-

My sister and I went on a post-supper neighborhood walk and happened upon a garage sale leftovers pile from that provided an empty Altoid tin and a sturdy plastic clothespin for me. My sister scored yarn, art supplies and a couple of books. We then came across two free ceramic flowerpots, one for each of us. My one has the same silhouette as one that already sits on my front porch, which is my kind of frugal serendipity!

-

I took that single Altoids tin and added it to my organizational system for tiny items. Keep in mind that I don’t buy Altoids, so these were all scavenged. I enjoy figuring out creative solutions that bypass corporate America, even when it’s just a small project.

There, that’s better!

-

I made another batch of chive-y cream cheese to keep in the fridge and spread on Dollar Tree Monet crackers. Cheaper than Boursin and all I added was seasoned salt, chopped fresh chives and garlic powder!

-

I dropped People of The Book off at the library and picked up Three Days in June, by Anne Tyler. I love this author and am happy that she’s still writing. I had to wait a long time for this hold to come in and I’m excited to delve into it.

On another note, I really appreciate that Portland’s libraries are open seven days a week.

-

I didn’t remove protections for my country’s most vulnerable citizens to benefit America’s most morally bankrupt businessmen.

Katy Wolk-Stanley

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

Remember when I planted sprouted grocery store garlic back in November? I’d read somewhere that you’re supposed to harvest garlic on 4th of July, so I pulled it up and was very excited to find that I had indeed grown garlic! This was a very passive effort and for that reason I’m calling this a success. I now have my massive harvest (Four! Heads of Garlic!) drying in the cool dark basement and will make sure to plant much more come fall.

-

My sister and I went to the Franz Bakery Outlet, as they sell their “Bargain Wall” bread for $1 apiece on the first Saturday of the month. I ended up with eleven loaves, as you get an extra loaf when you spend ten bucks. Plus I filled my punch card!

My favorite find was the gluten-free hotdog buns, which normally sell for seven to eight dollars apiece. Good thing I have a freezer!

Bonus photo of my entire haul:

-

The neighborhood pigeons who like to roost under my eaves are back, so I roped my sister and mother into accompanying me to Dollar Tree to buy helium mylar balloons. Why balloons? I fly them outside our front and back windows, which gets in the way of where the pigeons like to hang out. It physically blocks them, plus it freaks them out a bit.

I also bought panko bread crumbs, Monet wheat crackers and ginger snaps.

-

I curb picked these chairs back in April and had yet to refurbish them, so I set them out at the corner last night. They were gone by morning. I could’ve recovered the seats and painted the metal, but I either get right on a project or not at all. Perfect time to pass them along to someone else with fresh energy and creativity. Buh-bye!

-

I checked the library website to see if any fresh cultural passes had been posted, and lucked out on a free three-day pass to Rose City Comic Con! I’ve only once been to a comic convention, (mid-1980’s, and only because my father was speaking on a panel) but think this should be super fun! The normal cost is $99, so this is an especially good bargain. Thanks, Multnomah County Library!

Katy Wolk-Stanley

Like this post? Then please share it with your friends!

Like this:

Like Loading...

Please enjoy this previously published post.

Although I’m far from “shy,” I still have to gather my courage before speaking up for myself. Why? I think it’s simply human nature to want to smooth things over and not make waves.

I look back on times and events that I regret in my life, and I mostly identify when I did not speak up for myself or my children. The fourth grade teacher who was consistently negative and oddly punitive towards my son. I once asked her if she had anything positive to say about him, and she simply stared me down without saying a word. All the other parents said she was “a great teacher, if you have a girl.” (Just writing about it makes me white hot with rage!) And by the way, her main complaint about my son was that he wiggled in his seat and looked out the window.

But I’m older and wiser now, and realize that addressing the issues with the teacher was a battle I should have chosen. But at the time, I feared she would be even worse to my son if I confronted her with my concerns. I deeply regret this.

Luckily, my current life is pretty smooth, although there still seem to be times when I have to take a deep breath, gather my courage and speak my mind.

I went in for my annual work evaluation yesterday. The paperwork goes into my human resources file, and is as close to that dreaded permanent record as is likely at this phase of my life. Although I’ve been in the same hospital-based RN job for 19 years, these meetings always give me a case of the jitters. I sat down and noticed that I was being being marked as having “met” rather than “exceeded” at my job. And although “met” is considered perfectly acceptable, I felt the need to speak up.

I explained to my boss, (who is kept busy with meetings, and never sees me in action) that I felt that I earned the “exceeded” label. That I hold myself to a very high standard, that I work to support a positive work environment and that I try to be the nurse I wish I was working with. She listened to what I said, and then changed my rating.

It made me nervous to speak up for myself, but I did it anyway.

And this morning, I sat down to read through my e-mails, and sent out three very carefully worded e-mails that I would have much preferred to procrastinate or simply delete. Emails that required me to bypass my natural inclination to shy away from sticking up for myself. But because they were in written form, none will be the wiser that my voice was shaking; but yes, it was.

I often think of the popular bumper sticker quoting grey panther Maggie Kuhn, encouraging people to “Speak your mind, even if your voice shakes.” (I know that anything translated to a bumper sticker format immediately becomes trite, but I find inspiration in it anyway.)

How does this relate to non-consumerism?

By choosing a less traditional life, there are inevitable uncomfortable conversations. Whether it’s telling a family member that you want to tone down Christmas or simply declining expensive invitations. Or even just living a simple life that sometimes does require you to explain your decisions, even when it’s no one’s business but your own.

So please non-consumers, speak your mind. Even if your voice shakes.

Katy Wolk-Stanley

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

My friend Katie posted something on her Facebook page about donating blood to the American Red Cross. As a thank you, she’d received a free pair of $25 Goodr brand red sunglasses, which couldn’t have come at a better time, as A) I can’t find my preferred sunglasses and B) I am nothing if not filled with blood. I literally made a same day appointment and was quickly in possession of a pair of my own quality sunglasses.

-

We enjoyed a yummy at-home dinner with both my kids, plus my sister. Nothing too elaborate, as I just set up a simple tostada buffet with black beans cooked in the Instant Pot. Cheap, easy, tasty.

-

You already know that I enjoyed many free cookies while at The Red Cross. Plus a few to go.

-

I woke up this morning to find the there was no power to the refrigerator, which was not the cheery “good morning” that I expect from my appliances. Luckily it was just matter of pushing the ground fault interrupter button to get her purring again. Crisis (and big expense) averted!

I don’t think I lost any food, although I took it as an opportunity to make homemade chicken broth and soup from two frozen rotisserie chicken carcasses.

-

I didn’t gut America’s safety net to provide tax cuts for bloated billionaires.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

My husband bought a replacement shower head for our bathroom, as the last one was spurting water in a illogical manner. We both love the new one, but it unfortunately doesn’t work with the previous organizer caddy. I walked into Goodwill hoping to find a better solution and somehow found exactly what I needed! Priced at $2.99, minus my 10% senior discount, we now have a shower storage solution without supporting corporate America!

-

The Non-Consumer Advocate Facebook group bypassed 100,000 members today, which is a huge milestone. I never paid a dime to promote the blog-adjacent group, which makes this an extra satisfying achievement. It’s a great resource for people looking to find like minded non-consumer folk.

-

My sister is now visiting from NYC and we survived day one of her trip without hitting a restaurant. We’ll certainly eat some meals out, but we’ll try to keep it under control. Our meals today were:

• Breakfast — Spinach frittata.

• Lunch — Bean and bacon soup with tortilla chips.

• Dinner — A huge green salad with garbanzo beans, crumbled queso blanco, cucumber, avocado and pickled red onion. Of course the salad was topped with my homemade Tea Towel Salad Dressing!

• Dessert was Tillamook ice cream, which is currently on sale at Safeway for $3.99/half gallon.

All of these meal were prepared and eaten at home, despite being out and about for much of the day.

-

My sister has a Britbox subscription right now, so the three of us watched a couple episodes of the TV show Death Valley before heading to bed. Highly recommend!

-

I knew my sister would be hungry when she landed last night, especially as her six hour flight had been delayed for an additional three and a half hours! I went ahead and cooked her a bean and cheese quesadilla, which I brought to the airport. Cheap to make, satisfying to eat!

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I went to H Mart for sweet rice vinegar and soy sauce and chose the biggest jugs they sell. Yes, I spent more today, but the price per ounce was lower which equates to long term savings. This choice is always a bit painful in the moment, but I just take a deep breath and consider myself privileged to be able to invest in the larger, more expensive size.

-

I browsed the deli section and considered splurging on one of their delicious, (and actually not that pricey) premade options. Their kimbap looked especially amazing, but I reminded myself that “You have food at home!” and drove back for a lovely bowl of bean and bacon soup.

-

I returned a huge bag of books to the library, even though I’d only read a couple of them. I like to have choices of what to read based on mood and vibes, so I’ll deliberately check out more books than I can get to. Not only did this declutter my living room, but I got the thrill of new books without spending a penny.

I know it’s hardly an ah-hah moment to recommend the library over traditional retail therapy, but picking out and bringing home new books scratches the same dopamine itch as buying cute unnecessary doo-dads from Target. And we all know that Target is on our no-no-list!

-

I walked past Winco’s small book section and saw they had something by the author Jenny Green. I’ve read her novels in the past, but she’d slipped off my radar, so I made a mental note to see if Libby had any of her audiobooks available. I found that they had Falling for immediate download, which proved to be the perfect distraction from an upsetting news cycle day.

Libby lost some of their funding, so I’m only able to reserve ten books at a time instead of twenty. I’m now being judicious about what I put on hold, as filling my hold list with audiobooks that take six months would be sad in the here and now. Immediately available books for the win!

-

• I deliberately ordered a large portion entrée last night, so I’d have enough leftovers to bring to my daughter.

• I hung laundry on the clothesline on this hot and blustery day.

• My friend Lise gave me a pot of sedum she dug out of her garden.

• I went on the library website at the stroke of midnight on July 1st to see if they’d released any new discovery passes. Sadly they didn’t have anything for me, but it wasn’t for a lack of trying.

• I scanned an abandoned parking lot Winco receipt into the Fetch app and got 1250 points! For reference, I normally get the standard 25 points as I’m not buying national corporate brands.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I went to Winco and dropped $99.12 on a tremendous amount of food. I won’t bore you with a specific list, but it included lots of produce, a bit of meat, a few treats, plus stock items such as salt, yogurts, cheeses, rice and bulk popcorn. The clearance shelf held nothing of interest, but I took a gamble on the Lindy’s brand Italian ices, as they were priced at $1.98 per six-pack! We gave them a try this evening and gave them an A minus.

-

Popcorn may be dull, but it’s a straight up bargain all day long!

-

I had a scheduled dental cleaning and asked the hygienist to give me “as many flosses as you’re allowed to give.” Two, the answer was two. Still better than one though.

-

I met up with family at a restaurant across town, but left early to enjoy the library’s air conditioning and book selection. I arrived to find the branch was closed for renovations, which left me an hour-and-a-half early on a 93° day. I thought about depositing myself inside a cafe, but instead walked to a nearby park and located a shady bench. I had a book to read, but instead enjoyed an extended phone conversation with my older sister. I’m old enough to appreciate that long distance phone calls are no longer a financial splurge!

-

I’m readying for Amazon Prime Day by reminding myself that Schmeff Schmezos has enough of our money and deserves not a penny more.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

My sister is coming from NYC for a two week visit, which draws attention to our guest bedrooms. She usually stays in my youngest’s old room, but I’m saving it for her son who’ll fly in halfway through her trip. I rebuilt my daughter’s room from scratch a couple years ago, as she took all her childhood furniture with her when she moved into her apartment. With permission, of course!

My goal was to spend $0.00, or as close as possible. It helped that I could take my time with this project, as it allowed for everything I needed to drop in my lap.

Here’s what you’re looking at:

• Bookshelf from Buy Nothing.

• Rug from an after-garage sale “free pile.”

• Dresser was a curb find.

• Bed was something we already owned.

• Chair was a $3 thrifted find from years ago.

• Bedside table from a hand-me-down from a neighbor.

• The bedding was bought from a consignment shop a few years back. I think I paid $9.99 for the duvet cover with matching pillow cases.

One thing that has helped my family in our frugal journey was that we never bought (or garbage picked) furnishings marketed to kids. So no Disney dressers or race car beds that needed to be replaced once puberty hit. We outfitted their rooms with quality furnishings they didn’t outgrow. The antique dresser that our daughter uses in her apartment is actually her old changing table, although it no longer has a pad on top!

-

I found an abandoned carabiner at my husband’s soccer field and brought it home. These thingamawhatzits are very handy, so it’s good to keep a reserve on hand. I don’t think I’ve ever bought one, yet I seem to always have a couple on hand.

-

I boiled the $1 corn from last week, even though three out of the five got immediately demoted as leftovers. Fast forward a few days and I seared the cut-off kernels in a cast iron skillet and added them to our Mexi-bowls. Lastly they made an appearance on tonight’s black bean tostadas. It’s almost like corn is infinitely versatile!

-

I sold a pair of Christmas mugs on eBay for $25, which is happening more and more infrequently as I don’t thrift as much as I used to. However, it costs me nothing to keep old listings up and I certainly have the space to hold onto my stale but organized inventory.

-

I didn’t push through any legislation to impoverish our most vulnerable citizens, while simultaneously enriching my morally reprehensible friends.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

My neighbor set some garden items out on her parking strip, so I carried home the two colorful tables and the two black plant stands for my back garden. I left the tallest plant stand for someone else. I texted her a photo and let her know it was an “open adoption” if she wants to come visit with them.

-

I took a small container of leftover marinara sauce from the freezer and warmed it up in a saucepan, adding textured vegetable protein (TVP) from the Winco bulk bins. I then boiled half a bag of Trader Joe’s penne pasta, (99¢/lb) and served a fancier than normal lunch for my husband and I to enjoy in the backyard. The TVP gave the sauce a ground meat texture, while adding inexpensive protein.

-

I made a batch of sun tea using a two bags of mediocre Red Rose tea and a chai teabag from last month’s Seattle hotel room. (I absconded with all the tea bags from our pricey hotel room!) We don’t own a proper “sun tea” jug, so I used the glass pitcher we already own and rubber banded a plastic bag over the top to protect it from bugs. I could buy an official sun tea jar, but it makes more sense to use what we have. Not only is it cheaper, but it’s also environmentally advantageous to figure out multiple uses for the things we already own.

-

I took an evening walk and brought home this free-box can of Campbell’s Cream of Mushroom soup with a “best by” date of April, 2025. Pshh . . . that’s nothing in the world of expiration dates! I have no idea what I’d do with a jumbo can of condensed soup, but it can sit in my pantry until I figure something out. Ideas?

-

I didn’t spend a penny on Amazon, so I had no part of supporting a certain revolting billionaire’s wedding.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

My husband and I hit up Costco this afternoon with a short shopping list and a goal to stay away from impulse purchases.

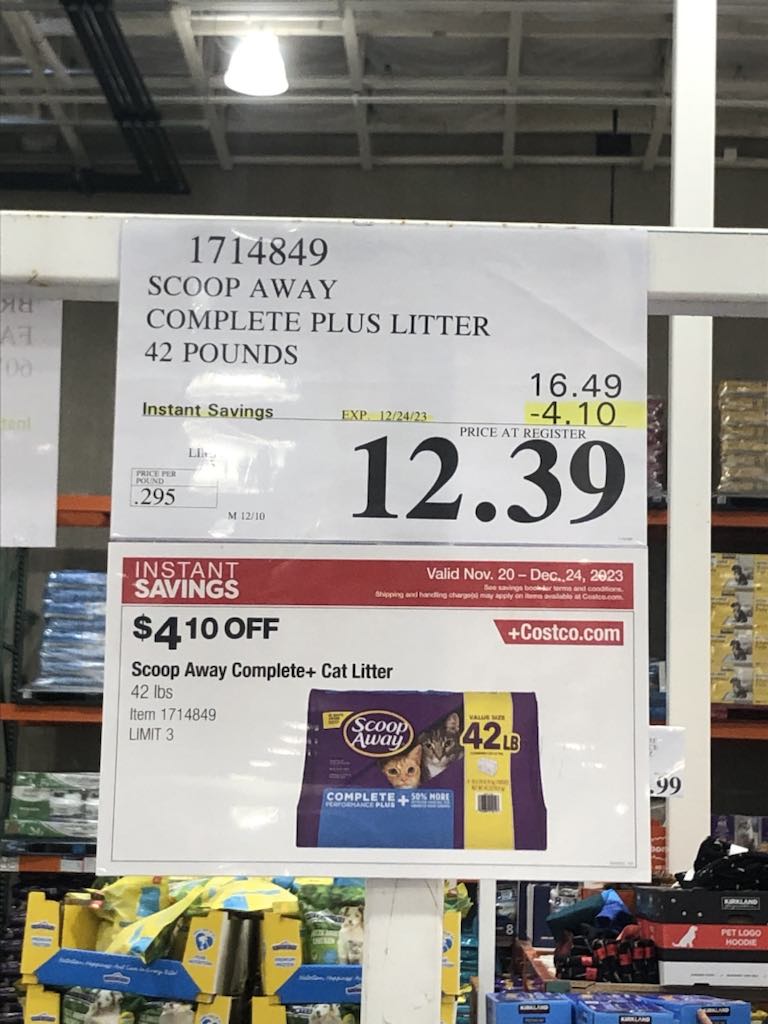

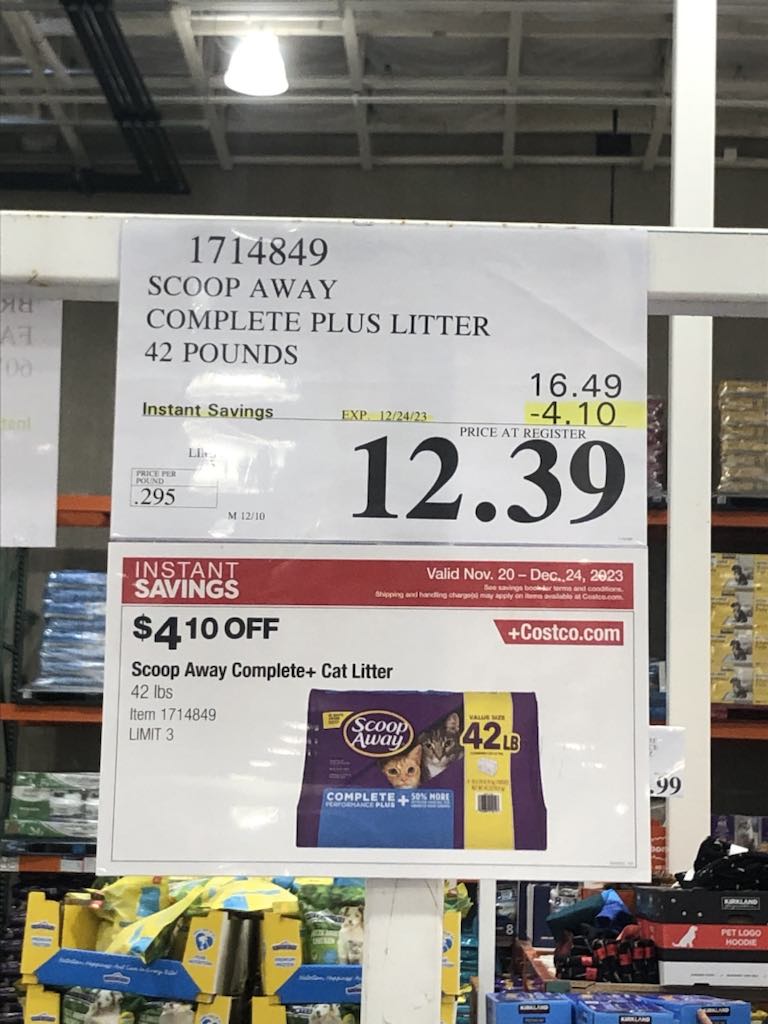

We were down to one small bag of cat litter, so I fully stocked up as there was an “instant rebate” and I’d rather get ahead of the cost. (We bought three four-packs.) The most boring purchase, but it can’t be avoided when you have a cat. I checked my photo library to see how the prices have changed and was shocked to see that the cost hasn’t changed since I took this photo in December of 2023! Something that hasn’t gone up in price? Crazy.

The other thing on our list was laundry detergent, specifically the Kirkland Signature brand. This tub-o-detergent lasts my family a full year, specifically because I immediately remove the large scoop and replace it with a tiny scoop leftover from some long forgotten container of Dollar Tree oxyclean. My husband and I are not ditch diggers, so a small amount of laundry soap cleans our clothing/bedding/towels without issue.

I would estimate that I use a tablespoon of soap per load.

Of course no trip to Costco would be complete without a loop around the store for free samples.

Beef sticks:

Hotdog:

Quinoa:

La Croix seltzer:

And chocolate chip cookies for dessert!

The joke is always “I went to Costco for batteries and came out with $500 of random purchases,” but it doesn’t have to be that way. My husband and I don’t buy premade frozen food and we don’t go down the non-food aisles. Costco on an actual budget, it can be done.

P.S. My husband did get a $1.50 hotdog + soda.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...