Coin-Girl Meets Dave Ramsey-Girl

The following is a reprint of a previously published post. Enjoy!

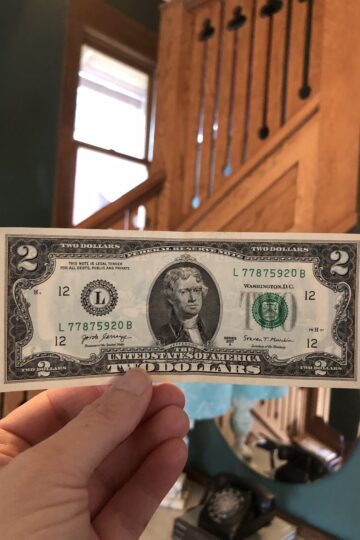

My regular readers know that even though I masquerade as Katy Wolk-Stanley, mild mannered labor and delivery nurse, I am actually better known as Coin-Girl. Staunch supporter of dropped change and defender of the the under-appreciated copper penny.

But Coin-Girl appears to be suffering from multiple personality disorder, as she is quickly morphing into Dave Ramsey-Girl. Staunch supporter of gazelle intensity reduction of debt and defender of the emergency fund.

I'm holding a garage sale this weekend, with the goal of raising $1000 for an emergency fund. I am fully aware that this goal is most likely unattainable, but a girl's gotta dream, right? (If I can meet this goal in a two week period, then I'll be satisfied.)

And all my profits will go into a savings account.

I'm working both tomorrow and Friday, so I wanted to get myself organized nice and early. I started yesterday by bringing some clothing to a consignment shop. They only bought a pair of sandals, but they'll price them for $20, which means I'll make $10. This super-cute pair were a $3 Goodwill find that never really fit me, so I consider this to be pure profit. I also sold a trail-a-bike for $25. (Part of Coin-Girl's powers is to sell a few choice items ahead of time.)

Today I returned an extra packet of clothespins and cashed in bottles and cans. When leaving the store, I glanced at the Coinstar machine, (which I always do, as they're often a source for free money) and found a whole handful of change. Granted it was mostly Canadian coins, but who am I to turn down a handful of cash? I found four pennies, one of which was a 1930 wheat penny.

Coin-Girl's powers are awesome and almighty!

In all, I raised $32. This amount is now deposited into my savings account/emergency fund. (A pittance to some, but a fortune to Coin-Girl.)

So who am I? A girl who will stop traffic at the mere glint of a fallen coin, or a girl with laser intensity for an emergency fund and debt reduction?

Let's just say I did wear a cape while depositing a lot of loose change at the credit union today.

And nobody bat an eye.

Are you working towards a juicy emergency fund? Please share your stories in the comments section below.

Katy Wolk-Stanley

"Use it up, wear it out, make it do or do without."

We have an emergency fund, more than $1000, but less than we want ideally. I think it'd last us about 2-3 months, but ideally I want one that could last us a year or more and I'd at least feel a lot better with one that'd last 6 months. That has to wait, though, until we're further out of debt -- which we're climbing out of slowly but surely. We're not quite gazelle intense, but we have to make it further than most gazelles. More like endurance runner intense.

As you might guess, the emergency fund is one area where I sort of don't agree with Dave Ramsey, but then I think our particular situation warrants a larger emergency fund, at least for now. Other than that, though, and maybe even including that, I think he has a great plan. My husband and I watch him on Hulu and I've read at least one of his books, maybe two (been a while), which I borrowed from the library.

I like Dave Ramsey. Thankfully we're out of debt other than the mortgage, but he inspires me to want to pay that off early too!

Coin Girl,

Do you save those Canadian coins in a jar and get them exchanged later? I'm not sure how much you would need to find to pay any exchange fees at a bank.

Jupe,

My sister lives in Canada, so I send my found change up to her whenever my parents visit her.

Ever yours,

Coin-Girl

Katy, I just wrote a post on my blog about going through some 'unwanted' coins and the ENTIRE TIME I was thinking, "Coin Girl would be SO PROUD of me right now!" I also linked to you in the entry. If you'd like to read it, here's the post:

http://divinebird.com/wordpress/?p=307

It's the one called "Coin Girl Would Be Proud". 🙂

So you know, I read every entry of NCA, though I'm terrible about commenting. While I haven't gone wholly non-consumer, my husband and I are slowly changing our thinking about 'stuff' in general. Thank you for your awesome blog! 😀

I wasn't working toward a juicy emergency fund, but now that I've read this, I am. Thanks for inspiring me! $32 is a lot when you figure it's found money that won't be counted as income tax. In my household, that looks more like $60...and in your emergency bank account, if you earn interest, it will turn into even more.

Love this blog!