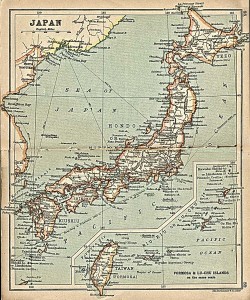

I started a personal savings challenge at the beginning of last summer. I knew my 14-year-old son would be going on a class trip to Japan the following April and that the cost would be somewhere in the $2000 range, before spending money. He had gone on a similar class trip at the end of fifth grade, and although we were able to cover the $800 from our budget, the $2500 for my husband to chaperone had to be borrowed from my retirement 403b.

This time, I wanted to be more on the ball.

So I started to put any and all unexpected windfalls in my credit union savings account. From pennies found on the ground to the $400 from a garage sale, no amount was too small. And it’s amazing how quickly this money has added up. I decided that this savings project could only come from non-work related income, as I didn’t want to derail our debt repayment.

One aspect of my savings plan that made it more satisfying was moving our money over to an online ING DIRECT bank account. Not only are we actually earning interest on our savings, (1.3% vs. the 0.25% we were getting at the credit union) but we’re now able to subdivide our savings goals into named accounts. For example, we have:

- Japan Trip

- Japan Spending Money

- Hiring a Web Designer

- General Savings — 14-year-old, 11-year-old, etc.

I know that it’s kind of dorky, but this seems to be the extra impetus that I needed. It’s somehow more fun to add money into a named account rather than a general numbered account. I have no illusions that Warren Buffet handles his finances in this manner, but it works for me.

So far I have put over $2500 aside, which I’m pretty proud of. And starting in January, our mortgage will be going down around $200 per month due to a refinance, which will propel our debt repayment that much faster. (%$$ #$##@&% Money-pit of a house issues. Don’t get me started.)

I had always thought that I should not be putting money into savings until I was debt free. But this method made preparing for known large expenses next to impossible. Reading Dave Ramsey gave me permission to prepare for foreseen expenditures while simultaneously paying down debt.

One aspect of my savings project that I would not have foreseen, is that although I’m not working any extra shifts at work, (I’m a labor and delivery nurse) I have been willing to do extra money making tasks that I normally wouldn’t bother with. Like saying yes to taking all my mother’s pop cans for recycling or play cleaning lady here and there for my mother’s guest cottages. Part of my frugal living lifestyle meant that I didn’t have to try and scrounge extra income. That was the point. But now, I’m really enjoying seeing that extra cash build up and not just get sucked into the abyss of a generalized bank account. Clicking on my ING DIRECT accounts to view my balances is fun! Well . . . Katy Wolk-Stanley fun.

I pretty much have enough money saved up for my son’s Japan trip at this point, and it has been completely painless. And when I switched the blog over to self hosting, I didn’t bat an eye at the expenses, (theme, web hosting, domain renewals, web designer, etc.) And last time I checked, I’d made a whopping 35 cents from the ads.

No over-time shifts or bizarre deprivation required.

So what will I save for after my son’s trip? I’m thinking I want to set up an official emergency fund, plus there’s another Japan trip during high school that’s for an entire summer.

That’s a lot of pop cans. But I’m not worried.

Are you working on your savings more than ever? Or are you living off an emergency fund? Please share your stories in the comments section below.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

{ 9 comments… read them below or add one }

Wow, congrats! What memories for your son. I lived in Turkey for two years and those memories are precious to me.

My goal will seem so frivolous to many, but I will take a big gulp and spit it out anyway 😉 My grandmother will be 91 next summer when she comes to visit. There is a play I have always wanted to take her to but never have. Time is running out to do so, so next summer is my goal.

When my family comes , I want to be able to go to something out here called the Medora Musical and Pitchfork Steak Fondue.

The musical is a really campy, kind of Oklahoma musical set in an amphitheater in the badlands. The fondue is what it sounds like lol

To pay for both the musical and the fondue for my family of 4 and my grandmother will be 500.00 including any taxes, tips, etc. I would love to say 800.00 and pay for my mom, stepdad and stepsister as well, but the main goal is to pay for my grandmother.

Kris-ND,

Your kidding me right? This is the most non-frivolous thing that I have heard of in a long time. Making memories with family is a top priority around here. As long as you have all of your other bases covered money wise, go for it!!

Enjoy!

Why is it that I see my own typos just as I hit the send button? Aargh….

Kris,

That sounds like a hoot. I say make this a goal and just go for it, and make sure to let us know how it went. Fondue and all.

Katy Wolk-Stanley

The Non-Consumer Advocate

Okay here’s a link:

http://www.medora.com/

Katy

Oh, I’m so glad you love your ING accounts! I knew you would. 🙂

Katy wrote:

“although I’m not working any extra shifts at work, (I’m a labor and delivery nurse) I have been willing to do extra money making tasks that I normally wouldn’t bother with. Like saying yes to taking all my mother’s pop cans for recycling or play cleaning lady here and there for my mother’s guest cottages”

Genuinely interested question for you (ie, I want to hear your answer, rather than indirectly make a judgement on your choices): why do you prefer tasks such as play[ing] cleaning lady and all that rest, to working another shift as a nurse?

And I’m with shymom about Kris’ goal: that’s awesome! It’s something they’ll all enjoy and remember, as a good time had as a family together.

WilliamB,

The reason why I prefer to “play cleaning lady” to an overtime shift is that:

A) I’m helping my mother out.

B) I consider this money to be “free cash” as overtime shift money just gets direct deposited into our account and sucked up by life’s expenses.

C) When I work as an RN, I have to drive nine very traffic-y miles across town, change into scrubs, work very hard in a stressful job, change out of scrubs and then drive back home. When I work for my Mom, I drive a couple miles, work for a few hours, get taken out to lunch, work a few more hours and zip back home. No fuss, no muss.

D) The more I work as a nurse, the more I burn out on that job. I am trying to not cross that line.

I do love my job as a labor and delivery nurse, but it is very stressful and intense.

I like to do both.

I hope this helps.

Katy Wolk-Stanley

The Non-Consumer Advocate

Katy, I love this post and I don’t think it’s dorky at all to feel motivated by naming your accounts. I always find it more motivating to save money or change my habits when I know I’m working toward something specific. Being thrifty for the sake of being thrifty isn’t nearly as inspiring as being thrifty to save enough money to go on a trip, or buy a house, or have a baby. I find it also helps on the other end – it’s easier to spend all that money when you know it’s been set aside for that specific purpose from the beginning.

I love my ING account and it too has a name. 🙂

(Suddenly I feel like singing that to the Oscar Meyer tune – “My savings account has a first name, it’s J-A-P-A-N . . . ” How’s that for insidious marketing- ha ha!)