Five Frugal Things

-

I was sent a coupon for a $19.99 Honda dealership oil change that included a car wash voucher. (This is cheaper than buying the supplies ourselves. Plus this car is in a state of whatever is worse than "nasty filthy.") I made an appointment to bring in our 16-year-old minivan, but first confirmed that they'd honor the coupon since it expired on December 31st. I used the down time to approve Non-Consumer Advocate Facebook members and start a new library book. I sent a text to my sister that I was "adulting," although die-hard Star Trek fans can call it "grup-ing."

-

Money is very short this month as we recover from making winter term's tuition payments, renewing my nursing license, Christmas expenses, repairing our sons' laptop and all the other shit that happens in a "shit happens" world. Add in that both of my 12-hour hospital shifts were cancelled last week due to low patient census, and you'll see my husband and I doing all we can to minimize our expenses and maximize our earnings. So far this week my husband has worked an overtime shift, I returned bottles and cans from our back porch, I sold a $10 mug, I put myself on call for work, (and ended up with seven hours of time-and-a-half pay) I scheduled an extra hospital shift, I'm selling a few items that I picked up at Goodwill and we're starting to make a dent in the massive pot of turkey soup that dominates our refrigerator. Not a lot of fun, but low bank accounts make me queasy with anxiety. Debt free living is not for the faint of heart.

-

My next door neighbor took me out for a lovely birthday/thank-you-for-feeding-my-cats breakfast at a local restaurant. I had enough leftover food that my husband was able to add a couple of scrambled eggs to it and create an entirely new meal. Thank you, Nancy!

-

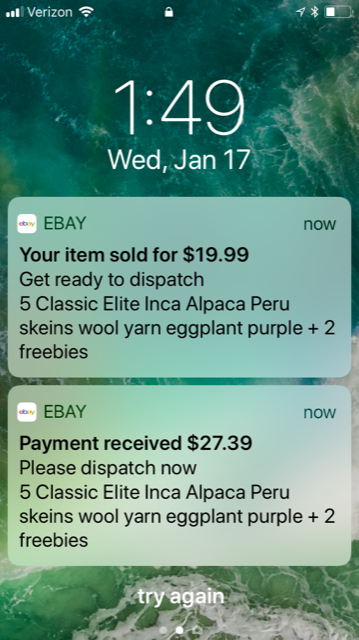

I put another book on hold at the library, turned the heat down to 61° last night since I was already under a blanket watching TV, wore the same outfit two days in a row and I sold some alpaca yarn that I had picked up at the Goodwill Outlet, (light as a feather, so it was the perfect item to buy by the pound!)

-

I didn't buy a Lear Jet or a vulgar gold-plated apartment in the sky.

My 5 Frugal things this week:

1) I needed to use the last half of a jar of home-canned apple pie filling and my dessert of choice required graham crackers. So I found a recipe & made Honey Grahams myself instead of buying. No special flours or anything! Costs only pennies.

2) Washed our clothes and hung the wet clean laundry on expanding racks to dry. It not only saved from not using the drier but also added much-needed moisture to the dry winter air inside our home.

3) Used cook-once, eat-twice method of dinner prep this week. One large roast was enjoyed the first night as roast and a couple of nights later as pulled pork BBQ

4) I had no BBQ sauce for aforementioned pulled pork sandwiches so I mixed some up myself with ketchup, mustard, balsamic vinegar and liquid smoke.

5) Part of my New Year's Goal was to clean out & reorganize my dresser drawers. I was contemplating replacing my older socks but found I didn't really need to shop for more - I had plenty I'd forgotten about still new in the package. Score!

~TMH~

1. "Me too" Katy - frugal January - living the debt free dream! Scrambling but I will pay the credit cards off of Christmas expenses without incuring any interest.

2. Doing Swagbucks as I type - need 95 more to get a Walmart $25 gift card - slow and sure.

3. Turning temp down in the house - was 5 degrees out when got up this morning. Looking forward to the warm up at the end of the week. Also closing doors, blinds, etc., to maximize our heat.

4. My skin is super -SUPER dry have resorted to showering every other day. Hopefully this will reduce our water bill that went up last month.

5. Free Redbox movie, going to watch Girl Trip and Get Out borrowed for free from the library.

Get Out was the single worst movie I have ever seen in my life. Glad you did not pay for it.

I liked Get Out - it was so creepy and bizarre. Definitely not everyone's taste, though.

Those two movies were at our house too. I left the room five minutes after Get Out started, but was trapped for Girl Trip. That is the most appallingly vulgar movie I've ever seen. Unbelievable! If people really talk that way and act that way the country is worse off than I thought. It could have been sort of good without all that smut as it had an engaging plot and the actresses had believable chemistry.

1) Saved cold coffee yesterday and heated it to drink this morning. This is more impressive than it sounds because our microwave stopped working last week and we opted not to replace it. So reheating on the stove, which requires all sorts of higher-level thinking (stove on, coffee poured into the pot before the pot burns, coffee poured out of the pot and into the mug before it boils away, stove off so the house doesn't burn down) before I've actually had any coffee.

2) Talking to everyone I can think of in my giant multinational corp about an idea that should lead to a new job. Found the right person this morning. Fingers crossed for the next steps. Frugal because the job I'm in is terrible for my health (long hours, rough deadlines, dreadful boss) and I'm tired of paying for blood pressure meds. Plus the new one would pay a lot more.

3) Brought last night's leftover salad for lunch. Took advantage of the company cafeteria for salad dressing, which is no charge as long as you're not unreasonable about it. I wasn't.

4) Remembered to pull something out of the freezer this morning to thaw for supper. With just me home, it's way too easy to talk myself into take-out if there isn't something staring at me when I walk in the door.

5) No Lear jet, no vulgar apartment, nothing gold-plated at all.

Hahahaha I’m laughing at your number 1!! Doing anything to completion pre-caffeine is award winning in my book!

I hope the new job comes through for you! Workplace stress can be such a destroyer of health and happiness.

FFT, Some Better News Edition:

(1) The Honda Element is back up and running. And thanks to the commenter who expressed concern about its security. (Stealing catalytic converters out of Elements? Is nothing sacred??) Happily, our Element lives in a garage with a good stout door.

(2) After a week in which it seemed as if we had a medical appointment for one of the other of us every @#$!! day (in iffy weather), we both have clean bills of health on various fronts. And in case I needed reminding that we're very lucky, two good Literary Society friends of mine are having to cope with major medical issues for both their DHs and themselves. (I still wish that a good fairy would bring back my DH's short-term memory, but we're dealing with it.)

(3) Our local Sam's Club was among those that announced its closing last week (in the wake of the much-ballyhooed improvements at Walmart). We are accordingly letting our Sam's membership go and swearing off warehouse clubs generally. We parted company with BJ's a couple of years ago over a hassle with our membership card; our only Costco is on the other side of the county; and I honestly think we'll be saving money by not being tempted to overbuy at the clubs. I know other folks' mileage on this issue may vary, and feedback is welcome.

(4) Otherwise, we're dealing with the same winter-related stuff as many of the rest of you. Re: various skin-related problems, I've found that the best and cheapest overall remedy is good old-fashioned Bag Balm. Great for cracked fingertips and chapped lips in particular.

(5) Like Taylor-Made, we're rocking the indoor laundry-drying racks for all they're worth. And we're both doing our bit to conserve on laundry by setting new records for not changing our clothes (at least the outerwear; I do insist on daily changes of socks and underwear).

A.Marie - have you heard of Dr. Mark Hyman's "Broken Brain" series online? I recently learned about it in the NY Times comments. First episode (of 7) is up today - you can probably google to find the link to sign up to watch if you are interested. I have family members dealing with memory issues. I'm hoping to learn some preventive or at least ameliorative steps to take.

Thanks for the suggestion, avl. I'll check it out.

Dr. Mark Hyman is extremely interesting. At the urging of my personal physician, I have slowly made the changes that he suggests with amazing results. Integrating good fats into the diet -avacado, coconut oil, nuts, and so forth-- have many benefits including stabilization of blood sugar and improvement to short term memory.

A. Marie - I look forward to your 'edition' titles. Glad to hear this one was good news!

Wait what is this about the security on the element? My man has one!

On the previous FFT, in response to a comment I made about my DH's Element, another commenter (Gina in KY, I believe) reported that there was a new trend in her city of people stealing the catalytic converters out of Elements that were parked on streets.

I'll have to try the Bag Balm. Sometimes I slather my hands, arms, and elbows with Vaseline before I go to bed. Then I use old knee socks where I've cut out the toes, pulling them all the way up my arms so they cover my fingers to my elbows. Yeah, I look like a crazy lady wearing black evening gloves with my pajamas (my husband laughs), but that Vaseline really helps super-dry skin!

Bag Balm is the BOMB!! We use that stuff almost as much as WD-40 and duct tape!

I put a plop of Vaseline in my lotion or olive oil before I smear it on my legs. My kids have eczema and I learned long ago that it's helpful to use a moisturizer such as a good lotion or olive oil then seal that in with Vaseline. I'm too impatient to smear on lotion then have to apply another layer of something else so that's the way I do it and it works pretty well. I like your sock idea and I may add that to my routine!

1. Did a hotel mystery shop. It was in my own town so not very exciting but earned a few bucks and they paid up to $40 for breakfast for 2, so husband and I ordered the largest portion things we could find and brought home enough to eat for dinner. Honestly, the omelet was even larger than I thought, so we shared his and I took home an entire breakfast, minus the milk.

2. We have an old clunker to sell. Did a mystery shop for a lube job to help bring it up to snuff. Plus, made an additional $40 for doing the shop.

3. Cut husband's hair again; he likes it short. Did my usual amateur job but since he still has plenty of curly hair (damn him! Why couldn't I have his hair!!) it hid my poor skills.

4. Husband came back from a week's work in another town a few weeks ago and never unpacked his shaving kit. I decided to put it away and inside were six bottles of shampoo, six of cream rinse and four bars of soap. Bless him, he said that he thought he'd save the shampoo for home since he could use soap. Poured it all into my main bottle, since I am not picky about shampoo and don't mind using a mix up of different brands.

5. Made a loaf of no-knead ciabatta that turned out really well, so made a loaf for a friend. She loved it and paid me with her hen's eggs to make 22 loaves for an upcoming church community breakfast, plus she supplied all the flour, yeast and salt. I now have enough eggs for at least a month, all raised humanely. She also didn't want the leftover flour so kept about five pounds of that, too.

Frugal windfall: I accepted a contract for a huge emergency grant writing job. It took me a week of insane hours but luckily the husband was gone so no distractions. I made $4,000! Loved the money but pumping out hundreds of pages of text/charts was pretty taxing. Spent $11 of the $4,000 on a Subway and fancy coffee as a reward, and put the rest in savings for next year's home insurance. Spent the day after it was turned in, watching Acorn TV, eating pieces of the sub throughout the day and napping.

Wow- on the grant writing job! You are a rock star!

I'm curious about this because someone told me that I could not receive payment for grant writing, but I could receive payment as a worker receiving part of the grant... I am a little confused about this aspect of grant writing. Do you know anything about this rule?? Or were they simply trying to get out of paying for writing a grant? Sounds like it was a nice windfall for you! 🙂

They used private funds to hire me as a writer. That is different than paying you for the writing once they receive the grant---that is writing on spec and not allowed by any grants I know of, although someone may know of private grants (versus state or federal grants) that allow it.

You absolutely can (and should) be paid for grant writing or bid writing. It is a huge cost. This is my job as well. I’m on staff just to do that. It’s 80% of my job. Nothing irritates me more than organisations that rely on grants but stiff the writers. It’s an investment but it adds value and is an essential role.

End mini-rant.

Agreed, Mand01 - it's part of the expense of the bid. I think what Teresa is referring to is a now-outlawed practice of paying the grantwriter out of the award - i.e., 6% of whatever is received, so $600 of a $10,000 grant. For federal grants in the U.S., payment for the bid cannot any longer be made as a percentage of award, but must be made up front.

Alas, I got into the business just after that rule changed. I make a reasonable salary, but seeing awards in the multi-millions come in and knowing that a couple of decades ago I'd have been paid from that can be . . . discouraging.

I understand that as a principle, but that doesn’t mean they can’t pay the writer. The company can pay them out of general revenue or as they’d pay any other consultant or staff. Without a good writer (and let’s face it, we aren’t just ‘writers’ - we are usually responsible for project management, research and solution development, not to mention team member hand holding and de facto social workers) the organisation will not win. And if they don’t win, they won’t be there.

Heh! De facto social workers - I'm adding that to my job title (in my head). It's so very, very true.

Mando - you are soooo right! Loved your job description. As a former fund raiser I can feel your pain and agree with you.

1. I'm staying on top of tracking our daily spending so far, an old habit renewed for 2018 to see what it shows us.

2. I've slowly been returning products that we bought for the house that we didn't end up needing.

3. We've mostly cooked from freezer and pantry so far this month.

4. PiC has been bringing home leftovers from meetings that would otherwise go to waste - I had a nice lunch of leftover Mexican rice with my own roast pork, and a breakfast of mini quiche.

5. I'm putting together a baby-gifts box for a friend composed of new freebies and hand me downs from my child that I've saved for her.

1. I stayed home today. My Mom came over and I helped her out with a few things that she needed done including waxing her eyebrows. I do my own as well as her and my daughters. This saves us both money. In turn she dyed my hair which saved me $60. For lunch we ate leftover veggie soup and crustless quiches that I had made the day before.

2. I made beef stroganof with a pot roast from my freezer that needed to be used. This was served over leftover cheesy cauliflower and I added some green beans and potatoes that my Mother was planning to throw out. We've had it for two dinners with a some leftover.

3. I walked with a friend yesterday for free exercise as well as good conversation and amateur therapy.

4. I received free toilet paper in the mail in return for doing a survey. I will also receive points that can be used for gift cards.

5. I picked up a few groceries yesterday including two free boxes of muffin mix with coupons that were given to me when I contacted the company about a problem I was having with the can of blueberries.

Maybe this sounds silly, but I want to know what's the benefit of waxing vs. plucking daily? (I have no sister to consult, I'm always looking for beauty advice, esp on the cheap).

It lasts longer and it's easier for me since I have a lot to pluck. It looks better than when I pluck - cleaner.

I agree. I have my eyebrows "done" when I get my hair cut - my stylist waxes them, and plucks any wayward stray brows. I have heavy brows, and the waxing makes it very smooth and stubble-free.

Ok thank you. Everything on me is sparse and fine, esp as I get older! The opposite problem.

Hey, I get a small container of wax at Sally's beauty supply and you just heat it in the microwave for a minute or so, apply to unwanted hair with a small wooden spatula(included), let dry a few seconds, then pull it off in one quick pull. It's called Gigi's wax. It's around $4 and last forever. It's not messy at all. I like it because I really hate tweezing each individual hair one..at..a..time...ouch! I like to separate the hairs I want to be waxed with a toothpick to avoid it taking off any extra hair.

(1) Returned unopened leftover supplies from bathroom recaulking to Home Depot. This was $30.00+ In the bag. I have to keep reminding myself of the physical cash represented by purchases I’m not using.

(2) Moved ATM Access at credit union from a savings account with limited free transactions to an account with unlimited free transactions.

(3) So much is free without any minimum balances at this credit union. I especially like the free etransfers, my other credit union charged $1.00 per transaction. They also print free cheques for their accounts.

(4) Started year by cashing out grocery points for groceries. I then physically take the money out of my wallet and into an envelope to save throughout the year.

I generally collect $1500.00+ a year this way. I earmark these dollars for special activities and charitable donations.

(5) One IPod has not been working. I’ve doing the remedies suggested on the Internet. Will be going to the Genius Bar for input before purchasing a new one.

I don't understand your #4, but $1500 sounds good! Your store gives you points you can use instead of money? What store, and how does this work?

I always had a grocery budget in my monthly spending. Those dollars would be put in an envelope. The credit card I use generates “points” for dollars spent. So large purchases like life and car insurance, or smaller ones like gas can be paid with my credit card ( and then paid off at the end of the month). My credit card is issued from a grocery store and it’s points can be spent on items in store like groceries ,household items, clothing , etcetera.

It has a separate points card not tied to a credit card and frequently store items have additional points on for purchase as does, gas and prescriptions.

Most of my shopping is done at this store. It price matches automatically the grocery stores surrounding and I live close by.

My frugal five:

1. Continuing to eat down the freezer with left over roasted chicken from Monday and rice from the freezer.

2. My sister picked up an "extreme outfitters" snow bib and coat size five in brand new conditions for 2.50 at the salvation army. We are in Florida so I don't think this was ever worn except maybe a weekend out of town. I am going to try my first ebay.

3. Cleaning out a closet I found two wooden drying racks. I'm pulling them out and seeing how it goes.

4. There is a new aldi s in the neighborhood with 5.00 of a 30.00 purchase and I have three to use so 90.00 worth for 75.00. I will be buying kitty food and staples.

5. Staying in this month and have only used half a tank of gas that was purchased with money received from a returned Christmas gift so no out of pocket gas price this month.

1. Haven't done any grocery shopping at all this week and won't need to for several more days -- we're using up things we already own and eating leftovers for lunch (instead of my usual big salad). That'll save us at least $100 this month!

2. Time to make another batch of homemade deodorant (http://bonzaiaphrodite.com/2009/08/natural-homemade-deodorant/) - costs virtually nothing and ACTUALLY WORKS.

3. I'm really noticing the savings on personal care products since I've been showering at the gym most days (where soap and shampoo are provided)!

4. Hubs is listing on craigslist a shed from our backyard that is in great shape and is big, so it should hopefully bring quite a profit.

5. Bought the sanding bit for Dremel (I'll borrow my dad's) so that I can file the dog's nails myself. She won't love me for it, but it'll save $9 every 3-4 weeks.

1. The weather was decent yesterday so a friend and I took a walk. We explored a path that connects to a paved old trolley trail we sometimes walk on. It was a nice diversion and we found some historical stuff to go see when we have time.

2. It snowed over night into this morning. I walked to yoga in the morning and ran a couple of errands this afternoon. Of course clearing snow is a good form of exercise.

3. I had a few ripe bananas so I tinkered with a recipe I made for the first time last week, for Grain-Free Banana Coconut cookies. They are much better this time, but we did manage to eat the first batch last week.

4. Eggs for dinner. Not vegan but sometimes you don't know what to make for someone that does not like vegetables nor have much affinity for legumes.

5. I broke the bathroom faucet. The handle broke off yesterday (really I think the weight of it was too much for the piece that attached it to the rest of the faucet. They don't carry replacement parts at Home Depot, Moen was so busy I was going to have to wait until tomorrow to talk to someone (and I don't have the 12 year old receipt). While at Home Depot I picked up another faucet, in case it proved too difficult to get the replacement part. My husband came home and was happy to replace the faucet, as we didn't like not being able to use the bathroom sink. $59 plus tax is not necessarily frugal, but replacing the faucet yourself is.

Just a small FYI - Moen does not ask for receipts when you call about a broken (whatever). Our house was all Moen and they have replaced several things over the years and there is never any charge.

Yup, we own rentals and install Moen because their warranty and service are so outstanding.

FFT, the deep freeze in the Deep South version:

1. Got a half day off for snow yesterday. Spent it frugally crocheting some scrap yarn into coasters by the fire.

2. Was so concerned about this morning's road condition report on the radio that I forgot to eat breakfast or pack one for work. Had some peanuts and raisins from my desk stash with free office coffee.

3. Only one of my co-workers made it to work today. She and I both packed home-cooked meals from home for lunch and drank water from the cooler.

4. Re-wore my heaviest trousers for the third day running because it's very cold and nobody cares.

5. Really wanted a beer after dealing most of the day with a software problem. The Mister took over, got it fixed, and reminded me that we had the ingredients for hot toddies on hand, so no money spent and no trip out in the cold.

1. Gave up soda for the new year, saving probably $30/a week

2. Cashed out last year's credit card points for restaurant gift cards for this year's birthdays.

3. Eating out of the pantry and freezer to save money and prevent food waste

4. Changed my cabin air filter in my car. Part was under $8 with tax. Dealership wanted $55 for part and labor. Watched a YouTube video and saved $47.

5. Took on an extra shift at work to pad the emergency fund.

Oh, how I wish I hold give up soda! We would save so much money and I know I would feel better too. Are you drinking only water? And did you have trouble with headaches?

That is a huge accomplishment!

I drink orange juice occasionally, but day to day only water. To get past the headaches, I bought a cheap pack of caffeine pills to wean myself off the soda. Took them for one week, lowering the dose each day. No headaches

My hubby is working on weaning himself off of diet Mountain Dew.....a habit of 5+ cans every morning, plus more as needed during the day (blech!! Though he feels the same way about my morning coffee). He asked for some super caffeinated tea (Zest Tea) and an electric kettle for Christmas, which I gave him. He is slowly working towards having regular tea in the a.m., and no Mountain Dew. I'm very proud of him, as this is a long standing (and expensive) addiction.

Liked your #1 resolution. Just computed my approximate soda and charged water consumption. It's not terribly high, but multiplied out it adds up to over $100 so I will at least cut down significantly. Thanks for the motivation.

1) I finally soaked and cooked a lb each of black beans and chickpeas. They had been in the pantry for ages and were quite elderly. As a result, I actually could have cooked them longer (than 8 hours in crockpot) since they are still a bit on the firm side. I think I will roast the remaining chickpeas to get full enjoyment out of their inherent crunchiness.

2) Also made a big pot of rice the same day. Some in the freezer, some in fish tacos, some in a tikka masala lunch dish I made today with Trader Joe’s sauce, chickpeas from #1, and leftover chicken breast. I love where we live, but we are about 200 miles from legit Indian food. I will have to learn to cook what I can.

3) I used all my creative food energy on lunch today (see #2 masala) so dinner was challenging. Tuna melts/grilled cheese, fruit and some leftover chips. Everyone was fed and appreciative. I am going to call that a win.

4) Cleaned off my desk, paid midmonth bills on time, paid estimated taxes from budgeted reserves, re/scheduled various medical appointments for myself/Dear Wife/DS, and got a flu shot today (finally) for free through our insurance.

5) Cross country skiing several days this week across the road from our house on equipment I have had for years with a family membership we have to the trail system. Being outside on skis makes me a nicer person.

Tikka masala --yum. I make falafel in my waffle maker with chickpeas as well as homemade humus.There are several recipes online for falafel waffle. Not Indian but healthy, inexpensive and easy. Good for you getting out in the cold and exercise! It is good for body and soul.

Bee, do you have a particular falafel waffle recipe you like? I still haven't lived down with my family the last time I tried to make falafel at home. I'm a good cook, but they still talk about the "awful falafel".

I'm interested, too....Susie's Daughter, your post reminded me that I have a bag of dried chickpeas I need to do something with. I have a friend who introduced me to choley (not sure of spelling), which is an Indian chickpea stew - delicious!

Robin, so funny about the awful falafel. Even good cooks have failures sometimes - it's all part of the learning process, as disappointing as it is.

Bee - I love the idea of a falafel waffle. Plus it is just fun to say...

This is the recipe that I used last time. You may need to adjust the seasoning slightly to your individual tastes. They do freeze fairly well.

http://www.foodnetwork.com/recipes/food-network-kitchen/waffled-falafel-recipe-3361890

Thank you for sharing the recipe!

I mix some of the TJs coconut milk into the TJ's masala sauce. Makes it less spicy so my little daughter can eat the dish. I also put in chickpeas, and some spinach and voila! It is almost as good as the chicken tikka masala from the restaurants!

Our bank account is in the same sad state - hate that all the big bills are due at end of year, but at least it spurs me to "frugal up" in January.

1. Sold hubs' commute car last week. He's been retired 6 months and we don't need the third car. Made some money and got a refund on the full year of car insurance I had just paid in December.

2. Eating from pantry and freezers this month, have only spent $100 on groceries in last 3 weeks.

3. Aldi near us had a grand reopening last week, and they not only had $5 off $30 coupons in the paper, they were also handing out $10 gift cards at the door. I picked up a 10 pound ham for .49 a pound, and using it as the basis for all meals this week.

4. Needed new running shoes since my toe is coming out the side of my old ones. I tried Plato's Closet and found a brand new pair of Saucony's in the final clearance bin,paid $4.80. I'm entirely too old and fat for their clothes, but shoes and handbags always fit, right?

5. Pantry challenge has also become a liquor cabinet challenge. Working with what I have rather than splurging on a 6 pack of Mike's Hard grapefruit lemonade (so yummy!) Created a delicious drink last week with vodka, a 2 liter of Squirt soda that was free at Tom Thumb a few months ago, and juice from a jar of maraschino cherries. Delicous!

Michelle H., I never thought of venturing into Plato's Closet for shoes and handbags. Speaking for myself, I'm also in the too-old-too-fat club to buy their clothes. Thanks for the tip!

Great job on selling the alpaca wool skeins.

1. Went to a potluck for a club and brought home enough leftovers for another meal. Many didn't want to take home their leftovers. Luckily we had extra plates, plastic bags, and foil on hand so that any one who wanted to take something home could do it easily.

2. A friend recommended a new Chinese restaurant to us. The restaurant has been around for a while, we just had never gone to it. We used it for our anniversary dinner. Everything was delicious and the portions were so generous that we had enough leftover for three more meals. Dinner with tip and tax was less than $20.00. How frugal is that? and leftovers, too!!

3. Attended a cook book exchange. I brought books that I had read and wanted to pass along and brought home books that I hadn't read. Everyone talked about a favorite book. It was a fun no cost activity.

4. Wearing old clothes and loving it. I actually have plenty of choices and it feels good to wear and use the things I already own. Frugal fashion.

5. I made dinner rolls today. It saved a trip to the store, the rolls only cost pennies to make and it fills the house with the wonderful yeasty smell of fresh bread, not to mention warming the kitchen/great room. We will eat some tonight and I will freeze the

1. I made some lovely, bone-warming, chicken and dumplings from a half a package of marked down chicken legs from the freezer and ingredients I already hand on hand. They should last for a few more meals, which is timely since they just cancelled school for tomorrow due to icy roads here in the South.

2. I am baking some chocolate cupcakes made with a box of cake mix and a can of packed pumpkin. This is a great way to sneak some fiber rich pumpkin into my kids and is a little healthier than a cupcake. It will also help us get through another day indoors since our roads are icy and I don't want to spend any money at the grocery store.

3. I went to our local thrift store on Martin Luther King day for their half price sale. I spent forever in the dressing room trying on jeans. If I don't try them on, I am wasting my money, because almost nothing fits me, it seems. After sweating profusely, while squeezing my hips into approximately 20 pairs of jeans, the sky opened up and the heavens shined down on me. The last three pair fit perfectly-insert big smiley face here-!!When I came out, the lady at the dressing room door looked at me strangely. She probably thought I got sick( or was shoplifting) because it took so long. Or it could have been my sweaty, red face that cause her strange look. I had no choice! I had only one pair of pants so I had to stay until the job was done--Frugal Mission Accomplished.

4. We repurposed some Amazon boxes into more insulation for the chicken coop.

5. My kids and I have not been changing clothes or bathing as often since we are stuck indoors. We aren't getting dirty because we aren't doing much. I do have to leave a stream of water running in my sink due to the freezing temperatures here. It's much better than burst pipes. I have been through that in the past and it's costly to repair.

Not sure why this says Jenniferd. I'm just plain old Jennifer..oh well! Guess that's why it said waiting for moderation?

Good for you for persevering with the jeans This can be a very frustrating task So glad you were rewarded

1. Have been using up all the odds and ends from freezer and pantry.

2. Made a quiche with small amounts of lots of different cheeses, onion, leftover bits of meats and veggies. Had it with a leftover loaf of Italian bread sprinkled with water and reheated in the oven.

3. We are having oven fajitas on Friday night so only have to pick up some green peppers.

4. Paid the auto insurance for the six month period (this state will not let you pay all 12 months at once) so got a discount.

5. No purchases except for the green peppers this week, and of course the auto insurance but we kinda have to pay that one!

Aw dang, I'm sorry to hear that it's been a tight month. This is why we live frugally though right? To make the tough times a little easier. 🙂

This week:

1. I rented several eBooks for free using Kindle Unlimited. I'm so happy to get back into reading more regularly!

2. I wanted sweets yesterday, so I threw together some cupcakes on the fly.

3. Today we sold two bikes on Craigslist for a whopping $100.

4. I made spaghetti (squash) with meatballs for dinner, using a homemade veggie-heavy marinara sauce.

5. I layered up today instead of cranking up the heat.

1. No spend day yesterday was successful. Snow day today, and tomorrow so 3 in a row likely!

2. My boyfriend and I are both off. We got almost 5 inches in the south which is pretty crazy! I listed on Poshmark all day while he studied. We made waffles this morning with batter from scratch, dressed up a frozen pizza and went down to the clubhouse for free coffee.

2. Continuing to wear my daily contacts 2 days in a row (when tolerated) to save cash. My eye doctor actually recommended doing this unless it causes irritation.

3. Having a “spa day” tomorrow on my second snow day. Giving myself a pedicure with some Essie nail polish I got on clearance at Tj maxx, samples of foot creams and some dollar tree boys, and using a face mask I got for Christmas.

4. Took my car to the 4 dollar car wash the other day (totally obsolete now that their is 5 inches of snow all over it). I live in an apartment, so diy is not possible. This place gives me towels to dry and access to vaccuums for free for unlimited amount of time, so it’s worth it. My car is almost paid off and I intend on keeping it for a while, so maintaining it is priority!

5. Enjoying my cheap-o heated blanket from target. Got it for about 10 dollars after coupons and gift cards and I love it for this snowy day. #cheapthrills

Gosh buys* and there* my phone auto correcting is not helping!

Hee hee! I was wondering what dollar tree boys were.... (grinning smiley face here)

1. $21.40 from consignment store

2. $33 in class action checks

3. Treated to early birthday lunch yesterday and today

4. Eating from pantry and refrigerator

5. Rented two audio books from library =$3

1. Spent most of the day straightening out my budget and paying bills. I had thought I paid a bill on BillPay, but I had done everything except make the actual payment. I did that today--it will be a few days late but I'm not planning on applying for any loans in the near future! I had written it in the checkbook at least. Not as organized as I used to be. Need to get on that.

2. Remembered yesterday that I had put 2 bags of apples in the basement to make room in the fridge for Christmas food. Rescued them yesterday, thinking I would make a pie and applesauce--but they were not in such great condition, so I cut away the spots and turned them all into applesauce. It made quite a bit so I didn't lose as much as I thought! (BOGO to start with!)

3. Also paid the real estate taxes today. When working, I budgeted for a Christmas Club and included enough for the taxes in that. It just hurts a little more when it comes from the savings and not from the Christmas Club. Since all retirement income goes into the checking account, I don't bother with a separate Christmas Club anymore.

4. Still using up bits and pieces from the holidays: made a meatloaf today using 3 packages of Saltines someone brought home from restaurants, as well as some from my usual box in the cupboard. I also noticed there was still some hand grated cheddar in the fridge--only about a half cup or so, but I put it in the meatloaf as well. It added some flavor for sure.

5. I made sure I avoided the stores on the way home from yoga yesterday. I don't need anything right now, so why bother going in the stores? I received too many gifts for Christmas and my birthday is next week---my family is taking me out to dinner instead of buying gifts--so we can all enjoy a dinner together. This happens every year but each year I need less and less. My sisters are taking me to lunch, and I suggested that was all the gift I needed--but I suspect they will bring gifts anyhow. That is just the way they are!

I started getting paid every 2 weeks instead of 1x a month and it kind of threw off my jam. I printed out calendars for every month (free ones of course!) and wrote down when payments hit vs when I get paid. I put it in a little binder with some other budgeting sheets and has really helped me get back on track! I cross off the payments when they are paid or they hit so I know they are gone :).

1. I haven't filled my gas tank in a week. Snow and cold help keep driving down!

2. I have saved orange zest from a few oranges. I will freeze the zest for future baking projects.

3. I have been watching episodes of the pioneer woman. Some of her recipes look delicious!

4. Walked my sister's dog in the snow for fun and exercise today.

5. I have been wearing layers and sleeping in layers to keep warm and the thermostat down.

1. I went to finish making dinner today and the pack of tofu (the only pack in the house) was bad. It was before the sell-by date, so I will take the packaging back to the store tomorrow. Normally I would be lazy and not bother, but I'm trying to bring my grocery spending down, so I will bother.

2. I cleaned the house today with nothing but vinegar and water. So cheap and so environmentally friendly.

3. I made another batch of hand salve today. It's very easy to make and so much cheaper than my favorite Burt's Bees brand of hand salve.

4. I had some frozen grapes from my neighbor's vines, and I am trying to make grape molasses. We'll see tomorrow if it turned out thick enough to replace maple syrup, which is our preferred sweetener.

I’d love to know how the molasses turns out

Me too, that's sound wonderful!

I'd love to hear your recipe for the hand cream!

I tasted the grape molasses this morning. It is soooooo tasty. The flavor profile is completely different than maple syrup or molasses, so it won't be a great substitute in baking, but I will be pouring it on my pancakes. There is also an old Italian recipe for cookies sweetened with red wine. This may work in that that.

The hand salve is 1 part beeswax to 4 parts olive oil melted together. I out the ingredients in a small mason jar and set that in a pan of water on the stove. That's it. Beeswax keeps forever, and I figure I am going to go through 2 ounces a winter, so the cost spreads out over several years. I use olive oil in all my cooking anyway, so I always have that in the house.

1. Still spending most of the time at home due to weather. We did go out to dinner one night to celebrate (his word) my husband's root canal. I ordered cheap and drank water. I can't take credit for the frugality in this, but our nice server gave us a cheese dip that she said was made by mistake.

2. I asked for a price check on a three pack of multi colored peppers. I know they are usually about $5 but there was no sign and I was hoping they were on sale. The produce guy couldn't get them to scan so he said I could have them for .99.

3. Switched tv providers. We will save at least $40 a month for a year. We will also receive a $300 visa card to use however we wish. After a year, I believe it may be the same or a little higher than what we have now, but we will have better reception. My main reason for switching is that we have a recurring problem of no reception in one room. It makes me mad to pay for something we are not getting. Multiple calls have not resolved the issue.

4. Working on cleaning out unwanted clothing from closet and drawers. I will have a very generous donation for Goodwill and will save the receipt for taxes. I thought I might find that I needed to buy some items after getting rid of so much, but all I need is two or three long tops and I will be set. Listening to a book from the library while I work.

I think that's it. This month we have had/or are having his and hers root canals and crowns and a cataract surgery. My husband's car is in the shop for the 5th time for the same problem. We really haven't spent money on anything but medical, car and necessities. I am looking forward to a less spendy month next time.

You are so correct that debt-free living is not for the faint hearted!

It’s also very character building. The other day my eldest asked if a relative was “rich” because they have a big fancy house, beautifully furnished with all the latest stuff. They might be rich - I don’t know anything about their finances. But I had to explain that just because our house isn’t that fancy doesn’t mean they are “rich” and we are “poor.” It’s just that we choose not to live with any debt, and that changes what we buy and when we buy it.

FFT:

1. We made sushi last night instead of buying it. Our homemade sushi fed four of us plus two people for lunch for about $8 (including a very expensive avocado). I could have skipped the avocado but I’m not a monster.

2. It was my husband’s birthday this week so I cooked him two curries, steamed rice and a big chocolate cake. There was enough left over for many lunches and these have gone into the freezer to prolong his happiness for longer. I can’t remember if I said that already...

3. I’m building up my savings account so I can get our old 70s bathroom redone at the end of the year (paid in cash, nach). It’s falling apart so it’s a need as well as a want. I’ve saved almost $1000 since Christmas.

4. No clothes purchased in that time. My resolution to stay out of thrift shops and wear what I have remains intact.

5. Australia is experiencing a pineapple glut due to unusual weather conditions in Queensland. I got two pineapples for 99 cents each yesterday.

Your #1 made me laugh!

Me too on #1 and hurrah on the pineapples! I had some today for breakfast as a winter treat...

1. took the last of the winter clothes to the resale shop. I'll go again in Feb. when they begin taking the next season. Got a check from them for stuff from last month and deposited it immediately into the checking account.

2. the weather has been so cold and I deal w/ it so poorly that I am staying in. Thus, no spending and eating meals w/ food already in the house---stuff in the freezer and home-canned. And I'm working on sewing projects that have sat around far too long as well as starting the quilts for the 2 weddings this year.

3. I did meet my cousin for our annual holiday visit. She wanted to go shopping. I usually just walk around w/ her but this year I looked at the 85% off clearance table---and found enough gifts for next Christmas for my (newly-joined) quilt group---they have a Christmas dinner and gift exchange. That's done and I'm happy with the gifts---and the price!

4. I cut way back on gifts this past year and came out of the holiday season feeling less burdened---and less under-appreciated---than the last several. But, still everyone had a good time and enjoyed celebrating together.

5. I continue to try to sell junk on local FB page---while keeping reigns on trips out to meet people. Got rid of a couple more things. And I listed several things on eBay---I'll see if there's any luck in it.

I'm feeling a little down on myself this week. It seems that for every frugal thing I do, another extravagance is staring me in the face. I haven't given up my weekly housekeeper, whose help really has changed my life. I don't have a single excuse, but I simply don't keep up with cleaning otherwise. I haven't cut cable and I'm sure my cell phone bill is too high. My dog and cat are spoiled, and while I will eat anything that's on hand and always take one for the team, they get what they like. For all the work I've done on the house there is more insulating to be done, always more I should have done. I start wondering what difference it makes to watch all the small stuff: walk twenty minutes to my office in order to park in the free lot, sell on eBay, dry laundry on racks, all the good things I've learned, when I haven't faced the big decisions.

Then that thinking tells me I should move into town and save the commute from my country home. And on, and on. I love this blog but boy when I really get thinking I realize that the questions for me have only begun. Thanks Katy for keeping me uncomfortable about all this world that is too much with us.

Hi Cynthia, please don't beat yourself up. I too am not nearly as successful at full bore frugality as Katy and many of the other posters. But I am working on being mindful about both my spending and use of our planet's scarce resources and this blog REALLY helps me with that. I can tell it's helping you with mindfulness too by the fact that you're realizing and grappling with the things you mention! Progress not perfection...

Cynthia, don't be so hard on yourself! We are all trying to improve, and remember, for every frugal tip, many of us (me included) are still struggling.

Cynthia, There as many different reasons to take frugal actions and types of frugality as there are people! As retirees, we choose to spend our money on gifts such as large wedding gift for a son and contributions to granddaughter's 529 as well as eating out, taking out elderly relatives, having a dog with a chronic illness that costs $$, etc. But we watch our spending carefully in categories that aren't as important to us so we can do those things without losing sleep or jeopardizing our retirement. I hope as you think about your options consider why you are wanting to be frugal and how far you need to go. BTW, I'd think of that 20 min walk to work as an exercise program!

I should add that there were many times during my younger years when I was frugal in everything because there simply wasn't the income to be anything else and I didn't want debt.

Cynthia

Try not to stress too much over not doing enough. I have the same problem. We have a once a month cleaner. I was always critical of able bodied people who had someone else clean their house. Then I had both knees replaced 6 months apart and had to have help every other week. It was wonderful. I just haven't forced myself to give it up altogether, even though I feel very guilty about it. It would take me all day to do what she does in three hours. And having a deadline for her arrival forces me to pick up and put away, which is really a bigger problem for us than cleaning. If you are using your small savings in other areas to pay for a luxury that really improves your life, I think that's ok.

Cynthia, I'm sorry you're feeling down on yourself. Remember, this is a marathon, not a sprint. Everyone is at different points in their lives and their NCA journeys, and what is realistic for them. Having someone come in to clean house totally makes sense to me, if you can't keep up with it and it makes life easier. I wish i could convince my hubby of its value - I'd do it in a heart beat! And I truly think every little bit helps. Selling my kid's old toys on fb marketplace isn't gonna let me stop working full time - but it contributes to son's college fund. It all counts!

So many great comments! Many of us struggle with frugality from time to time. There are so many good ideas on this blog. However, I know that some of them won't work for me. I realize that not everyone has the same priorities, values or lifestyles. Therefore, one person's frugal choices might not look like mine. I try to remember that even small changes can pay big dividends. Hang in there! A journey of a thousand miles begins with just one step.

I think frugality is very personal, just like anything finance related. If it makes you happy, and actually gives value to your life, you need to take that into consideration when spending. I spend money on things that people on here would never dream of spending money on, but I also save money and do things that most of my friends/peers think I am INSANE for doing. Comparing your frugality to other's is not fair to yourself. I think Katy would agree that the point of these posts is to give each other inspiration and ideas, not to shame and "compete" with one another's spending habits.

I found it very motivating to have a column in our expenditures for "freebies." I write down every penny I save using coupons, selling on eBay, looking up how much it costs to use the dryer (I just had to call my electric company and they told me) and writing that down as a savings when I hang up instead of dry stuff, when I check out instead of buy a book, remembering to get rebates, Ibotta earnings, free lube jobs through mystery shops, My Points and Swagbucks earnings...I end up pretty amazed at how much the little things save. So far this month I have made $238.00 just on things like that but if I had not kept track it would have seemed like I have done very little to save money this month. You might try keeping track and see if that helps it not feel so pointless to save on small things.

And, the truth is, I have had times when it was all too overwhelming/discouraging and I stopped being frugal with small things and just concentrated on not buying new clothes or eating out. Do what you can do.

Hi Cynthia,

It's also not an all or nothing thing. If you bring coffee from home instead of buying one, your saving a couple of $ (or more depending) that can go into something else AND you're not contributing to landfill. Everytime you buy things on sale that is a NCA victory. Walking to work saves gas everyday you do it, plus wear and tear on your car and reducing your carbon footprint and doig great things for your body and mind with the exercise. I really believe the little things add up. A few weeks ago, Katy posted about frugal fails and everyone followed suit (I apologize as I can't remember the exact title, it was a great reminder about the realities of life.

Wonderful comments and responses here. Yes, it is all personal, different, and definitely not a sprint! And expanding consciousness of waste is uncomfortable, naturally! Thanks for all the ideas.

Girl Trip is the most appallingly vulgar movie I've ever seen. Unbelievable! If people really talk that way and act that way the country is worse off than I thought. It could have been sort of good without all that smut as it had an engaging plot and the actresses had believable chemistry.

1. Batched errands with a friend who wanted to get together, she drove so no cost to me. I brought water with me to drink and ate one of the banana's that I purchased to keep the hunger at bay.

2. Picked up some reduced banana's which we have already dove into .. the ones that are over ripe will be turned into a banana loaf.

3. Did a free workout with my friend in her complex's weight room. Getting healthy and strong for free is a win win in my book.

4. Ate breakfast lunch and dinner at home. Dinner consisted of yummy leftovers for me and the kids got to feed for themselves with what we had in the fridge and freezer.

5. Haven't bought any new clothes since November. I have a closet full of things and although I would love something new I am focusing on paying off my mortgage because come on how sweet would that be!

1. Today, I made chicken broth from a chicken I roasted for my mother's birthday dinner on Monday.

2. I baked cookies and made dinner from ingredients we had at home. The cookies used nuts and dried fruit from the freezer.

3. Since the new year, my husband and I are slowly cleaning out clutter. It feels great .

4. I got 40% off a new swimsuit from Lands End, my go to place for swimsuits because they come in "long."

5. I signed up for my discounted pool pass through work.

Land's End has terrific bathing suits. I love that they offer such a wide range of sizes (including Plus for us curvier gals).

So true! And if one is patient, one can get a great deal.

Do you have a Land's End store to try on bathing suits, or do you order from the catalogue? I always need to try on many before finding a suit that works for me. Then they are over $100!

I mean in general, not Land's End. We don't have any of their stores nearby.

Our local Sears carries them. I can usually try a on couple of styles and then know what sizes to order. I’ve found them pretty consistent.

I've been pretty lucky ordering them online, without trying it on first. My first LE bathing suit was a basic one-piece bought on deeply discounted clearance, and have bought different style one-pieces from them since. (I think my expectations are low - mostly looking to camoflage the lumpy and bumpy bits, lol!).

* Our microwave just died on us. Asking FIL to take a look (he's an electrician). Until then, picked-up a free one on kijjiji.

* Used a "10$ off birthday coupon" doubled with sales to buy a pair of pants for 8$. 8$ for Plus Size pants is a steal!

1. Sold a few items on ebay.

2. Sold 5 Disney character glasses on a facebook garage sale site.

3. Sold 2 Disney items and a set of James Herriott kids' books to a friend for her granddaughter.

4. Used the last of my birthday deals at a couple of local restaurants.

5. Had my hair washed and blow dried yesterday by a new stylist at a very nice salon for absolutely free!

The young lady had posted on a Facebook garage sale site that she needed people to come in for her so that she could gain experience before actually being on the salon floor and working.

1. Used a few pieces of stale bread to make French toast. They bread broke into pieces when dipped into the egg batter, so I'll use the remaining pieces to make croutons.

2. I've been eating and finishing up open packages of things from the freezer and pantry. Over the past few days we've finished up a package of ravioli, some pierogis, store brand Ritz crackers, veggies from the freezer, grated cheese etc.

3. I was down to one pair of jeans. The only brand of jeans I really like are Express but when I went to browse online, the were $80 a pair. Nope! So I went to thredup and found 2 like new pairs of Express jeans and paid $24 for them ($12 of which was shipping.) Both pairs look brand new and one pair still had the plastic tag attached.

4. I've been stacking sales, rebates, coupons etc and have gotten 5 Greek yogurts, 1 power bar, 14 packages of Huggies diapers & 1 box of tampons for free over the past week or so.

5. Sold two items I got for free on ebay for a profit of about $40 after all fees.

6. Redeemed my .50/gallon gas points and saved $6.50.

1. Made soup using:

- a can of tomatoes from the excess I have;

- half a can of Ro-Tel salsa;

- carrots, celery, and onion (cheap veggies);

- remainder of the braised pork that turned out bland;

- stock from the bone of the braised pork.

2. Inventoried pantry for foods to use or rehome, which included:

- sorghum syrup (needs to be rehomed, turns out I hate the stuff);

- macaroon mix (a gift from a france-visiting friend);

- crepe mix (a gift from the same france-visiting friend);

- several jams, fruit butters, and fruit syrups (will go well on crepes);

- inari skins (bought at 60% off).

3. Developed habit of picking up sticks to use as kindling.

I used to reuse the plywood from clementine boxes ... then I realized that I don't know if the glue is safe or toxic, so I'm not using them anymore. Plenty of downed wood around here, from the winter storms.

4. Found a low table at Goodwill for $10, which I will fix up using paint and stain that I already own.

5. Continued to use the public library and used books sales.

6. Still plan to make caramels using the condensed apple syrup from making applesauce. I've never made cooked candy before so keep your fingers crossed for me. Fail? - I had to buy cream for this.

Frugal Fail:

The bread I made - for the fruit jams and butters, natch - didn't rise. Considering whether to make Overnight French Toast and therefore risking wasting the eggs and cream if it doesn't work, or making a lifetime supply of breadcrumbs. But I don't use breadcrumbs very often...

You could make croutons. They don’t last long in my house.

I'm team croutons myself. Though i did make a yummy over night "cinnamon roll" casserole for NYDay that was delicious......

Breadcrumbs freeze just fine.

1. I DIDN'T buy the $69 worth of super deals on clothes/accessories I found browsing online during my lunch break yesterday, now I just need to break the habit of recreational online shopping altogether... I can recreationally research dream trips to take in several years when I retire instead! Both fulfill the purspose of mindless stress reduction.

2. I DIDN'T go out to dinner last eve even though hubs and I considered it. Instead, we had a relaxing evening in and ate whatever (in my case cereal and crackers and cheese!). Now that I look at it, quite the carb fest yesterday between breakfast, lunch and dinner (see no. 4). Maybe a salad should be in my future today...

3. By cutting food bill and not succumbing to unnecessary expenses (e.g. 1 and 2 above) I was able to pay off credit card bills in full this a.m.(payday) which reflected both the last bits of holiday spending and prepayments for some items on some upcoming trips.

4. Took banana bread (made 2 loaves this weekend to use up old bananas) and potato soup (also made over the weekend) with me to work yesterday for breakfast and lunch.

5. Worked on 2018 budget and discussed with hubs. We are going to up our savings in 2018.

1. Staying home and not driving anywhere but the transfer station for 6 days (courtesy of some awful weather) resulted in both vehicles having full gas tanks one week later. Love it!

2. While our Costco membership has saved us a lot of money on some things (husband's hearing aids. Contact lenses. OTC meds. Gasoline...to name a few) there have been a couple of potential "oops" purchases. Like the giant bag of walnuts (husband swore he loves walnuts but he really loves pistachios). And two big bags of frozen fruit for smoothies (followed by one of the coldest and wettest summers ever, summer being when we drink frozen smoothies). A number of weeks ago, I started putting walnuts on my oatmeal each morning. I've made a serious dent in the batch and found I absolutely love walnuts in my oatmeal. Another thing I love in my oatmeal are blueberries (courtesy of the giant bag of frozen blueberries). I'm eating down the ridiculous surplus, and once the last of the fresh fruit is gone, we will be eating the mixed fruit from the other bag and I won't buy any more fresh fruit until that sucker is empty.

3. We will be passing through a town with a Costco today, so I have a small list that I WILL stick to (husband has been warned). I'm learning from the mistakes of #2 above.

4. Did a small grocery shopping trip to Aldi yesterday - $13 and change for some basics and a few things I needed for upcoming meals. Grocery spending for the month remains well under $100. As it should, considering what all is in the freezers. Hoping to bring in this month at around $125 (or less).

5. Used Menards merchandise credit rebates to pay 100% of the cost of suet for the birds, a couple of hardware items we desperately needed to fix a few things, and brackets for shelving.

Re #3 and 4 - so true for me, too. Heading to Costco today, and my list consists only of dog food, light bulbs and Dave's Killer Bread. Must. stick. to. list.

oops - #2 and 3

I love walnuts and blueberries in my oatmeal too. My daughter gave me a large bag of dried cranberries at Christmas last year, so I throw all of these in my morning oatmeal. YUM!

I eat oatmeal with blueberries and walnuts nearly every morning. It's the perfect pre-workout fuel.

Frugal trip:

1. Used a travel site to buy my tickets. I did pay for travel insurance, for 20 dollars I had peace of mind in case I had to cancel.

2. Packed almonds for snacking on the plane. It helps pop my ears too.

3. Got stuck in a layover and was so hungry, walked around staring at the high prices, then realized I had a Starbucks gift card. Used that to buy a somewhat healthy sandwich and small plain coffee.

4. Went to two GW with my relatives there, used a Visa gift card I'd found earlier in the week while cleaning out my closet.

5. Gifts for the grandkids were books I'd gleaned from a free book swap.

- I had LASIK, lifetime savings on eyeglasses, contacts, solution, etc.

- I wasn’t able to read or keep my eyes open for very long in the first 24 hours, so I found the book I had been reading in audio book form from our library and downloaded that.

- I have friends who are getting married next week so I searched my own stash for a card instead of buying one. I was proud of this since I normally forget to shop my stash first.

- 2 different friends at work wanted to get lunch this week so I suggested we bring our own and meet somewhere on campus instead of going out for lunch.

- Had leftovers for dinner last night, organized the freezer and found lots and lots of food to make and eat, including a bit of frozen banana bread which I toasted for breakfast this morning.

LASIK can be great, but when near age 40, a condition called presbyopia often sets in, which causes vision problems that LASIK can't fix. . . I wish I had understood that. I had 3 great years, but that was it, and I now have to wear complicated bifocals which cost a lot. I ended up paying much more for the procedure than I did for glasses and contacts. Moral of the story is it's cost-effective if done before age 30!

Yeah the office I chose for my procedure was actually very forthcoming with information about that and the possibility of needed glasses to correct it starting around the age of 40. I just turned 30 a month before I had the procedure so I figure I’m looking at a good 10 years before I’ll need anything. And they told me there are procedures being researched to correct presbyopia with a laser surgery for people who’ve already had lasik. So maybe by the time I develop presbyopia, there will be a procedure for it!

I had LASIK surgery in 2006 and I am 40. Just had my eyes checked last month and I still don't need glasses. I don't feel like I can see as perfectly as I used to, but I have saved a fortune on glasses and contacts. My contacts were extended wear torics, due to eye allergies, I would have to throw them away almost daily. It was worth it for me so hopefully I won't have any problems in the future.

That’s what my optometrist said to me recently. She said at my age (early 40s) not to waste my money.

1. My two year old computer was having trouble holding a charge. I took it to a local place that was able to rig it for $30 two months ago - and it's still working.

2. My husband was more than pleased that we finally cut the cable and landline cord but keeping the internet. He gave himself Hulu for Christmas and it's quite a savings.

3. My mom has a big birthday in a few months and she loves a certain gourmet cookie. The company keeps sending me coupons in e-mail but I decided that I can make her homemade cookies - she likes those just as well. Don't pay someone for something that you can do yourself.

4. My husband works in sales and has a fairly large territory. He only makes it to the furthest spots every other year. So he spends a weekend away every now and then. I'm lucky enough to go with him which I'm doing now. We packed up all the food and hit the road only to run into a snowstorm. The hotel we are staying at served dinner for the staff and patrons last night - free dinner and none of the patrons had to go out in the snow and ice.

5. I've brought my library book with me on my trip, we are traveling off season so our weekend hotels are bare bones budget, we brought lots of food with us and we may even enjoy a hot tub soak at one of them.

If your husband gets tired of Hulu, he can put his subscription on hold or cancel, and you can get Amazon Prime or Netflix monthly. You are not committed for more than one month, so you can rotate services.

Don't forget Acorn TV and Britbox, same thing. Both of those also offer a free trial.

How do you get internet without a landline or cable? Would love to do the same!

1. Made a gorgonzola, bacon, and onion pizza with apricot glaze at home, similar to one we tried in a restaurant a few months back. The home version was so good that I won't ever go back for the restaurant one. Brought leftovers for lunch today.

2. I have been actively looking for a used Fitbit. I knew I didn't want the Flex or the Fitbit Charge, which left the Alta or the Charge 2. Meeting someone tonight locally to buy one for 35% the price of a new one. Not my fave band color band, but cheapskates can't be choosers.

3. Picked up my library holds and liked the new Philip Pullman book so much that I went back and picked up his earlier trilogy. I love that our library is the next block over from my office.

4. Sold a Wii game on the FB boards and two smaller items for a couple bucks that I had thrown into a last chance sale album.

5. It would seem that my shower repair is holding up. When I crammed the ladder into the closet for my surveying, apparently it pulled on the rope to the pull light switch and then the light was stuck on. When I unscrewed the piece to look it over, the chain popped back in and is working again as it should. Lucky me.

Cynthia, I'm sorry you're feeling down on yourself. Remember, this is a marathon, not a sprint. Everyone is at different points in their lives and their NCA journeys, and what is realistic for them. Having someone come in to clean house totally makes sense to me, if you can't keep up with it and it makes life easier. I wish i could convince my hubby of its value - I'd do it in a heart beat! And I truly think every little bit helps. Selling my kid's old toys on fb marketplace isn't gonna let me stop working full time - but it contributes to son's college fund. It all counts!

Ugh. Not sure how this ended up here a second time. Please ignore.

Nice job on the alpaca yarn sale, Katy. Sounds like you're doing all you can to stay frugal. The hospital where I work has been overflowing census-wise (due to flu and pneumonia), though I can't speak to the maternity floors.

My fft:

1) Am home sick this week, so less gas used in my car (hubby has used my car a couple of times, since it's better in snow than his car).

2) Have found a few low cost items on an online auction site that I will tey selling on ebay (my first try on ebay).

3) Discovered that my insurance company tried to code a routine MD office visit as a "specialist" visit back in November, which is $30 more co pay than a "regular" MD office visit. They will be getting a call to rectify that.

4) Have been using up pantry items and fridge items....less food waste.

5) Did another profession- related survey online. Another $10 check will be coming my way.

No Lear jets or gold plated anything this week! Did see a vintage TWA travel set, including electric kettle, cups, etc with case on the auction site....the kettle was missing the finial on top, and a similar (more complete) set hadn't sold on ebay, so didn't pull the trigger.

1. I work 3p-3A at the hospital 3 nights/week. I’m determined to bring my dinner and overnight snack to avoid the cafeteria. It was an eye opener to see I spent nearly $400 last year on mediocre food. On Thursday nights, 2 other co-workers and I brainstorm and we bring items to make something since we have a kitchen on our unit. Last week: real fast sandwiches. Tonight: pancakes and fruit.

2. Unplugging everything I can when I’m gone.

3. Bundling up when I’m home to keep the temps down a bit. We’ve had -30+! windchills these last couple weeks so I haven’t always been successful but I’m trying.

4. Found a new to me scrub top at Goodwill to replace one that is beyond wearing.

5. Mended a pillow as well as my mittens. My sister gave me the mittens about 4 years ago. I haven’t lost them yet! They were felted from sweaters and I love them. Perfect for Iowa winters!

I am starting to save a little to give to the survivors of the house of horrors. It is my community and I cannot do nothing. I am hoping to see a donation site through the city.

I am bringing a meal tonight to a friend that just had a baby. They are ultra picky eaters, but that's okay, spaghetti it is. Frugal to boot.

Did a double batch of dinner last night so we could have some for lunch. We love us some Mexican pizza.

Having my husband's coworkers over Saturday. Talked him out of wanting to host another Thanksgiving. He wanted turkey and the works. Talked him into having homemade pizza.

Have a neurologist appointment coming up. My pulmonologist thinks I'm having break-through seizures at night. Did some research on anti-seizure medicines since it's been decades since my last known seizure or anti-convulsive medicines. Looks like there might be one drug to address my compulsive eating, possible seizures, migraines and depression. Sounds like a whole cauldron, but feeling hopeful about the future.

I live in Ontario, California. What city are you in?

Menifee, about 1 mile away from the house of horrors. 🙁

I listen to KFI and 1070 am on my way to and from work. They were talking about making donations to the victims. But I missed where to donate. Those poor victims have a hard time in front of them.

I was hoping Menifee 24/7 would give us a link to a donation site. I'll have to try tuning in to KFI. Thanks!

Some anti-convulsants can cause compulsive eating.

Well, here's to not taking that medicine!!!

Hi, Bethany. I take Keppra for seizures, and I haven't had any in 4 years since I was diagnosed. Hoping that one med that would help all of those issues is right for you; wishing you the best.

Thank you, Liz!

Mando1- Curious- which ones, do you know? And, Bethany, which med are you thinking of?

Valproate is that I know of, having been on it. Not sure about others.

Topamax is a seizure med and will cause you to lose your appetite. It even makes carbonated beverages taste awful. The side effects were difficult for me to deal with and I could never titrate up to the therapeutic dose. I know others who love Topamax, though, so it depends on the person. It is now FDA approved to use for weight loss.

It’s the only anti-convulsant that’s ever worked for me. It hasn’t had the side effect of making carbonated soft drinks taste bad for me but it certainly has helped suppressing appetite. It’s not magic though. I still have to watch what I eat because so much of eating is emotional.

1. I've switched from scourer/sponges to knitted washcloths for my dishes and kitchen wipes.

2. A friend gifted us a SodaStream and 2 extra canisters last year, saving us about $1 a day on soda water. Yesterday I did my first canister exchange at Bed Bath and Beyond, and used 20% off coupons, spending only $12/canister.

3. I used the almond meal from making almond milk last week to make gluten free flatbread to go with the soup I made from the fridge and freezer. There was enough soup to also provide my work lunch for three days.

4. Didn't meet my friend for dinner before book group. I saved my hunger till I got home later.

5. I made my own infinity scarf from some jersey knit fabric I had on hand.

Katy, college tuition is so expensive! We are struggling as well with that.

1) Enjoying some salmon for dinner that my mom had shipped to us from Omaha Steaks. This makes the cost of my dinner under $3 when I combine the salmon with mashed sweet potatoes, peppers and cucumbers.

2) Packing meals for our upcoming trip so that we only eat out once. We like to go get pizza when we travel because then we have leftovers for another meal. Cheap way to feed 3 people 2 meals for under $20 when you are not able to cook.

3) Triple checked on a bill I keep getting from our dentist that I don't think we owe and they do indeed say that we owe nothing. Not sure why they keep billing us then, but for now I will go with we owe nothing.

4) We cleaned out our basement last weekend and looked shelves at Home Depot. Dh said we had enough scrap wood for him to build some shelves. That is his project this weekend.

5) I have a homemade quick bread in the oven while my dinner cooks. Breakfast for tomorrow made at the same time as dinner = energy savings.

1. Took a vintage heavy cotton sheet that had a worn spot and made 3 pillow cases from it.

2. Took another sheet and added some vintage rick rack after removing the lace trim that my husband put his hand through.

3. I had bought 2 half aprons at an estate sale - super cute vintage fabric - today I disassembled them to use the fabric for a coverlet my daughter asked me to make her. Will use mostly my stash fabric to add to those pieces.

4. Bought a vintage floral sheet to use as the backing for her coverlet at Value Village. I have a 20% of everything coupon for JoAnn and batting is already 50% off so I think that is the best I can do.

5. Decided that I love to sew but only things that have a use - thus #1 -4!

Chris, your projects sound awesome!

Hey Katy, Please let us know if you like The Book of Less. Thanks for telling me the short-version of the Swedish (!) get-rid-of-all-your-stuff-before-you-die book so I could cancel my library request for it. Interested to know how you find this read.

1.I started getting shocked by my light switch in our downstairs bathroom, luckily my dad who is an electrician is going to come and fix it on Saturday...thank goodness!

2.We had snow this week and we live in Alabama, which means we stay home when it snows! So I did not go to town for 2 days which saved gas and money.

3. Picked up some freebies at Kroger

4. Remembered to pick up library books for homeschool so we had plenty to do when it snowed

5. Free fun-Snow slushies with kool aid and built miniature snowmen in 10 degree weather...fun times...

1. Shopped my freezer. This means that I cooked the random things in there before they became unidentifiable frost balls destined for the garbage.

2. Didn’t go to the goodwill bins. I love this place, but I end up buying things that I don’t really need. I’m trying to pace myself.

3. Avoiding the temptation to take the family out for dinner tonight. We’ll have a chickpea curry. The kids barely notice it’s vegetarian!

4. Working on getting my new cast iron pan seasoned. The end goal is to phase out the use of nonstick pans that need to be replaced every two years.

5. Read that you are debt free which makes me feel less weird about also being debt free. I feel like it’s something I can’t even talk about in real life, and this makes it tempting to just take the easy road and take on debt like everyone else. It’s actually very helpful to know I’m not alone in this!

You are not alone. We are debt free except for our mortgage and we are working on it. Feel free to talk about it here all you like. It encourages me to pay my mortgage faster.

Debt-free except for mortgage here, too! Please do talk about it - helps keep me motivated!

We are debt free too and were for quite a few years for retirement. We don't talk about it to the family members and friends who complain about their financial challenges. We have talked about it a lot with our sons and DILs who also are on the same track and have the same approach.

1. I've eaten all my meals in this week, except for lunch Thursday.

2. I've eaten up leftovers (including having chicken and broccoli for breakfast this morning so it wouldn't go bad)

3. Drinking free coffee and water at work...no coffee shop stops for me!

4. Made plans with friends for tonight-Friday-and am having them over for pizza instead of eating out.

5. Stuck a toy in the back of my car with the receipt so I can return it.

1) I've been listening to Tony Robbin's new book "Unshakeable" on audio. He's a great motivator & financial speaker. I had over $6500 in cash reserves in one of my retirement accounts and, after listening to his advice, I found a good S & P index fund to invest it in so it will serve me better in the future, when I retire.

2) My daughter gave us a Red Lobster gift card for Christmas, which we used to go out to dinner last night. I had some leftover, which will be my lunch today.

3) My daughter & family moved to a new house, so she's been recycling stuff to others and making a free pile for the stuff no one wants. I have a few things at my house I want to get rid of and they can use them, so I'll be taking those to her when I visit tomorrow.

4) I ran out of oatmeal here at work, but had some rice cakes and PB, so that's what has been for breakfast this week, with my coffee provided by work. Pretty yummy too. I may just stick with those instead of oatmeal for awhile.

5) It's FINALLY warming up here again, which will help our heating bill at home. I loathe sub-arctic temps, they suck! YAY for warmth!!