I’ve been practicing extreme frugality ever since I discovered The Tightwad Gazette while on maternity leave in 1998. I had a two year old, a newborn and an overwhelming job working night shifts as a labor and delivery nurse. The ideas in that book hit me at just the right time.

I started washing out baggies, found free activities and I stopped frittering my money away five dollars at a time. My kids might be grown, but I still work hard to spend as little as possible on the small stuff. This might sound dour, but I consider it to be a creative challenge.

I figure out new ways to save money at least a couple times per week and those ideas often come from the comments section of this very blog!

You already know my favorite unusual money saving ideas, but today I want to know yours! What are you doing to stretch your dollars?

Please share your money saving hacks in the comments section below.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I made a batch of pickled red onion, which’ll be a fun topping for various savory dishes such as tacos, salads, chili, etc. I spent 56¢ on the onion and used a cup of white vinegar, water, 1/6 cup of sugar, peppercorns, garlic powder and salt. The recipe recommended using a mandoline, but I have a recently sharpened knife and decently adequate knife skills. I followed this recipe, although they’re pretty much all the same.

-

I set two wastebaskets out on the curb and one was nabbed by a passerby before I could even walk back into the house. I put unwanted items out on a nearby corner that gets significantly more action that my own front yard and I don’t think I’ve ever set something out that didn’t get taken.

-

I took the 46 pounds of my late in law’s financial papers to the free shredding event that I wrote about last week. (Saved us $46!) What I didn’t write about was how among their hundreds (and hundreds) of unopened pieces of mail were two checks. One from a class action lawsuit for $200 and the other from their insurance company for $800. My husband contacted the insurance company and provided them with the proper paperwork to get it reissued. He also mailed paperwork to the class action firm, although that one’s likely to be a lost cause. My husband is the estate administrator, so he’ll split any funds with his two brothers.

-

• I borrowed two books — Emily Henry’s “Book Lovers” from my mother and Molly Gloss’ “The Dazzle of Day” from my father.

• I mixed chopped chives into the last of some cream cheese. The chives have been in my freezer since last autumn when I harvested them from my garden. It’s good to preserve food, but it’s the goal to remember to actually eat it.

• I mixed up a batch of The Frugal Girl’s cilantro sauce to use up some cilantro that was on its last legs. I’m not sure what I’ll use it for, but I’ll figure something out.

-

#5 is from my sister, who is a NYC high school teacher. They have a tremendous amount of cafeteria food that goes to waste, so the teachers can take home certain items. This is directly related to her sudden interest in making batches of “raisin forward” granola.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

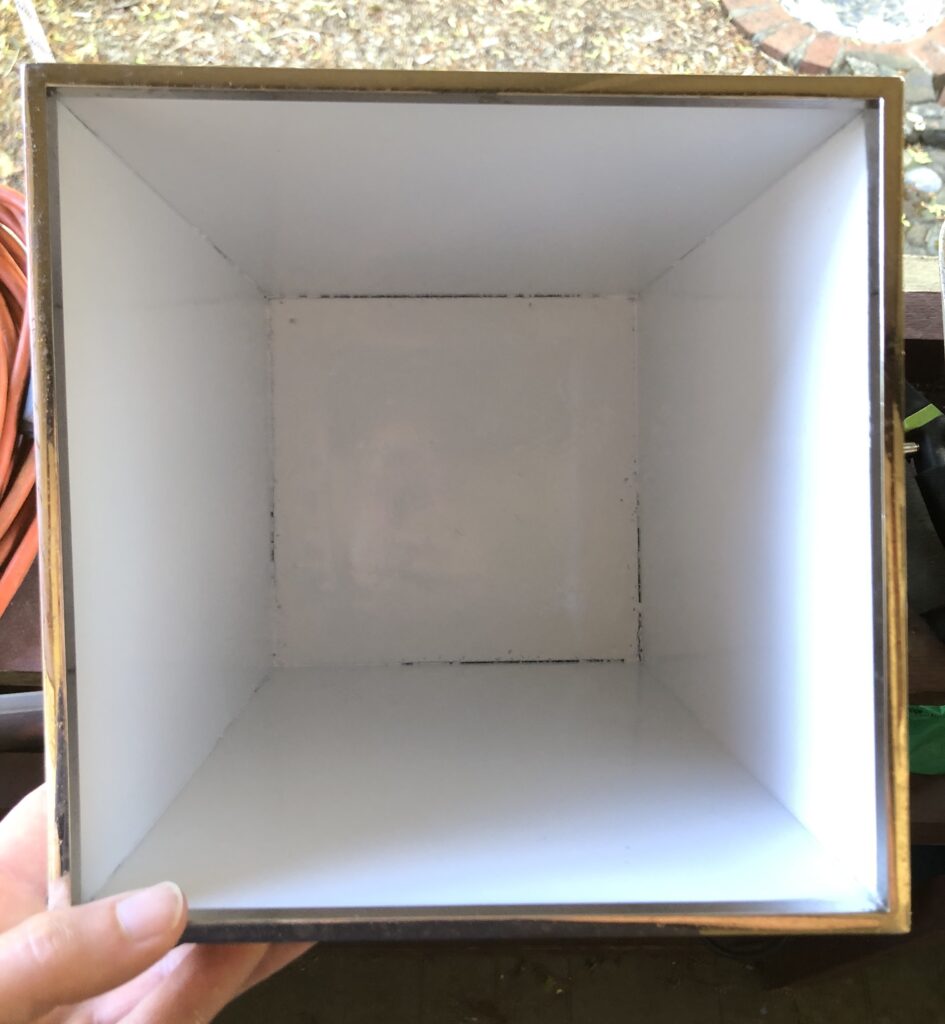

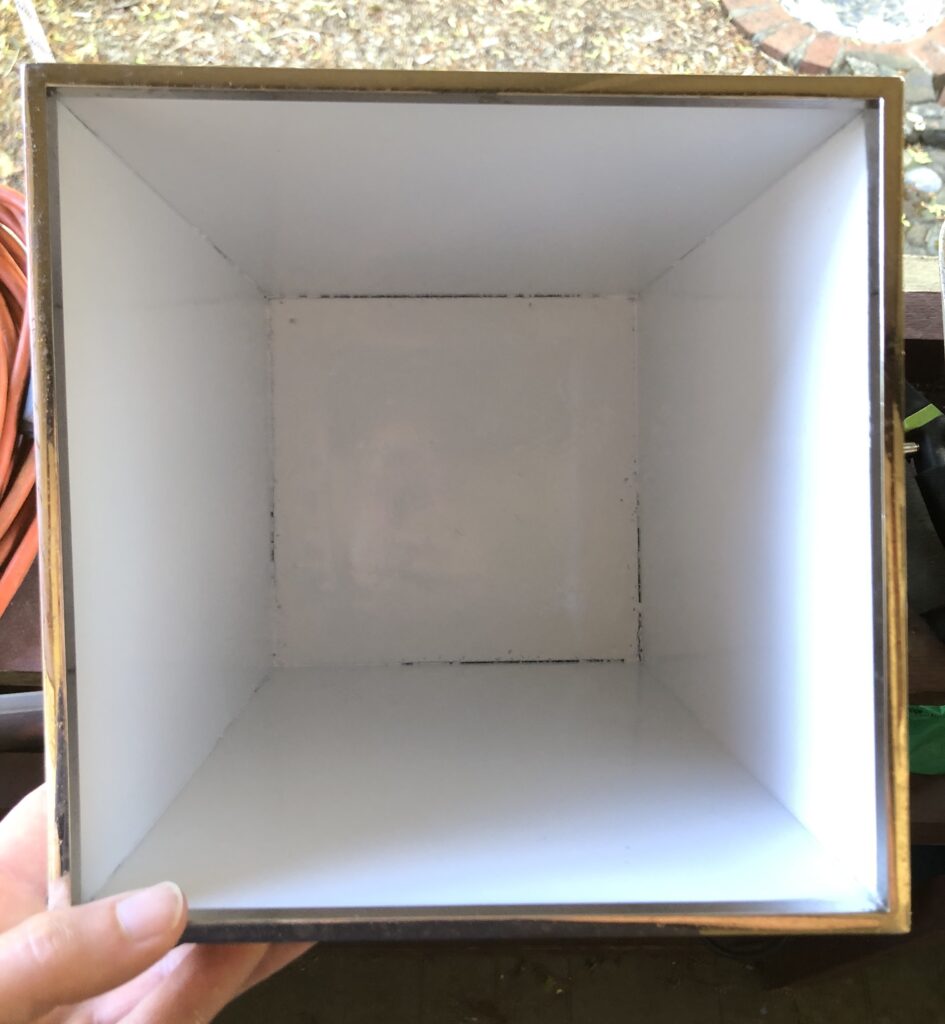

One of the things that I brought home from last week’s neighborhood garage sale freebie fest was a Restoration Hardware polished nickel wastebasket. It was superficially rusty on the inside, but I welcome a DIY challenge.

Please enjoy the funhouse mirror effect, although I promise you that my reading glasses are not this big!

Step one was to take sandpaper to the interior to smooth out the paintable surface.

Step two was to tape a bag around the outside to protect it against paint overspray. Although the inside was silver, I chose white spray paint as I already owned it and my goal is to always use what I own before buying anything unnecessary. Because, c’mon . . . the inside color of a wastebasket doesn’t really matter.

It’s the same found-it-in-the-basement paint that I used to paint over my scratched toilet seat a couple weeks ago!

I sprayed three light coats of paint to get even coverage and then let it dry overnight before removing the tape and bag.

For those who think this is an excess of effort to revive a revolting old wastebasket, I see your point. However, I need to point out that the closest version of this item is currently on sale for $499 on Restoration Hardware’s website! (Although this one is a mere $140!)

For comparison, my husband and I paid $500 for our first car in 1987, a 1972 VW squareback!

Behold an even white interior surface, not disgusting looking at all!

I think I’ll use it in our bedroom and give away the plastic lined wicker wastebasket I’d been using through my Buy Nothing group.

Here’s one last no-money shot to impress you with the power of white spray paint. This free rusty wastebasket went unclaimed throughout an entire day until I stopped by after the garage sale. Goodwill wouldn’t have accepted it and it surely would’ve hit the landfill. Now it’s back in use and no money was spent.

Katy — 1, throwaway society — 0!

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I scored this Bonne Maman jar from a free box. My neighbor who sets them out in her yellow recycling tub is moving away, so it’s good to have a couple backup jars. These jars + Winco’s bulk food section = a match made in heaven!

-

My next door neighbor invited me over for tea and croissant yesterday morning and we had a lovely chant and vent session. I brought my own tea and she supplied the pastry. We take turns hosting and it’s a perfect way to scratch that socializing itch without breaking the bank.

-

I made a cranberry coffee cake using this fantastic recipe that’s infinitely adjustable. The “cranberry” part was just leftover cranberry sauce that I swirled into the batter. I brought a couple squares to my neighbor, as well as serving it to the guest I was hosting.

-

I’ve started rehabbing a Restoration Hardware metal wastebasket that I picked up for free. I’ll do the reveal tomorrow, but rest assured that it’s worth the effort. Here’s a sneak peek of the rusty interior:

-

I made a big pot of white bean rosemary soup yesterday, which was extra yummy as I still had a bit of bacon leftover from making baked beans a few weeks ago. I like this frugal recipe as the white beans are a nice break from the pinto and black beans, which are a staple in my kitchen.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I picked up a free Abercrombie & Fitch sweater at last week’s neighborhood garage sale, as it was cotton and I like natural fibers. It was a bit fuzzy, so I pulled out my sweater shaver and got to work. It didn’t actually look that bad, but I was still able to remove a satisfying amount of fuzz.

-

I spent a good twenty minutes weeding the parking strip in front of the house, which is a chore I’ve been procrastinating for at least three months. It sure would be nice to have someone else do my least favorite tasks, but it sure is cheaper to do them myself.

-

My husband gave away an extra bike that’s been sitting in our garage for a couple of years. We could’ve sold it, but he wanted to do something nice for a friend.

-

I watched a YouTube video from Frugal Fit Mom on why “Why looking poor is important in 2025” and paused the video to write down two different quotes:

“Admire, don’t acquire” and “When you try to purchase status through objects, it does not work.”

-

I planted six summer squash seeds that I got for free, even though the packet was dated from 2022. Can’t hurt to try!

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

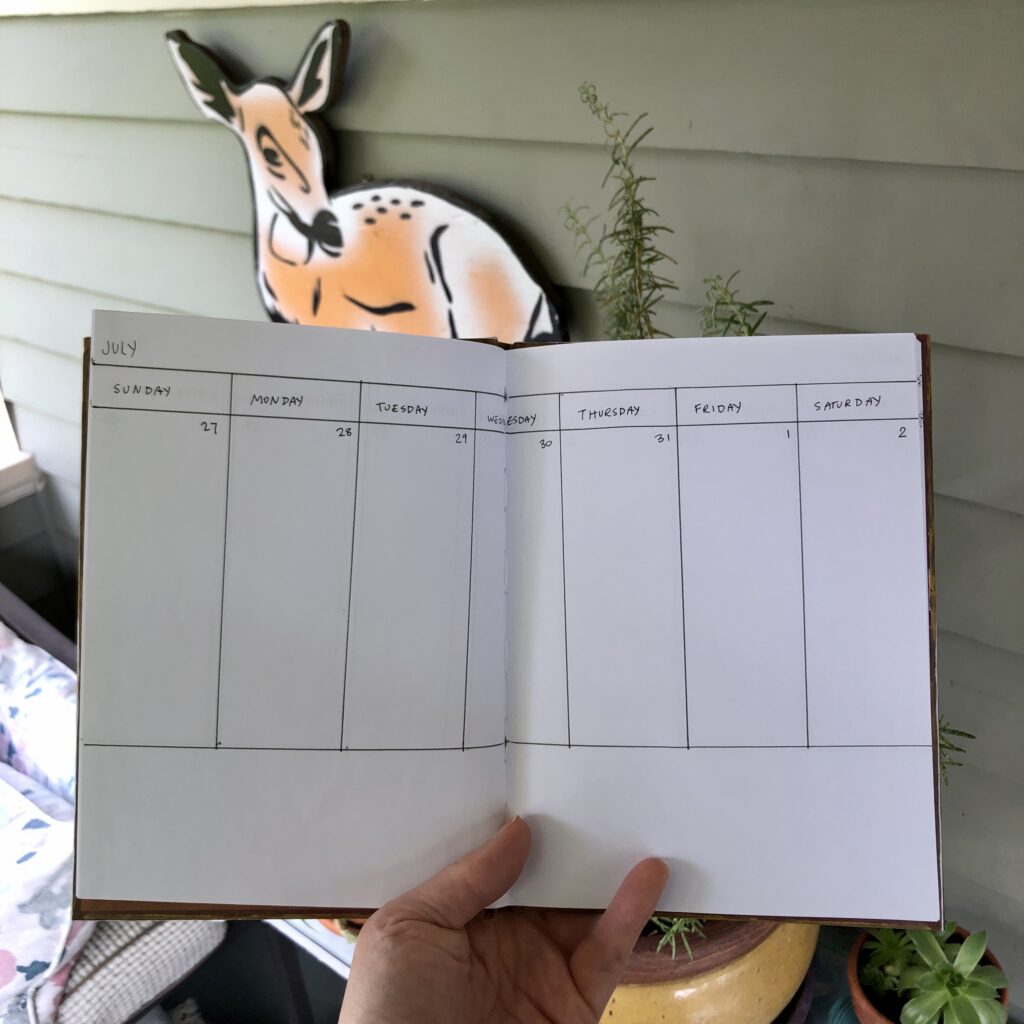

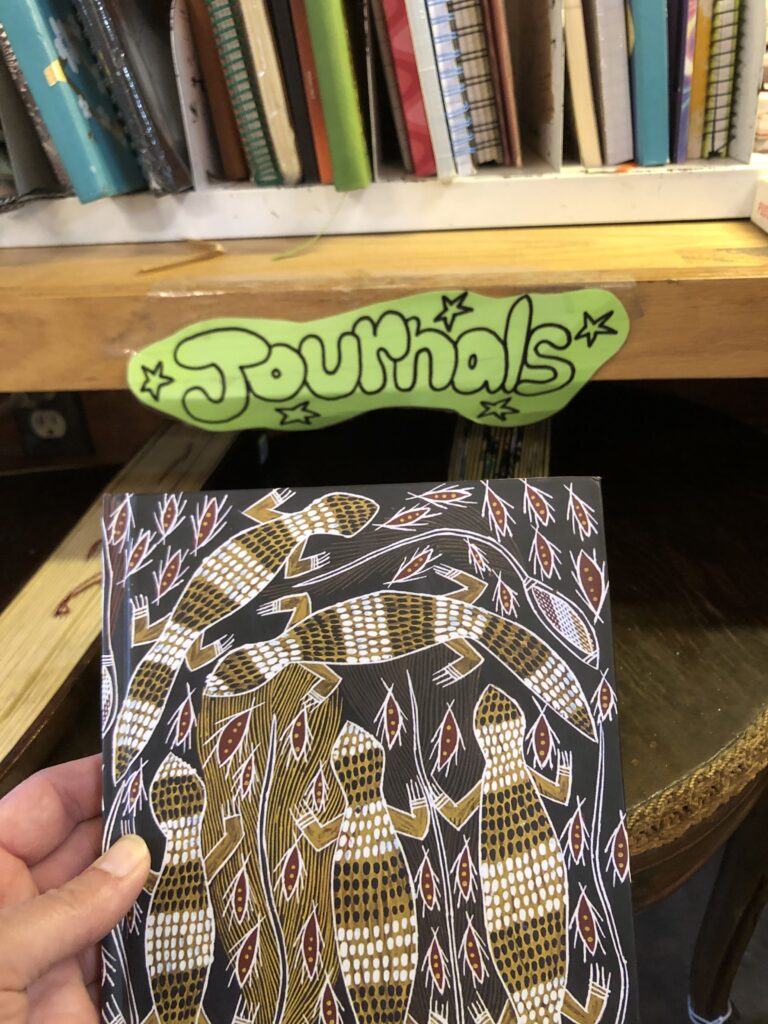

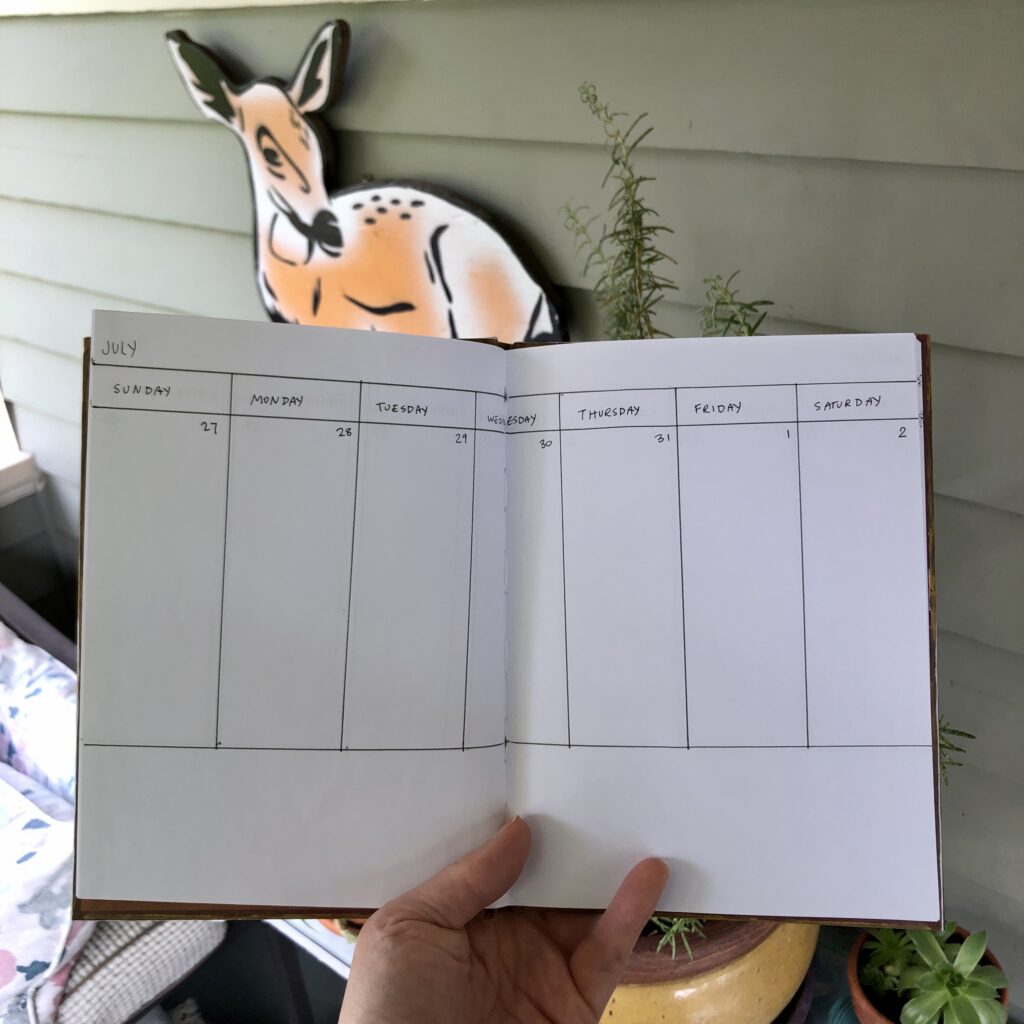

I started using a Mossery brand daily planner in 2020, as they were sold at a neighborhood store and I liked the size and configuration of the calendar pages. I also appreciated how you didn’t have to replace the entire thing each year, as they sell replacement inserts to tuck into their reusable covers. I learned that this specific planner helped me to stay organized and productive on a daily basis, which is how I became brand loyal.

Then I figured out that you can get a full year and a half from the planners by purchasing the blank pages instead of the calendar pages, so I switched over to that in 2021. Yes it took an hour or so to draw a calendar grid on each page, but I’m never one to shy away from a time consuming frugal hack!

My hack job calendar is a few weeks from running out, so I drove down to the store last week for a fresh blank insert only to discover that they’d closed their brick and mortar and don’t sell the blank inserts on their website. I even went to the Mossery website only to discover that the shipping on a single planner was $24.98, so I hatched a new plan.

Deep breath, Katy . . .

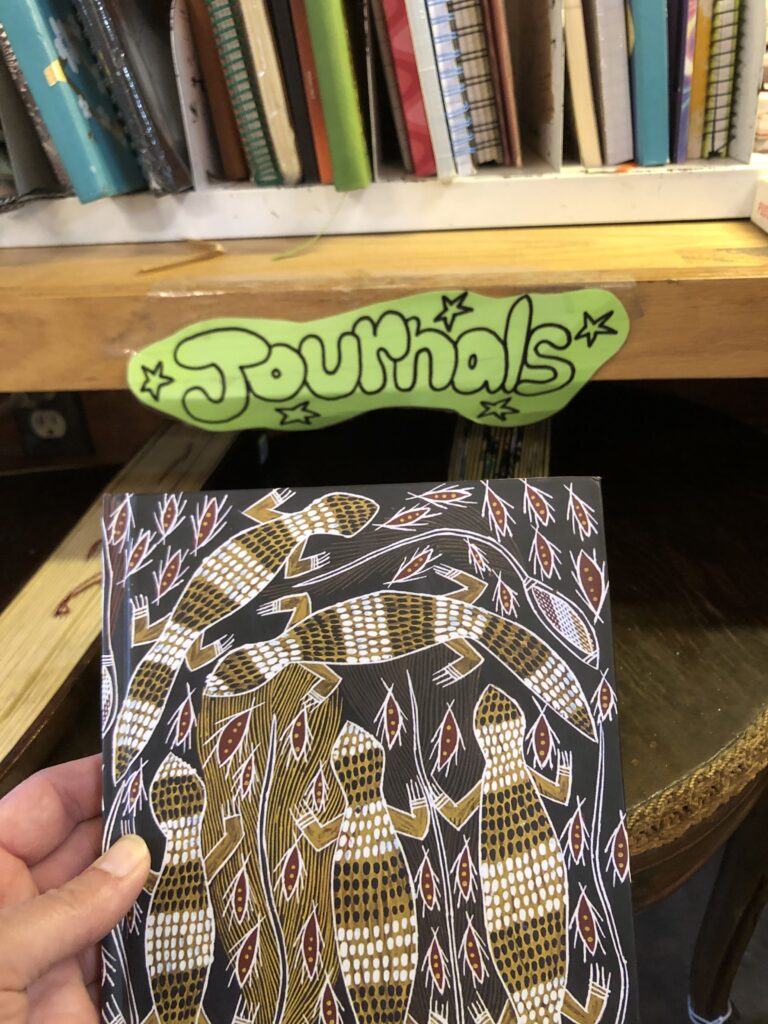

My friend Rosalie and I happened to walk over to a local consignment shop the other day, where I discovered that they had an entire shelf dedicated to nothing but used blank books. I chose one big enough for my over the top daily to-do lists, yet small enough to fit in my purse.

This $3 specimen fit the bill.

It took me a couple of hours to transform it from a blank book into a daily planner, but it was satisfying work and justified the binge watching of some old ER episodes. My current calendar still has a few weeks before it runs out of pages, but I’m now ready for that event.

I put way too much research into sourcing a not expensive planner replacement, but am ridiculously happy with my $3 solution. I didn’t overspend, I didn’t support that Schmeff Schmezos guy and I got to exercise my creative muscle! I love nothing more than figuring out frugal solutions to everyday problems.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

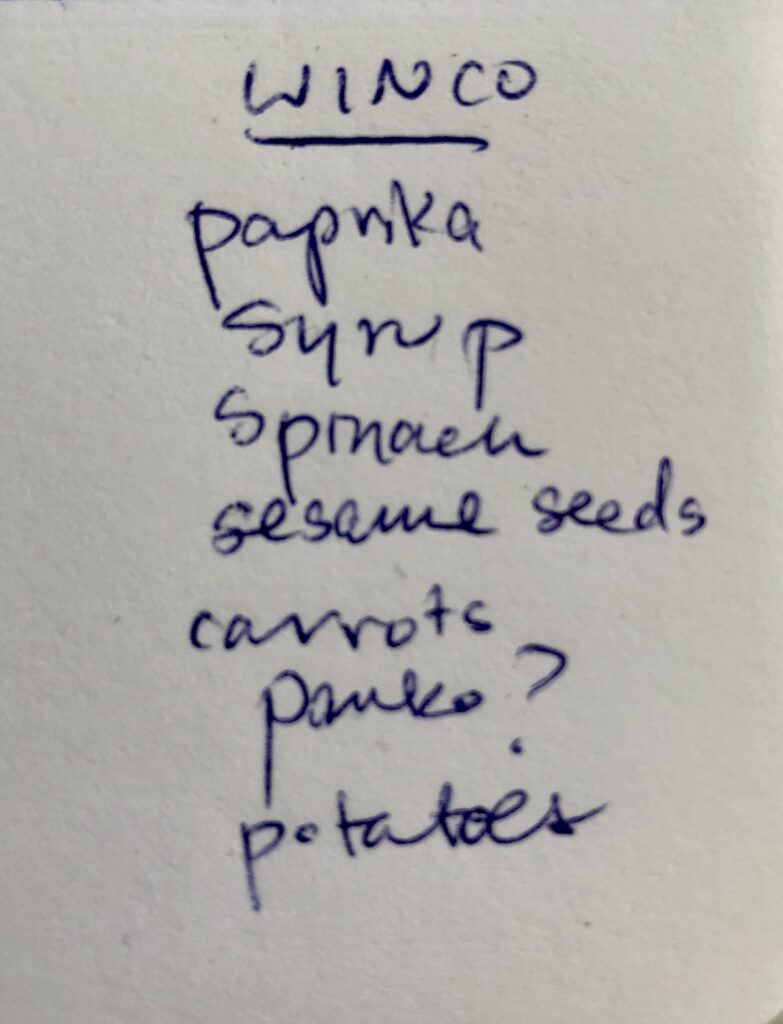

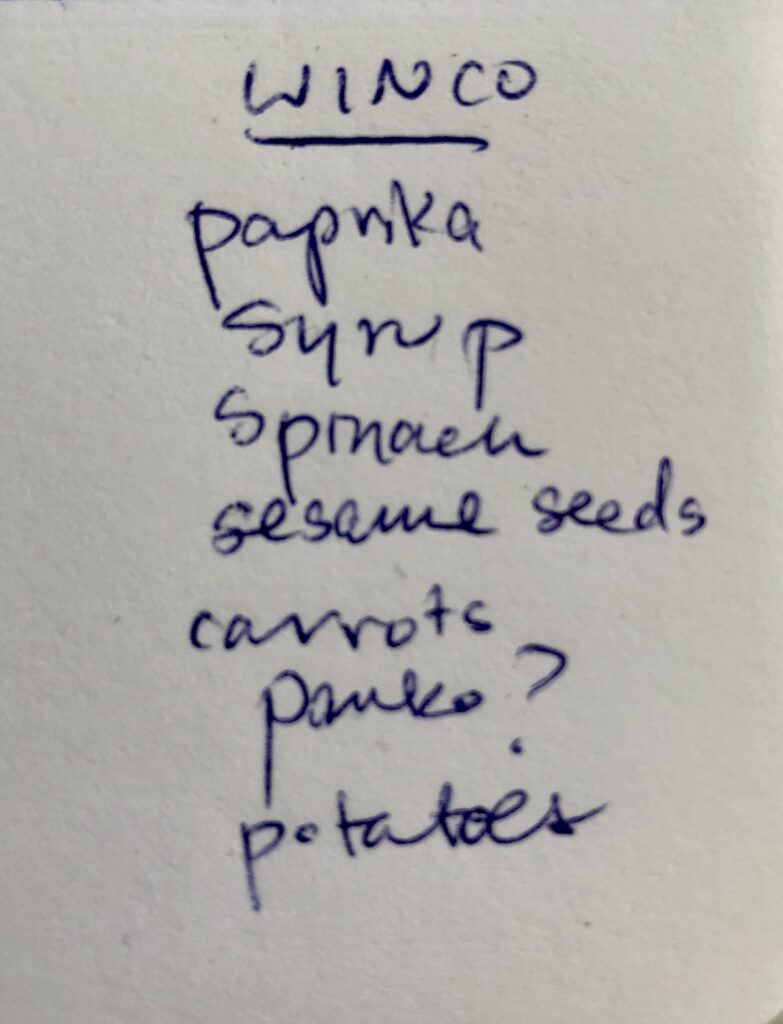

I’ve spent the past couple of days building a grocery list in anticipation of a Winco shopping trip. For those outside the Pacific Northwest, Winco is an employee owned no-frills grocery chain and is pretty much the cheapest game in town. (Plus their bulk food section is amazing!) This might not seem like much of a list, but I know I’ll add much more than what’s on here.

The standard advice on how to save money at the grocery store is to “make a list and stick to it!” But I’m here to say that this advice doesn’t make room for surprise bargains, like these sweet mini peppers for $1.98 apiece. I bought two.

Or these lil’ tomatoes for 98¢, I also grabbed two.

I also would’ve missed out on these 78¢ hotdogs had I stuck to my list. I’ve seen some Instagram reels where people stick a skewer into a hotdog and then cut it into a spiral and thought it would be fun to give that technique a try.

In the end I walked out with 24 grocery items instead of the seven on my original list.

Here it is all laid out at home. You’ll notice that I didn’t buy the panko crumbs from my list, as Winco’s version was 45¢ more than Dollar Tree.

The total cost for my big Winco trip was $51.23, which is kind of miraculous in these economic times. I always procrastinate going to Winco, as it’s kind of a schlep, but I’m always happy that I’ve gone as their prices, especially on fresh produce make it worth the effort.

Do you have a similar store in your part of the world?

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I took some a hose, soapy water and a scrub brush to all my random outdoor furniture cushions to freshen them up for the season. (A.k.a. grime and bird poop removal day!) They’re currently sopping wet and hanging on my laundry line and hopefully should be dry enough to put back in place by tomorrow. Every single one of them was either curb picked or handed down to me.

-

I curb picked an unused filter that’s the exact right size for our furnace. They only cost around $7 or so, but that’s seven dollars I get to keep in my bank account!

-

I used the last of the okonomiyaki batter for this afternoon’s lunch and then assembled a big pot of chicken soup using the last bits from a rotisserie chicken, plus carrots, potatoes and peas. I really need to go to the grocery store, but I enjoy the challenge of making do from what I already have on hand. I also saved the chicken bones and carrot peels in the freezer for future stock.

I’m proud to announce that I fully used up a ten-pound bag of potatoes, a two-pound bag of carrots and a jumbo bag of spinach without even a smithereen of food waste since my last big grocery shop.

-

I may hit the Pizza Hut that’s next to Winco as I read that they’re offering $2 personal pan pizzas on Tuesdays throughout the month of June. Too much of a bargain to not investigate. You know, for the blog . . .

-

This Saturday, June 7th is a “free fishing day” in Oregon, (no license required to fish, crab or clam) as well as free state park day and $1 bread day at the Franz bakery outlet. Good day to be a bargain hunter!

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

I finally sold my pair of Restoration Hardware bar chairs, $100 for the pair. I’d started them at $300, but that was apparently too ambitious, even though they originally sold for around $600 apiece. I thrifted them for just $16, so it was still a tidy profit. I’ve held off on thrifting for resale since listing them, as there’s nothing more humbling that holding onto bulky items that gather dust and clutter your home. Buh-bye!

-

I ran out of the thick plastic Safeway bags that my neighbor gives me to use as kitchen bin liners, so I texted her and she dropped off a new batch the next day. It’s hard to get ahead financially when all your money is tied up in garbage bags.

-

I garbage picked two brand new bottles of Method brand dishwashing liquid. I’ll keep one and give the other to my friend Lise.

-

I stocked up on Tillamook ice cream as it was on sale at Safeway for $3.49 per carton. Excellent price for the very best ice cream! I also hit the clearance shelf and paid 50¢ apiece for two dented cans of diced tomatoes.

-

I didn’t garbage pick a Lear Jet.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

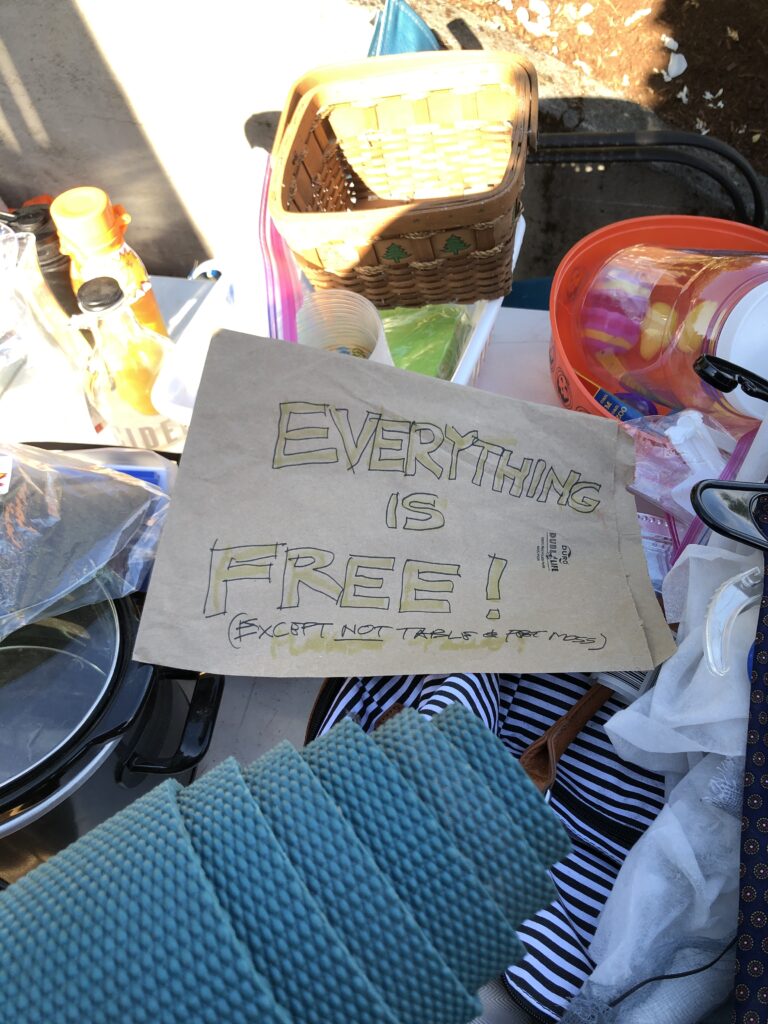

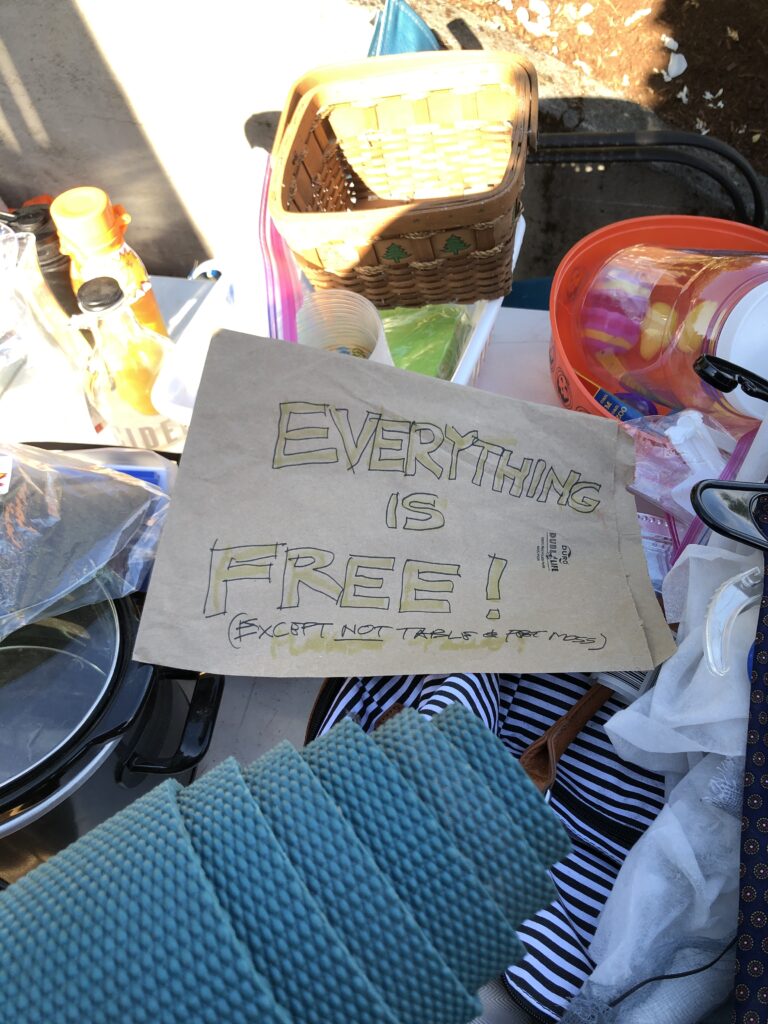

Today’s blog post is just a sneak peek from a wealthy neighborhood garage sale day, where I hit everything at the end of the day — you know when the homeowners are back inside and everything is free!

This sweet blue wooden table now resides on my front porch, where it serves to hold my crazy spider plant. As a point of comparison, here’s similar table, priced at $58!

Stay tuned for a future blog post where I post the good, the bad and the ugly!

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...