickup to save shipping fees. In my "gift box" I found Ikea stuffed baby toys that I got at a rock-bottom discount and will include one in her package.

2. For my closest old friend who lost her mom, her sister and her beloved pet all in the course of a year, I created a photo illustration of her dog with free printing courtesy of Shutterfly. (I saw on FB that she wanted this). I found the perfect frame at Kohls with a 50% off plus a 15% off coupon, coming to under $10 and used a Kohl's gift card from Xmas to pay for it. I will mail that gift today for her 60th bday next week.

3. My son stopped by last night and I convinced him to let me make us a nice salad here at home instead of him running out for fast food. Topped it with leftover steak to make it more substantial. Win-win... it tasted great, he saved his $ and I got to sit with him and talk for an hour. xxxooo

4. Convinced daughter to let me make her an egg mcmuffin for breakfast today instead of running out to buy one! Tasted much better than McDonald's and she saved $2 plus we didn't make waste.

5. Found my LL Bean rubber boots from a Costa Rica vacation 25 years ago... in perfect condition, still fit and worked great for gardening this past week. This is the most rain we've had in Southern California in the last 7 years... the ground is perfect for working. Cleaned up the flower beds, picked some lemons and planted sweet peas 🙂 Great week. I love this blog.

What a good friend and mom you are!

1. Got 10 cans of Well Yes! soups and 4 cans of Bush's beans free with coupons. Also found white chocolate chips and cinnamon chips on the clearance shelf for 75¢ a bag! Frugal cookies this weekend!

2. DH, DS#1 and I are all coffee drinkers on the go and we go a lot due to the nature of our jobs. So our travel mugs take a real beating and don't always seem to come home. I buy them at the thrift store when I can find the good ones with decent lids for a good price. I bought a Contigo one at the thrift store Tuesday for $2.99 and have now found that the lid won't screw back on properly. They do have a warranty so I'm deciding whether it's worth the cost to mail it.

3. While doing a mystery shopping job at the grocery store, I walked past the Contigo display. Out of the corner of my eye I see a sale tag of $3 and I think "What?" It seems that 2 colors of travel tumblers were marked down from $13.99 to $3. I bought all 5 and found it ironic that it was the same price as the one I bought at the thrift store earlier that day. I will now clear out the odd assortment of travel mugs we currently have which will greatly simplify what lid to what mug!

4. I've sold 7 items on Amazon in the past week! College fund!

5. I'm not jetting off to Florida this weekend, or any other weekend at tax payer expense!

I had a not so frugal week. Ended up in the ER Monday with a heart rate of 209. They thought I was going to have a heart attack or stoke out, but I didn't. I was there til Wednesday. I'm just imagining what the bill will be even with insurance.

Back on the frugal bandwagon today.

Mia very sorry for your health scare and glad that you DIDN'T have a heart attack or stroke.

Mia - Sending thoughts for recovery (from the health episode and the bill)!

Thanks for the good thoughts. Back to work today.

Thanks. It was scary. But feeling a lot better today.

Tidying up is one of THE best cheap thrills, isn't it? You inspired me to tackle some nagging tasks in my minivan this afternoon. I cleaned doggy nose prints off the back windows, threw out trash, wiped down my dusty dashboard, and scrubbed dried bird poop off the *inside* of my car door (it landed there after I'd left the windows open overnight). I'm ashamed to say that bird poop had been stuck to my door for at least eight months. 🙁

My FFTs:

1) One of the local grocery stores ran a really good sale on pork butts right before the Super Bowl. I bought a seven-pound portion and cooked up a double batch of pernil from Tasty Kitchen's recipe (http://tastykitchen.com/recipes/main-courses/slow-cooked-puerto-rican-pulled-pork-pernil/ … I use only two teaspoons of salt per batch instead of four). That fed us for one dinner and filled three freezer containers for future use.

2) Our dishwasher runs a heated dry cycle automatically, unless we turn that option off each time we start it. I've been diligent the last two weeks about turning it off and letting the dishes air dry instead. Hopefully I'll shave a few dollars off the electric bill by not firing up that heating element twice a day.

3) I picked up a six-month supply of heartworm pills for our two dogs this week. The vet's assistant gave me a rebate form I can send in to the manufacturer to get money back on the purchase.

4) I've made good progress on my 2017 resolution to "read down the book pantry." So far I've finished two books and am halfway through a third. The first book I finished reading? The second edition of Getting Things Done. Heh.

5) For the last three years, I've used a combination of Evernote and OneNote to keep lists, brainstorm, and externally organize my brain. Last year Evernote started requiring users who access their software on more than two devices to pay $35/year to continue to do so. Since we already use OneNote in our family business, I decided to give the (free) OneNote app a try as an Evernote replacement on my smart phone. It works great. I've officially jumped ship from Evernote as a result. I don't begrudge them charging for their software, but why pay for a service when I've got an alternative that doesn't cost me any extra to use?

Working on my bookcases too. I do love bag day at the library book sale.

Ha, me too! I had to stop going to the library sale because my bookcases were starting to overflow. Trying to read through and purge some of the books now.

1. have been walking home from the train every day instead of taking the bus, even when it's been bitterly cold. I take the bus down to the train every morning so I feel like this balances it out, plus, when I get off the train into the city I do a fair amount of walking to get to my office as well. A bit of exercise and $1.60 that I keep in my pocket each day.

2. haven't bought coffee from the coffee shop all week. drank the ok coffee at work for free instead. my iced tea habit still runs pretty deep but i've been using the DD app to pay and earning free drinks along the way.

3. we receive pay stubs every week even with direct deposit and it annoys me to no end to have these pieces of paper that i just shove in a drawer and an envelope i throw out every week. remembering that my new landlord wants our rent checks left in envelopes in her "rent basket" I blocked out the writing on this envelope and wrote "LAUREN'S RENT" on it. Now I don't have to buy more envelopes (while I continue to look for the ones I packed away during the move) and she'll be happy that i'm following her protocol.

4. went grocery shopping last weekend in an attempt to bring lunch to work all week. only managed to do that once (but it was once more than usual) and I've eaten some of it for meals during the week, so that's meant less takeout.

5. Have been running swagbucks videos in a separate window while I'm at work.

And here's my frugal fail for the week -

I opened a truly terrible bottle of red wine the other day, but after reading on this site about how some people freeze wine cubes to use in cooking etc later on, so I decided cooking would mask it enough, and I wouldn't completely be out the $9. I decided that since I don't have cube trays, I could just pour the wine into a ziplock and put the whole block in the next time I cooked a pot roast. Well, I put the bag into my freezer.. and a half hour later.. the ground looked like someone had stabbed my fridge and it was bleeding out. WINE EVERYWHERE. total fail.

the upside is... I no longer reside in the apartment with the squirrel that breaks in, because had I still lived there... I'd be dealing with a very drunk squirrel.

Love your frugal fail, I needed that laugh! Similar thing happened to me with a large amount of tomatoes I washed, blanched, cut, pureed, then froze in one of pricey freezer seal type bags. I was so upset after putting so much work into the preparation. I should have known that big a bag of tomatoes was gonna be doomed. It burst and covered the entire bottom of my freezer. Such a yucky difficult mess I had to clean up. However, it wasn't a bad as when I dropped the deep fryer onto my wood floors the day before Christmas and right before all my company arrived. It was like the Gulf oil spill only I didn't have a buoy to contain it! It just continued to spread bigger and bigger.

I got a freecycle freezer from someone who had many things thaw and start to rot during a power outage. She decided it was more aesthetically pleasing to get a new freezer than to clean the stinky one. I figure I grossed about $100/hr while cleaning it out. I did leave it in the sun with a coating of baking soda for a couple days.

Glad to make you smile! The oil spill sounds terrible!!! (For another laugh - I'm picturing my old squirrel figure skating around in it).

1. I got my family a box of marked down Valentine's chocolates to share as a cheap treat. I also got some stuffed animals that were 50% off to put up for Easter surprises.

2. I made a chicken/veggie casserole sorta thing last night that was pretty good. I used some marked down boneless chicken thighs cut up into pieces, a half a a bag of frozen veggies, a half a tub of sour cream(about to expire), a couples slices of cheese, and herbs/spices for the bottom. The top was some tortilla chips(stale), 4 slices of bread from the freezer, parm cheese, and herbs/spices that I whirred together in the blender then spooned on top. I topped it with a drizzle of olive oil and baked. I feel like being frugal has so much to do with learning to create things out of what you already have on hand. I have to admit that I have mostly hits but a few misses, also.

3. Still putting off a haircut and color. I plan to get them done before our upcoming cruise.My daughter is in cosmetology school so it shouldn't cost me much.

4.Frugal fail- Speaking of cruise, everything I have read says cruise casual is the appropriate attire for dinner each night. These people haven't taken into consideration that I barely have a wardrobe at all! I plan to go to the thrift store and see what I can come up with.

5.My mom's birthday is today so I will be using a gift bag from a pile that my friend gave me when his mom died. She had collected gift wrap/bags her whole life which is saving me the trouble. I am giving her a really nice lotion gift set that I got from Christmas markdown's to put in my gift closet and a super nice pea coat I found on clearance for $9

Also, I agree with an earlier post that February is a slog through the mud as was January.

1. Work provided dinner one night this week and it was really good.

2. I got a free pass to the museum, which was so great because there was an exhibit I really wanted to see.

3. Got a ride to the museum so I didn't have to pay for the parking. Total saved for the total museum trip was $26.00.

4. Continue to cook and bring meals to work.

5. Stopped at Aldi to get .59 cent eggs yesterday and they were out. I will stop again on my way home since I have to pass the store anyway.

1) Along with Tracy, MW, and KJD , we have also had a week of "whatever" for dinner here in the household. Tonight everyone had the remaining "whatevers" from earlier in the week. I think applesauce and guacamole may be the only fruits/veggies DS has had all week, but still he grows.

2) I had routine fasting blood work done the other morning before my regular mammogram and was DELIGHTED that the radiology waiting served very good free coffee for all. I even had my travel mug with me since I was planning to buy some in the cafeteria. Woohoo! Really it is the little things in life...

3) I have been baking my way through the first 100 days of the new administration to manage. Using my flour and sugar bought on sale and the other stuff that is around. So far Lemon Bread is the big winner of a new recipe since when life hands you lemons, make lemon bread. Thankfully, it keeps snowing and I keep cross country skiing. Otherwise I would be gaining 100 lbs in the first 100 days.

4) Heading West to Seattle next week using Dear Wife's many many air miles (she travels overseas 5 times a year for work) to be with my very dear aunt who is ailing. Being with family = priceless.

5) Trying to up my food prep game before I travel so that Dear Wife will not have to shop while I am away and can feed herself and DS without a lot of hassle. Made breakfast bites and apple crisp topping tonight. Will make blueberry pudding cake, apple crisp and the aforementioned lemon bread over the weekend along with resupplying bread at bakery outlet. Makes me feel better to know they have yummy things on hand.

You may be baking for 4 straight years. 🙂 Safe travels!

1. shopped at Aldi and bought 78c eggs, cauliflower and delicious organic granola.

2. A friend took me out for sushi tonight to say happy birthday

3. Am seeing 3 clients tomorrow instead of the 2 I thought I would have.

4. Sent my nephew a birthday check in a card I had from a stash and will bake him some peanut butter chocolate bars from ingredients I have on hand.

5. Having a quiet weekend after work tomorrow, a couple of walks, reading and catching up with my dvr.

I loved the description of a frugal and satisfying putter-around-the-house day. That is exactly what I'm planning to do this weekend. But first, I will write down all the to-do tasks broken into even smaller steps so that I can cross them off my list.

5 frugal things:

1) Watched Captain Fantastic from the library tonight with my husband and mother. Gave my mom a 30 minute shoulder rub, which she loved (it was actually an Xmas stocking gift coupon redeemed)

2) Was taken out to lunch Thursday and managed to save half my meal to eat on Friday at lunch, something I usually intend to do and then don't.

3) Went to $5 yoga classes. Indulgent but affordable.

4) A neighbor brought us a baguette (she is retired and hangs out in bakeries) and we made pizza bread for dinner with it last night.

5) Am planning a frugal homebody weekend with books, movies, walks, baking, and chores.

Sick bed version of five frugal things.

1. I have a terrible cold, so I have been staying home and nursing myself. No money spent. No gas used.

2. Made dinner with leftovers madeover into other meals. No sending DH for a pizza.

3. Took a half dose of my store version of Nyquil bought last year on a BOGO sale. Half the cost and no Nyquil hangover the next morning. Standing over a steaming pot of water with towel over my head instead of my fantasy sauna.

4. I don't have enough hankies to manage, so using a box of tissues bought on sale with a coupon months ago. Throwing said tissues into a used bread bag to put into the garbage can.

5. Doing laundry and hanging to dry .Cleaning bathrooms using baking soda, vinegar, lysol bought on sale years ago and Awesome Orange cleaner from the Dollar Tree, recommended by NCA Katie. A little behind on the housework, but getting caught up this morning.

My 5 frugal are all things I learned reading this blog and the comments:

1. Cleaning with orange/vinegar cleaner

2. Buying very little processed food anymore

3. Using containers from food, etc, when I need to organize instead of buying containers.

4. Stopped buying lunch at work, ever. We used to all order out on Fridays, now we do pot luck lunches a couple of times a month. We do it on Thursday and eat leftovers on Friday.

5. Making gifts instead of buying them.

1) Hubby took me out for Valentine's dinner on Sunday and I signed up for the free BJ's reward app while we were there, so the waiter took the discount off our ticket. Nice - the beer was good and the dinner was wonderful.

We rarely eat out, so it was a nice treat, especially since I'd spent the day cleaning my stove, oven and the floor underneath - yuk! I was exhausted.

2) I bought a Valentine card for my love at the Dollar Tree and wrote him a nice note and posted a special song in tribute to him on Facebook. He loves the attention and it cost me all of a dollar for the card.

3) I took my daughter to Victoria's Secret yesterday and used the gift certificate they'd sent me for my birthday to let her buy new underwear for her birthday gift. Their underwear was on sale - so double score and she got a free water bottle and a pair of sunglasses she's going to give my oldest granddaughter. We had a fun afternoon together.

4) We used the Cracker Barrel gift card she'd given us at Christmas and had lunch, after shopping. The card paid for our entire lunch and left me with $6 to spend at a later date.

5) Our church potluck is today, so I'm going to whip up some Alfredo pasta for the dinner and eat lunch with my fellow parishioners. It's nice to catch up with them each month. We live and work in different towns than where most of them live, so I only see them once a week. They are wonderful people and the potluck is a nice treat for us all.

Thanks again! I love reading these lists.

1. My sister and I save boxes of stuff for each other that we don't need or want. We then pass them off to each other hoping that there are things that they other needs or wants. Then what isn't wanted is passed to someone else or charity, etc... We've done this for a long time. My Dad saves coupons for me and brings them to me when he sees me.

2. At our church, we have an annual swap. No money is taken or exchanged. Everyone just brings their unwanted or unneeded items and we place them on tables. We then ask people to walk around and look and when we start the swap, we ask people to pick an item and step back to give others a chance to pick an item. We do this like three times, and then we say , shop! We ask them to take things they know others might need. We save the clothes, shoes, etc... to send on a mission trip, we donate the unwanted items to charity. It's a win, win, for all. There are no rules about how much you bring or how much you can take. I feel like I really win if I just find a few needed items. I sometimes find things to put in my son-in-law's Christmas bag or box of goodies. We used to do this swap with my sister and two friends and go to each other's homes. It was a lot of fun, and this is how it grew. What's kinda cool too is that there are several of us at the church who wear the same size blouses. It's neat to get a new one for free. You wouldn't believe how much stuff shows up each year!

3. We are still eating freebies from my b.day. Sunday, I will get my free sub and drink from Jersey Mike's and hubby will eat my free burger from Ruby Tuesday. If you haven't already, google birthday freebies. There are more than you can prob. use. Eating out costs so much that this is a treat!

4. I sign up for a lot of freebies online. You can pass on what you can't use or don't need. My Mother-in-law loves to get a basket of supplies as a gift. These go nicely in there too.

5. My husband loves to take adv. of the free videos on youtube when it comes to a prob. with the car or truck, etc... There are how to videos on different things. Of course one has to be careful on who to trust. My husband installed our tankless water heater by watching one of these videos, I think. Caution again, the info. is only as good as the one giving it. You have to careful about who you trust.

One other thing we sometimes do with the church swap is to ask a few weeks in advance if anyone is looking for something in particular. We have a list and they can write down several things. One year, my husband got a pressure cooker this way.

1. Lunch one day this week at work was leftover Olive Garden lasagna from the open house dinner for the teachers. Yum! Saved my lunch for the next work day.

2. Signed up for the gym in January and have been walking/working out 5 days a wk (no weekends) since - my blood sugar numbers are dropping and my doctor cut one of my meds in half.... better health and less $$! Proud of myself for making myself go walk after work, instead of heading home for a nap.... Also signed up for a 90 day supply of most of my meds, which further cuts the cost.

3. Downloaded some more free books for my Kindle - I love always having something in my purse new to read at all times!

4. I have a stockpile of greeting cards - I love them and have in the past bought way too many. So now, I'm trying to use them up by sending notes and greetings to far-flung family and friends, even ones I "see" on FB all the time. In this day and age, getting something in the mailbox that isn't junk or a bill is awesome!

5. Loaded my car with stuff for this wk's errands: books to the used book store for credit, magazines to a local "free reading material" shelf in a favorite coffeeshop, more books to my SIL, who's a fan of the author (any she doesn't want will also go to the used book store), and plastic bags for recycling at the grocery store. Getting stuff out of the house but keeping it out of the landfill..... for the win!

and a bonus....

6. Bought a brand-new condition children's book at the used book store and a like new baby toy at Goodwill (which I washed!) and will be giving them to our great-niece for her upcoming birthday party.

1. DH and I give 8/$1 Valentine cards to each other every year and thought this was pretty frugal until I heard from a friend that he and his wife go to the store, pick out a card, exchange, read and place back on the shelf! We may try this when our stash runs out.

2. Friends whom we haven't seen for a few months invited us for dinner. Delightful conversation and a wonderful meal, at no cost to us. We'll return the favor.

3. Still lowering temp at night to 60 degrees. Thank goodness our snow is finally starting to melt.

4. Pot luck at church tomorrow, taking cookies from Christmas from freezer, and lasagne found already made cheaper than I could make homemade.

5. Made homemade granola with items purchased on sale. So much better than store bought.

Teri, your friends that do the in store card exchange only to put them back is the ultimate in frugalness. This would allow you to choose the most expensive card for your beloved, brilliant!

1. Planted lettuce, chard and snap peas. It's unseasonably warm here in the heartland, looks like this will continue. If harsh weather makes an appearance, I'll only be out a few cents for the discounted end of season seeds. Worth the risk.

2. The warm weather has all the local VW fans working on their cars. This means my sales are back up which earns cash for my old bug.

3. Hand washed my daily driver at home for free. Looks pretty good for a car that has to park beneath a tree each night.

4. I've marked one Sunday on my calendar each month to pick up trash and take photos along the MO riverbanks. My old landlord down in the river market is letting me put the trash in his dumpster. I'm personally worried about pollution in the river and hope that photos will journal changes. Not much but makes me feel good and is more powerful than passing out leaflets or crying on social media platforms.

5. Used my child free time to clean, reorganize and redecorate my garage. That's my equivalent of a spa day. Rewarded myself with a cold beer and hippie music while sitting in my old bug. Divine.

OK, gotta ask...what kind of hippie music??

My dad and I work together, usually The Doors, Canned Heat, Janis and of course the Dead, because no Old VW shop is complete without. ✌️

Still miss Jerry and it's been over 20 years...

I'm up the river from you (on the Ohio) and I feel the same about the river trash. I have tried to outreach and advocate about picking up litter. I wish there was a way to sanction convenience marts and fast food restaurants for all their specific trash as I see so much of it near or in the river. I know it is a controversial topic, but I really wish a plastic bag ban would happen as well. Photos are great for illustrating and sharing the problem. Thank you for doing what you are to help the issue.

We have a plastic bag ban in our state. If you want one it costs between 10 and 20 cents. Produce bags are free but shouldn't be. It works well overall.

Our county has a plastic bag ban. Its wonderful. We use paper or bring our own. I've learned to pack a "wine bag" (free at the grocery store with purchase) with the other cloth bags, one in each slot.

This close to the ocean, they are very aware of plastic bags in turtle and other sea life's tummies.

LisaC, I didn't realize there was a county in Florida that had this ban. I am always picking these up at the beach and often removing them from the water. I have even written Publix asking them to discontinue using them. No luck.

Thanks! I tried to join some local groups but none of them pick up trash, they don't really do anything other than pass out leaflets and talk. That's when and why I chose this path. I agree with you completely on plastic bags. They're completely unnecessary. Our shop is in "the hood" and plastic bags are everywhere. I find it revolting.

Bee, I'm in NC 🙂

I'm sorry. I thought you were in Florida for some reason. Perhaps comments regarding Hurricane Matthew? Nonetheless, a beautiful state with quite a coastline and bountiful waterways. 🙂

In Santa Fe, we have " Friends of the Santa Fe River". Different organizations take responsibility for sections of the river and clean up their section. I am a garden club (GCA) member and we take a section. (We garden club ladies don't talk much -- we DO ). Perhaps you could look into organizing something like that in your community.

We saw 'Loving' as well. I am pretty sure we watched it for free, I think either HBO (through Apple TV) or Netflix. It was a great movie indeed. Can't believe that the lows in Virginia lasted for as long as they did re: interracial marriage. I am sure next generation will be looking back wondering what buffoons their ancestors were.

1. Still trying to use up food from fridge/freezer/pantry. Valentine's day dinner was veggie lasagna from ingredients on-hand. Subbed chard for spinach. Splurged $5 for dessert when I found cannoli at the store. Made butternut squash soup and used turkey stock I found in freezer since I was out of chicken stock. Later in the week made chicken noodle soup from the carcass of the roast chicken.

2. Son decided to make strawberry shortcake for his gf for Valentine's Day. When he accidentally added 2 cups of rice milk instead of 2 Tbs, I did my best to strain out the excess rice milk. We finally decided that he needed to just start over. I ended up rescuing the funky dough with a few additions and corrections for a batch of chocolate chip scones. Not great, but they got eaten anyway!

3. Reading lots of library books and apparently I went for plenty of armchair travel (and food): Provence 1970: MFK Fisher, Julia Child, James Beard, and the Reinvention of American Taste; Sunshine on Scotland Street; and Fika & Hygge and How to Hygge: The Nordic Secrets to a Happy Life; plus a couple of French cookbooks. I think I'm trying to read away my anxiety about the US.

4. Wearing another thrifted outfit. Thankfully I found a pair of jeans in good condition on my last visit to GW.

5. Finally got the refund from our insurance company after they discovered they'd overcharged us on last year's homeowner's. Took it straight to the credit union.

I am on the wait list for the Hygge book. I completely get your statement!

1. Doing a much need update in our airbnb bathroom (hasn't been touched since the 60's - tile is failing etc). Going to reuse the sink faucet, donating existing short vanity to a friend and using an "ooops" paint from the hardware store ($4 a gallon and in a soft dove gray, too)! I'll use all the packaging for the other things for ebay packages going out.

2. Cleaned all the shower liners in the house with a vinegar and water soak. They are all brand new again!

3. Bought 75% off V-day chocolates. Diced them up and used them in place of chocolate chips for baking cookies. Froze the remainder.

4. While on my daily walks with the dogs, I keep an eagle eye out for my neighbors tossing cardboard boxes. We use them to ship out ebay sales. I refuse to buy packaging (well we have to buy shipping tape).

5. Walked all of my errands this week and to work. I know that is a luxury for this time of year.

Having a challenging week already (it's only Monday...).

1. Passed extra produce I obtained from the volunteer efforts out to family. Keeps it out of the landfill. I wonder why more people don't take the produce, but maybe it is just to much to deal with when life is difficult.

2. Finally bought a car, but now I am having second thoughts. I have a few more days to bring it back for 100% refund. I am ok with the car as it is really fuel efficient, but it really scaled back on everything else (it doesn't even have a temperature gauge!) I am trying to tell myself not to be spoiled, but it's hard. The VW had everything.

3. I have court this morning for my custody woes. It is not a happy moment and it's in a different state than the one I live in. Thankfully, I have family in the area and I can stay at their homes. Gratitude for family and friends is priceless. Alternatively, stress is very costly.

4. Brought dried and fresh fruit and water from home for my trip. I did end up buying a $1 bean burrito yesterday in a weak moment. Otherwise, still no spending and eating from the blessed pantry.

5. Reading books I already own or from the library. I have a huge library both in my city and at home.

I pray your custody hearing goes well!

A car with no temp gauge? How would you know if it were overheating? I'm probably missing something here, but if it has a radiator, holds antifreeze and lacks the dash thermostat, I'd be very afraid. Just from one NCA VW fan to another. Is there an owner's manual? Maybe the gauge is somewhere weird?

I'm a few days late, but we had a pretty frugal weekend!

1. My husband and I are using some old pallets to make some awesome, FREE, wall art.

2. I trimmed my daughter's hair. So difficult on a 3 year old.

3. I am diligently sorting through our daughter's toys and clothes to sell at the huge local consignment sale coming up in my area.

4. We are at 7 months and counting of not purchasing any meat! We are fortunate enough to have grown up on family farms that are still in operation. We receive freezer beef, pork, and chicken for most holidays. Additionally, we support our local county Jr. Livestock Sale at county fair-time. This is something my husband and I were very active in when we were younger (it's where we met!), so we give back to the youth in that way.

5. Ate leftovers all weekend, dramatically reduced our trash output now that our county solid waste district developed a robust recycling area (yay!), sifted through seed catalogs to prepare our garden for the year, dehydrated some strawberries that were on the brink of going bad, and didn't eat out at all.

Well, if you ask me, the most critical part of structuring your finances and optimizing savings is just having a plan. Whether you use a spreadsheet or a tool like Geltbox money — you have to get everything out in front of you so you can make smarter decisions. Once you do that, then implementing your disciplined savings strategy becomes critical.