Please enjoy this previously published post!

After a summer dominated by preparing all the necessities for my kids’ off campus apartments, (including the arduous task of finding said apartments) I can finally move forward with my life and enjoy my empty nest.

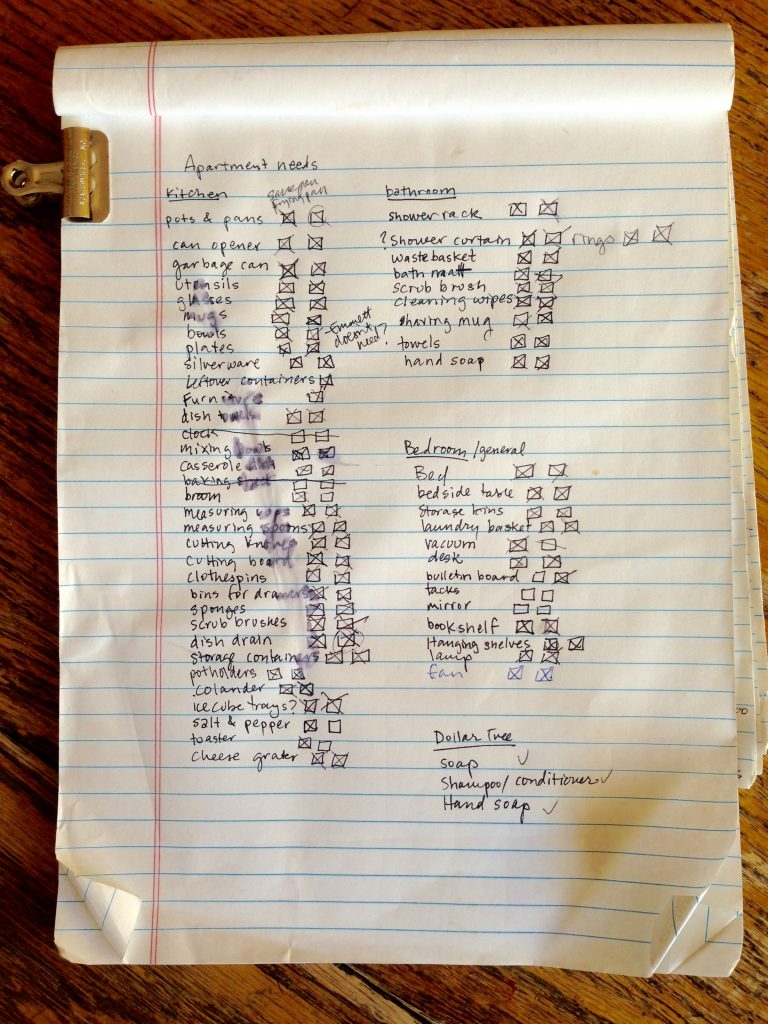

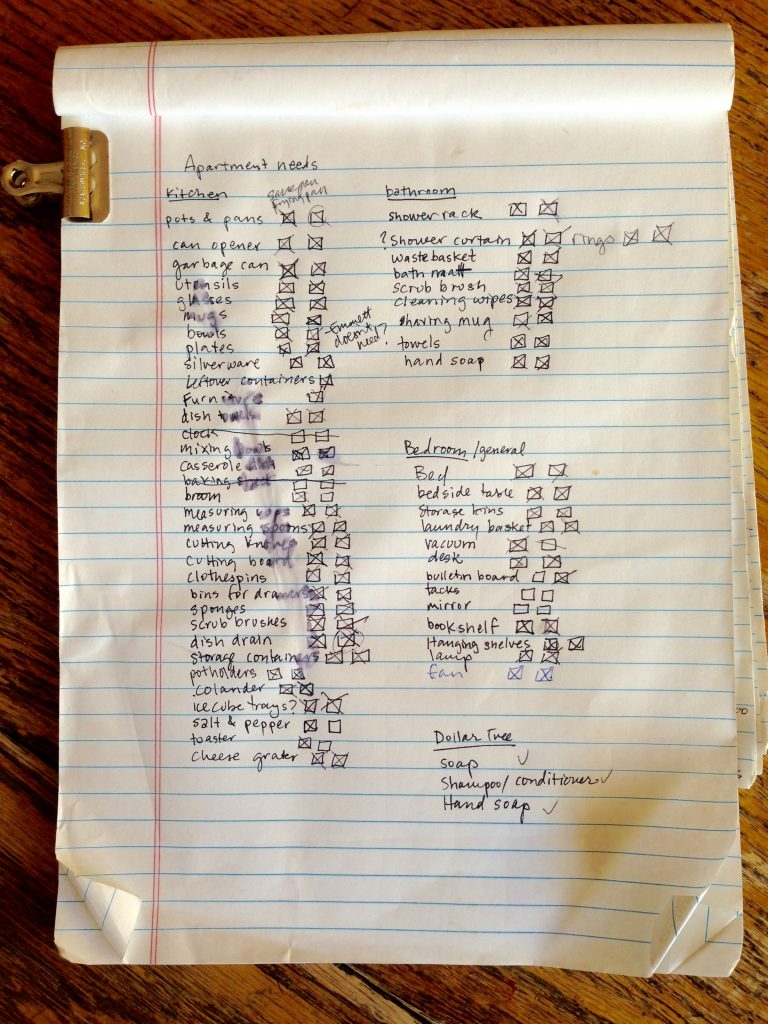

This page? It ruled my every move.

I made a decision in January of 2007 to buy nothing new. This was financially motivated, but also from a strong craving to move away from the over manufacture of poor quality consumer goods. It’s mostly a non-issue ten years down the road, but having to source so many specific things on a deadline was a real challenge. I’m not going to lie, it would have been so easy to walk into Target and cross everything from my list in a single trip.

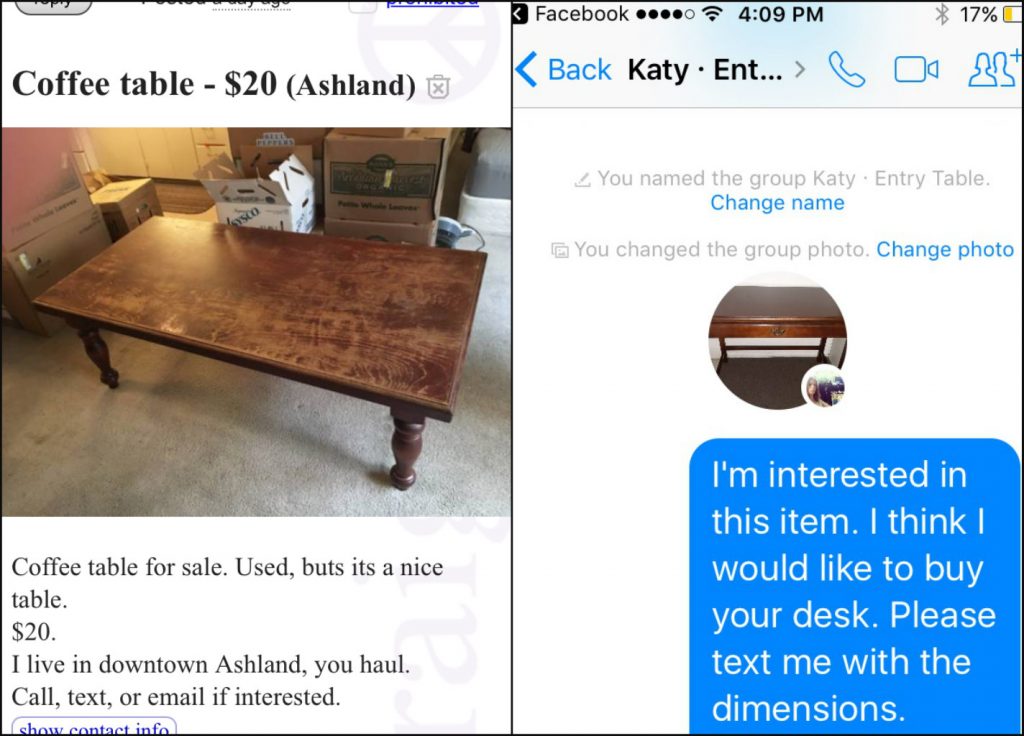

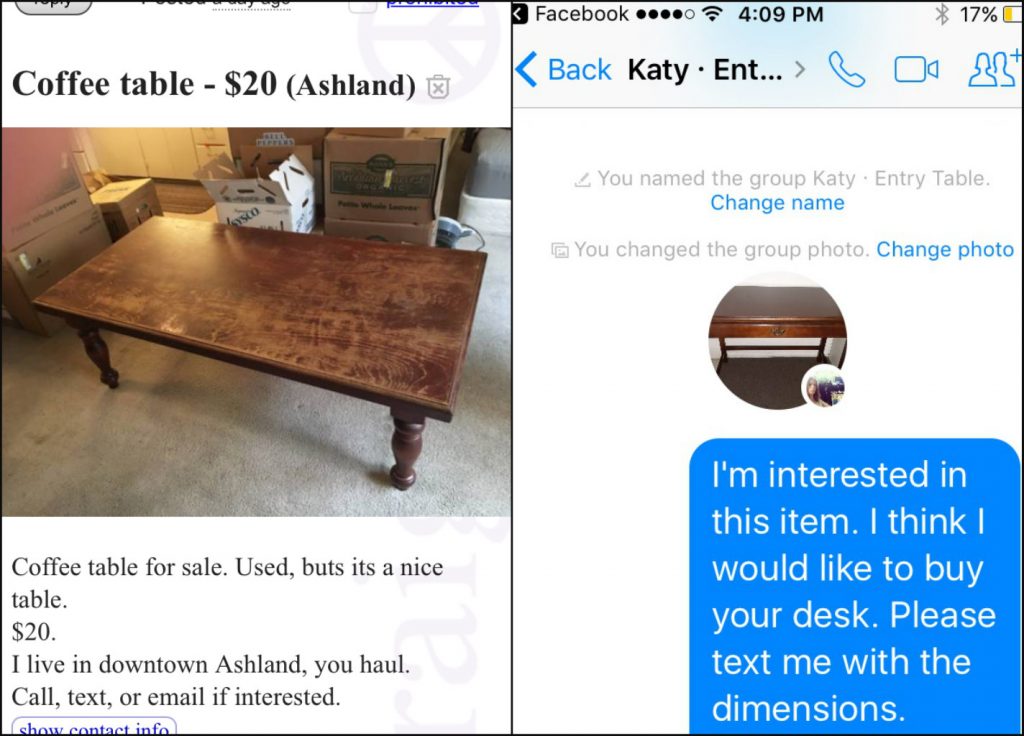

We were able to assemble pretty much everything we needed from thrift shops, my buy nothing group and stuff around the house, but we made a decision to buy a coffee table and desk in Ashland, Oregon in order to fit everything into our minivan. (Our youngest moved into his apartment last week.)

Of course, the best laid plans will invariably go awry. My husband, son and I unloaded the car and then set out to grab the last few items from my list. None of the five (five!) thrift shops that we visited had anything acceptable, which took me to Craigslist and Facebook Marketplace. $50 later, and my daughter was finally outfitted with a solid wood coffee table and desk.

She also needed more hangers, but the Medford St. Vincent DePaul proved to be a terrific source.

I do confess that I made one brand new purchase, which was a whistling tea kettle from Bi-Mart. However, I consider it to be a safety requirement, as my daughter has a history of setting water to boil and then completely forgetting about it. (Nothing non-consumer about burning down an entire apartment complex!) I looked and looked (and looked) for a second hand kettle, but the thrift shops were oddly devoid of this item.

My daughter’s roommate was providing a couch, so you’ll just have to imagine one in this space. That bright blue table? I picked it up at an Ashland garage sale for $8, which brought the grand total of this furniture to be a whopping $28 as the chair and lamp were both garbage picked.

I would estimate that we spent approximately $200 for all the furniture, bedding, bathroom stuff, kitchenware and miscellaneous stuff for both apartments. It’s impossible to pin down the exact amount as a lot of my purchases were from the pay-by-the-pound Goodwill Outlet bins.

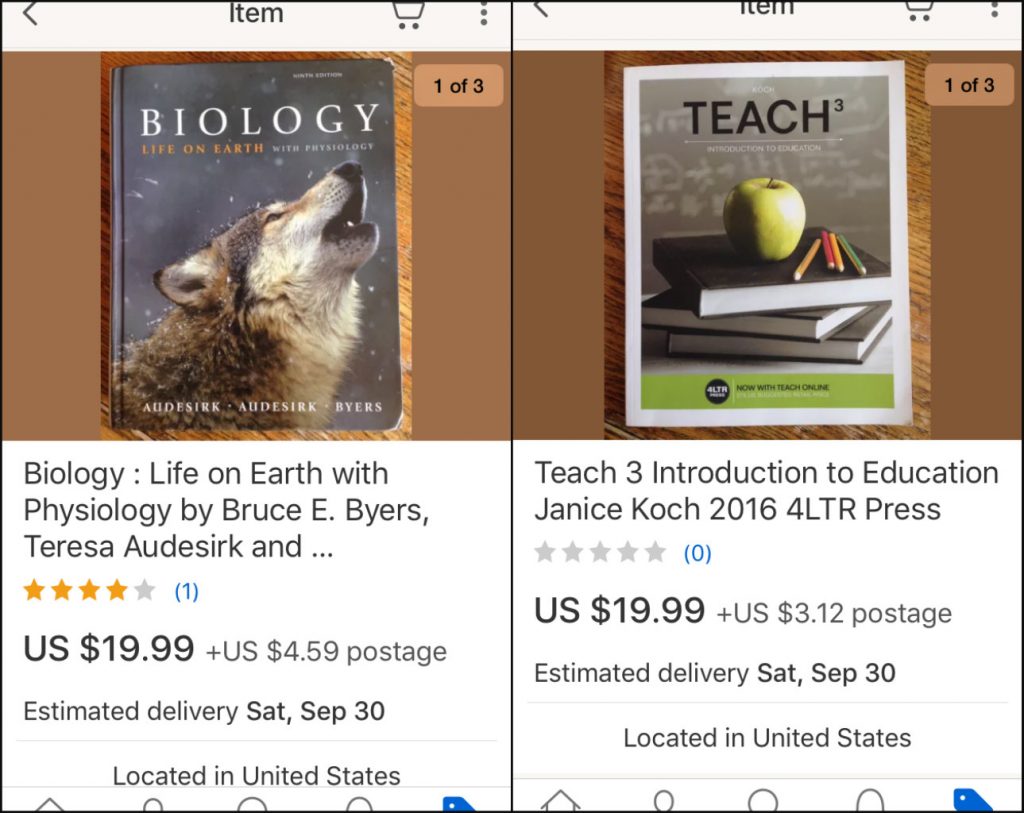

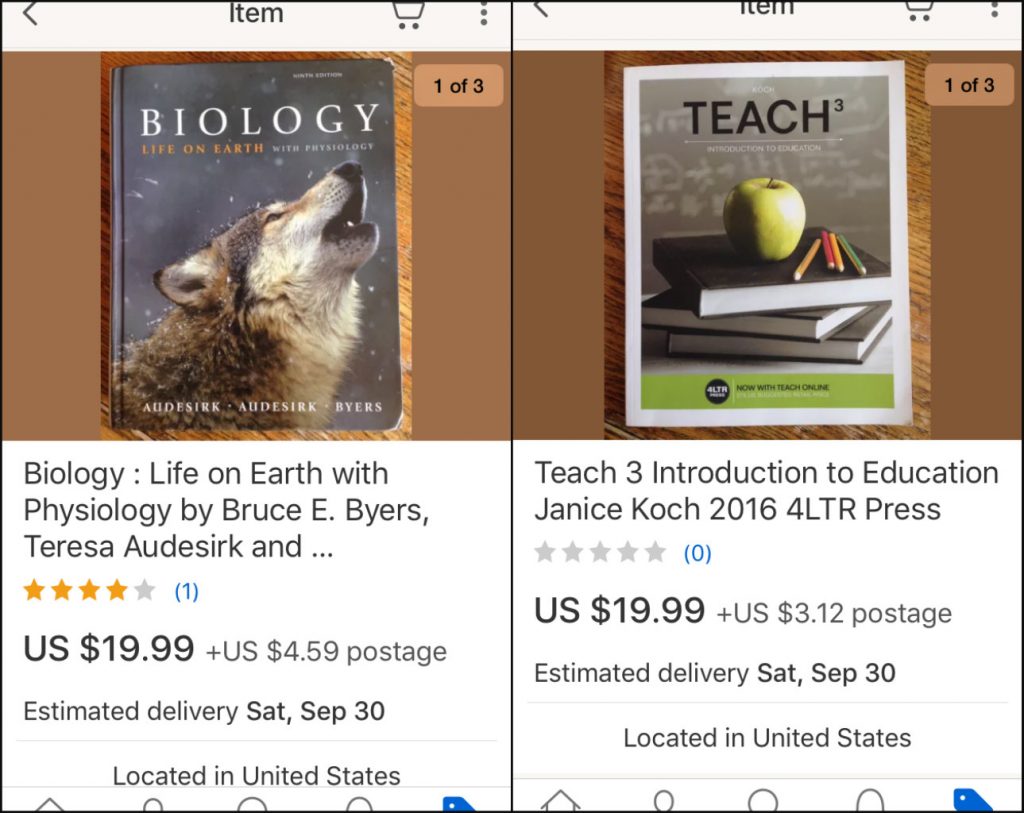

Of course no Non-Consumer Advocate visit to a college town would be complete without some of my signature garbage picking. You threw out your old textbooks? I will scoop them up for eBay!

Including these . . . umm . . . unique sunglasses. Totally my style!

My husband (sporting what he calls his “vacation beard”) and I finally decided that we’d accomplished all we could, and pointed the now empty minivan back towards Portland. The two of us discussed how we keep coming to the Rogue River Valley without ever taking the time to enjoy the breathtaking landscape. This prompted us to sneak in an impromptu hike up Table Rock, although we could only hike around a third of the way since it was getting dark and neither of us had water or proper attire.

Look at those empty nesters. Don’t they look miserable?

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Click HERE to follow The Non-Consumer Advocate on Pinterest.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

I finally got my free hair cut at the Supercuts training center, which is always an interesting experience. Tucked in the back of a regular Supercuts salon, the room is without ornamentation and the approximate size of my minivan. I think if it as a speakeasy, at it’s a special secret for those in the know. Only without bathtub gin.

Zero ambiance for zero dollars.

Of course, I’m not one to complain about decor. I like to save my dollars for more important things than haircuts. You know, like the cost of groceries or a full tank of gas.

Before:

After:

I mostly get my hair cut once a year or so depending on how much it’s bugging me. So I can now check this off my 2024 to-do-list!

This frugal hack is not just local to Portland, as Supercuts is a national chain. I know that my friend Joel from How To Money in Atlanta has employed this specific money saving practice as well. The way I found the person to contact for a free haircut was to just call different locations until I found the right person. Something you can do as well. I’ve gotten my hair cut at the training center four or fives times at this point and have only had positive experiences. All the stylists are licensed and it actually takes less time than at a salon as it’s just the cut without any frou-frou add ons.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

The popularity of thrifting for resale is through the roof right now, which I support with all my heart. Secondhand goods finding new homes while supporting small businesses? Hell, yeah!

I’ve been selling on eBay since 2005 and I’ve learned a thing or two. I’m not intimidated by the shipping process, but there are still a few categories that I prefer to sell locally. This is either due to the impracticality of shipping, (furniture, I’m looking at you!) or because of local stores that’ll buy my items for a quick and easy flip.

One of my absolute favorite items to thrift are vintage lighting globes. This may seem odd, but let me explain. There’s a groovy store in my neighborhood that upcycles old globes into colorful lighting and will always buy from me. This is not based on selling a couple of times, but dozens of times.

So when I saw this $3.99 globe sitting on a Goodwill shelf this afternoon, it was a no brainer to pick it up and sell it ON MY WAY HOME!

A no brainer. (The decision, not the woman in this photo.)

In case my description wasn’t colorful enough:

Will I get rich off this single thrifted category? Absolutely not, but turning $3.99 into $20 with almost no effort is worth it to me. Let’s estimate that I’ve sold thirty vintage globes to this store over the years.

30 X $15 = $450. Worth it.

Of course, glass globes are just one of the many items I’ll thrift for profit. Just a scrap in my patchwork income.

Want to learn more about selling on eBay? Check out this blog post from a few years back.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

My husband and I were driving back from Vancouver, Washington, (which is just across the river) and decided to stop into Ikea as it was on the way home. I wasn’t hungry, but my husband ordered two meatball kid’s meal instead of one adult one, as it’s the same amount of food at $8.58 vs. $9.99. ($1.41 savings!) Instead, they were running a special where it was somehow $3 for his two plates of food using the Ikea family card!

This prompted me to look up their deals once I got home and here’s what I was able to find. Note that you need the free Ikea Family Card.

Monday: Meatless Monday — All plant based meatball plates are $3. (Did the cashier think my husband’s meatballs were veggie?)

Tuesdays: $3.99 adult meals.

Wednesday: Two free kid meals with the purchase of one adult meal.

Thursday: $1 off Meatball entrees.

Friday: 50% off adult entrees.

Weekends: No deals.

Not too shabby, especially since there’s no tipping and the coffee is free.

-

I’m listening to Marge Piercy’s Gone To Soldiers through the library’s free Libby app and reading a Lucky Day library copy of Weyward, by Emilia Hart.

Gone to Soldiers is one of my favorite books ever, but this is the first time that I’ve listened to it as an audiobook.

-

My husband and I stopped into a Goodwill while in Vancouver, but all we bought were a 99¢ commemorative baseball, (my husband) and a 99¢ spice rack, for our son. I still have the remnants of a Goodwill gift card from Christmas, so our out of pocket cost was just 54¢.

-

• I picked up seven discarded 10¢ deposit cans while my husband was at hockey practice.

• I keep two foldable reusable fabric tote bags in purse at all times, which came in handy for the cans. They’re machine washable, which is great as there were a few sticky drips.

• The Supercuts Training Center had to change my appointment time, which meant my friend could no longer go. I got a $12.99 Great Clips coupon in my Instagram feed, so I signed my friend up for the offer. Not free, but still a good price.

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I scored an adorable antique dresser from my Buy Nothing group, which was sorely needed as my son’s old bedroom had devolved into a literal “bed” “room,” as it contained a bed and no other furniture.

I’m trying to avoid spending money on extras as we had a deluge of unwelcome expenses in December and January. My goal is to not touch our savings account if at all possible.

-

I try to balance the giving/receiving when it comes to the Buy Nothing group, so I looked over my eBay inventory for something to part with. I chose four vintage style blow-mold Santas that somehow didn’t sell over the holidays. I list quality items pretty frequently, so I’m not concerned about it being a precise exchange of goods.

-

I finally scored appointments for a pair of free haircuts for my friend and I through the Supercuts training center. I didn’t get a response to my first email inquiry, but a follow up a few days later was a success. The stylists are all fully licensed and often have years of hair cutting experience, they’re simply new employees.

If you’re also looking for a free haircut, call around to see if the Supercuts in your region have a training center for their newly hired employees.

-

• I yelled at a passerby to stop picking my neighbor’s daffodils, which resulted in my neighbor being able to enjoy what was left of her flowers. I rarely absolutely do not approve of theft as a “frugal hack.”

• Someone left an empty kombucha can in front of our house, so I added it to our stash of returnable cans. I’m never going to turn down an easy 10¢.

• A different neighbor borrowed our muffin tins and returned them along with two frosted cupcakes.

• I drove to Safeway to pick up a $1.49 half-gallon of milk and their 99¢/pound chicken quarters. I took a minute beforehand to glance at Ibotta* and loaded a 5¢ coupon for “any brand milk.” Meh.

• I spent an hour or so pruning my backyard wall of hydrangeas and otherwise tidying up our outdoor space. A yard that’s simple enough to maintain on my own is a frugal choice.

-

I didn’t thrift any Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

* Referral link

Like this post? Then please share it with your friends!

Like this:

Like Loading...

When I started writing this blog in 2008, my goal was to share “how my family works with the challenges of living on less, living less wastefully and the occasional obstacles that come up.” It didn’t occur to me how much of a two way street it would become. (Is “roundabout” a better metaphor, with all the cars circling the same center?) Either way, we’re all getting ideas and inspiration from one another.

Today I want you to share your very best frugal hacks, the ones that don’t show up on those useless “lose that latte habit” listicles. The creative, the extreme, the ones from your depression scarred grandparents. The ones we might be able to incorporate into our daily lives.

You’ve heard all my frugal hacks, now it’s your turn. What is your best frugal hack?

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

I stopped by my beloved dented vegetable store yesterday afternoon and shelled out $7.78 for an impressive amount of (actually undented) groceries/produce. Here’s what I got:

• Two yellow heirloom tomatoes.

• One container of cherry tomatoes.

• Three heads of broccoli.

• One container of mixed greens.

• One big yellow squash.

• Two boxes of egg & onion matzohs.

Food prices are predatory right now, so it pays to be creative whenever possible.

-

I walked my plastics wishcycling recycling to New Seasons Market without shopping downstairs.

-

I came across a damp free pile on my way back from New Seasons, but I still took a minute to look through it. I wasn’t interested in the half used toiletries, but I did grab these two plastic organizers, which cleaned up perfectly after a run through the dishwasher. Organizing supplies are my love language.

-

• My husband forgot to use coupons at the grocery store, so I stapled them onto the receipt so I can show them to customer service the next time I’m at Fred Meyer.

• I finished listening to The Immortalists audiobook through the library’s free Libby app.

• My plant cuttings are all starting to show roots, which means I’ll be able to fill my outdoor flowerpots without spending any money.

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

-

-

Fred Meyer sent me coupons for free Ben & Jerry’s and Haagen-Hazs ice cream, which prompted me to walk to the store and buy the ice cream and nothing else. The Ben & Jerry’s Tonight Dough was unpleasantly gritty, like it had defrosted and refrozen, but we ate it anyway as I was free.

I guess you occasionally get what you pay for.

-

I cut forsythia from the garden to force an indoors flower arrangement. My father propagated the forsythia from a shrub at his house/my childhood home. As scrappy as it looks 11-1/2 months of the year, its yellow flowers are so cheering and hopeful when winter otherwise looks like it’ll never end.

-

I mixed up a batch of brown sugar using nothing more than granulated sugar and molasses. Using 1-2 tablespoons of molasses per cup of sugar, it’s about the simplest kitchen hack around. I didn’t start making my own brown sugar until recently so it still seems like magic when I mix up a batch. I used a food processor, but I’ve made it before using a pastry cutter. I suppose a simple fork would work as well.

-

• My husband and I watched the movie Past Lives through the library’s free Kanopy app. Amazing movie, I highly recommend!

• The woman who organized the free haircuts for my local Supercuts training center moved away and I haven’t had luck finding her replacement. I decided to ramp up my efforts and called a couple different Supercuts locations until I found someone with the email address for the new training director. Apparently there’s a training session for their newly hired stylists at the end of the month and they’ll need models (ha!) at that time. Crossing my fingers that my email finds the right person.

• I walked to the library to pick up my hold copies of Katrina Rodabaugh’s Mending Matters and Make Thrift Mend. I’ve only leafed through them so far, but they’re very inspiring. However, they were extremely heavy which was noted on my walk back to the house.

• I stopped into the Trader Joe’s in my son’s neighborhood and picked up two bunches of 19¢ bananas. I had the checker run them as two transactions as we have to use this debit card twelve times per month to qualify for 1.5% interest on our regular checking account.

We recently opened a different credit union account to get a 5.25% high yield savings account, as well as their checking account which kicked back an extra $100 if we used their debit card twelve times in a month. So yes, using two different debit cards, twelve times apiece. Don’t worry, there wasn’t anyone in line behind me.

-

I didn’t thrift any Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

I haven’t thrifted much lately, maybe because I don’t want to clutter my home but mostly because my energy to list on eBay is at an all time low. I really don’t want to buy things to resell if I’m going to actually do the work of listing.

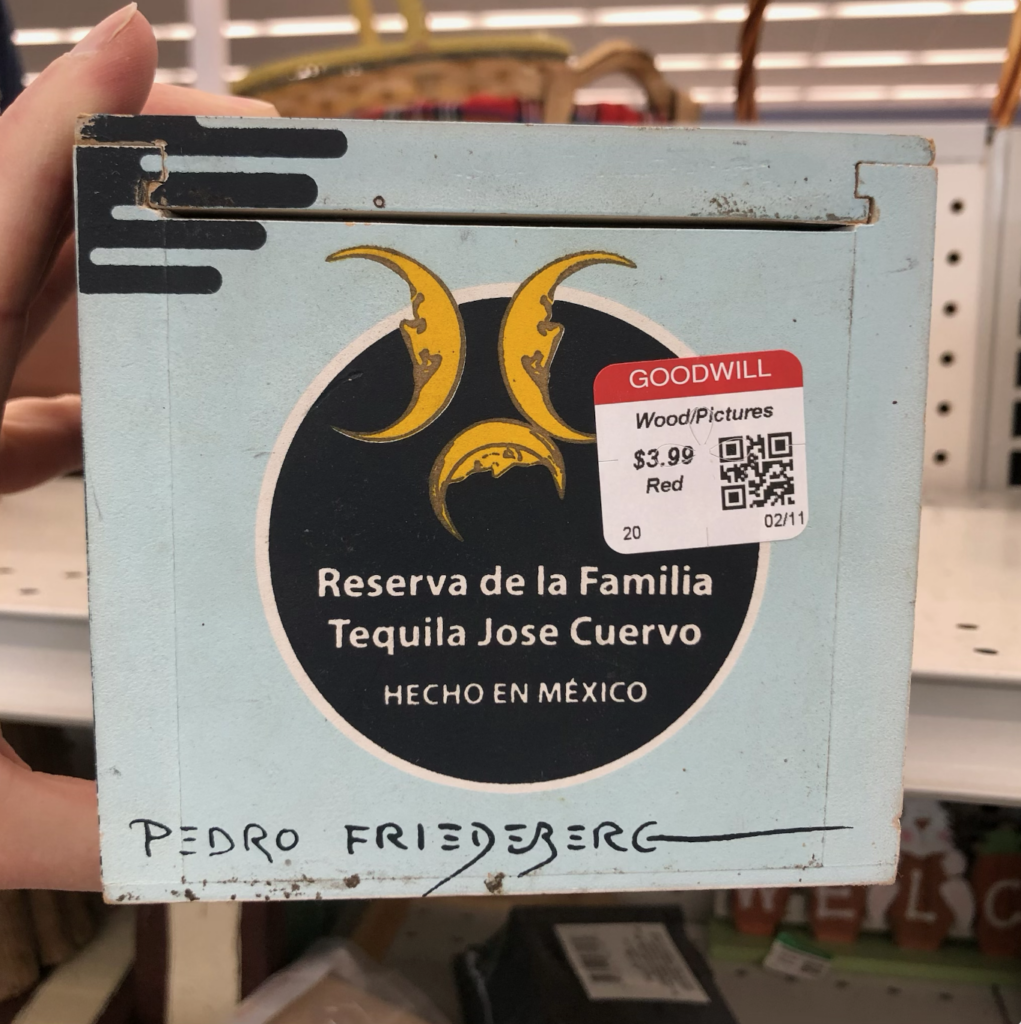

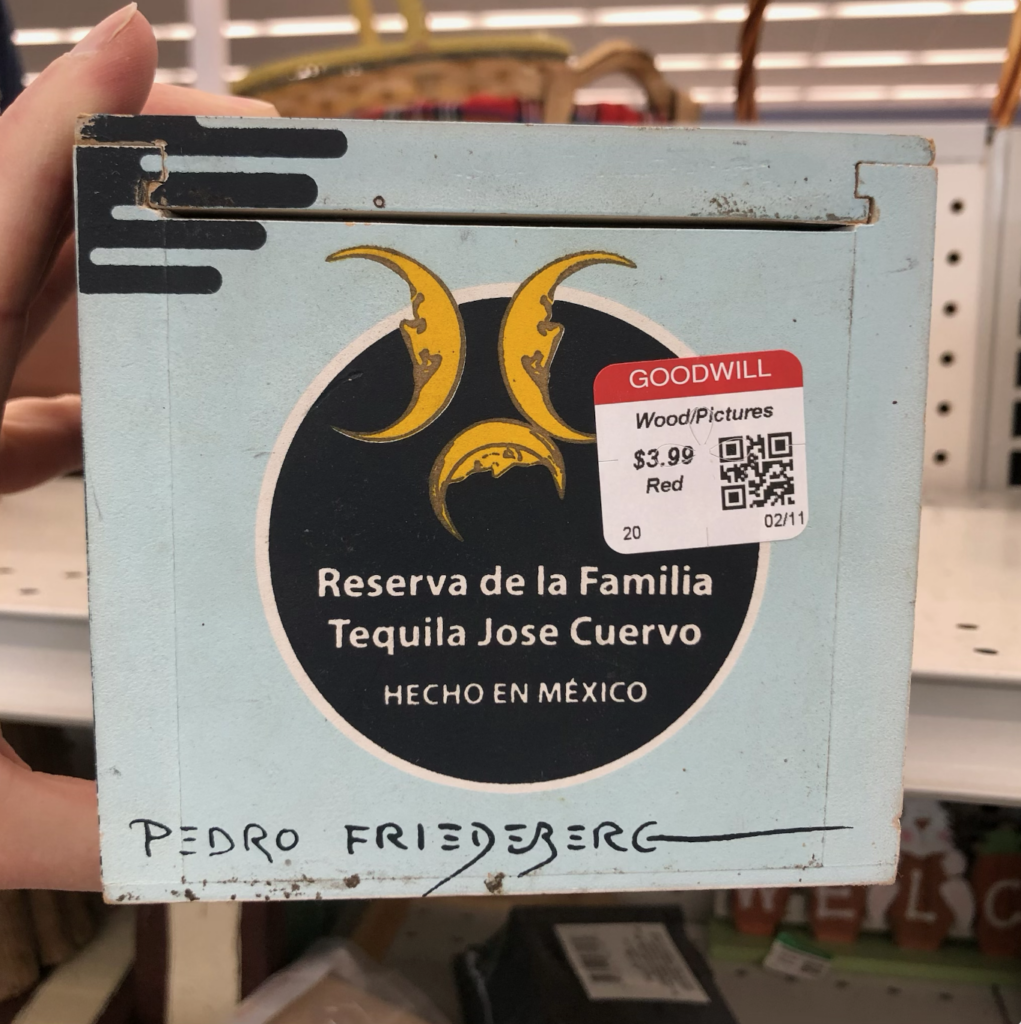

However, I did stop into the Goodwill that’s next to Winco Foods last week and found some unusual items. I didn’t buy anything, but I still wanted to document them for the blog. Oddly, everything was wooden.

This vintage centerpiece (candelabra?) was priced at just $6.99 and I was thisclose to bringing it home, but couldn’t pull the trigger as it would take up a tremendous amount of space to store.

This wooden case caught my eye and I almost bought it as I’ve done well in the past selling liquor related collectibles. Such cool graphics!

The price point was perfect, but I still left it on the shelf.

I love old tile work and this (slightly blurry, sorry) vintage trivet was also priced at just $3.99. Maybe I should have bough it as it wouldn’t have taken up too much space, but alas I left it behind for someone else.

The last cool wooden item is this hand carved wooden corbel. Absolutely stunning and I think it was just $6.99. Yes, I’m a fool to not snap it up, but I was there as an observer not a shopper. To document, not purchase.

Was I a fool leave so much goodness on the shelves? Probably, but Ive made my peace. What would you have bought?

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...

“Ugly” chair

-

-

My husband bought a discounted one year Apple TV subscription at Costco last year, which we hardly watched. I happened to ask my husband about it the other night and he clicked into our account and stopped the automatic renewal, which was scheduled to happen at the end of the month. Close call.

-

I saw an Instagram reel about how you can ask your credit card companies to waive the annual fee as a “retention offer.” We pay $95/year for an airline credit card, so I thought I’d give it a try. I called customer service and although the employee offered to lower our interest rate for services we don’t use, (cash advances, etc.) he wasn’t able to waive the annual fee as it won’t be charged until June 30th. However, he said to call back a couple weeks beforehand and they’d likely waive the $95.

So yeah . . . that’s in my calendar!

-

It took three (very polite) phone calls and two (also polite) emails, but I finally got the Oregon Humane Society to refund the $315 my son overpaid for spaying Mama’s Little Meatball. He’s not able to make personal phone calls while at work, so I took on this task.

-

• I treated my friend Lise to lunch for her birthday and we both happened to want their $12 lunch special, which saved me $8. We then drove over to the main Goodwill where I browsed but didn’t buy anything.

• My son still needs dining room chairs for his new apartment and I found two at Goodwill that I thought he’d like. They were priced at just $5 apiece, so I took pictures to see what he thought. He replied they were “ugly,” which saved me $10!

• I’ve been enjoying leftovers on my own over the past couple days, but my husband is off work tonight so I’m planning a taco/tostada bar for tonight’s dinner. Very frugal as I can cook beans in the Instant Pot and I already have all the other toppings.

-

I didn’t thrift any tiny Lear Jets.

“Use it up, wear it out, make it do or do without.”

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Like this post? Then please share it with your friends!

Like this:

Like Loading...