Note: This post is now also published on The Huffington Post and can be viewed HERE. I would be ever grateful if you would write your comments, and share and “like” it on the actual HuffPo page. Otherwise, the post has zero chance of making it to the front page and being read.

Thank you.

It’s been a difficult three days for America, as we’ve gone from shock to deep mourning for the murdered children and staff of Sandy Hook elementary school. And however you feel about the growing debate surrounding gun control, one consensus has come out of this tragedy, which is to hold your kids tightly.

Appreciate the gift of life that is more fleeting that we can bear to admit.

So when I woke up yesterday to a kitchen full of dirty dishes, a mountain of laundry to put away and living room full of cat hair choked furniture, I asked my younger son if he wanted to go on a day of downtown adventures. (My older son was sleeping, and my gift to him was to let him continue with his favorite hobby as long as he wanted. After I kissed him a couple dozen times, of course.)

The chores could wait.

We chose to take public transportation, as we both have free passes, plus it frees us from the shackles of having to stay close to our parked car. We stopped first at the local Einstein’s Bagels to get a free pumpkin latte to share, as well as a toasted and buttered jalapeño bagel for my son, which we did not.

We stood in the rain and waited for the bus, and talked about nothing and everything and passed the overly sweet latte between the two of us. And I ached for all the Connecticut parents who had these future moments stolen from them.

No shepherding a child into adulthood, no shared coffee drinks, no worries about high school grades that will determine college opportunities.

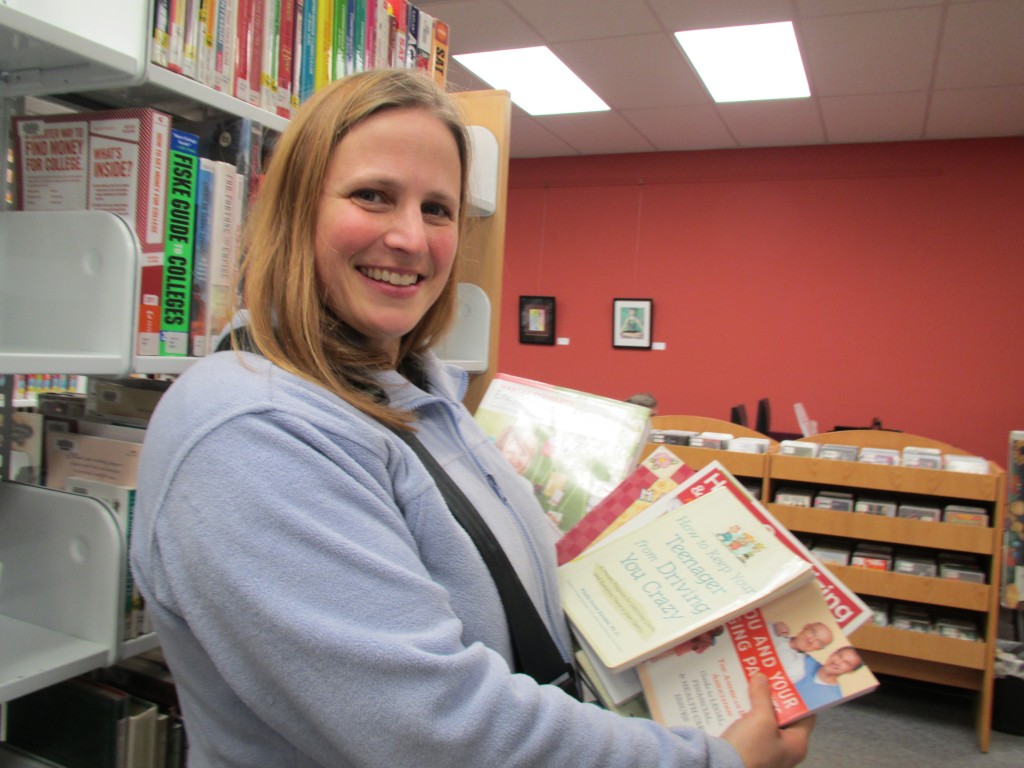

My son and I wolfed down food cart falafel in the rain, browsed expensive European soccer magazines (him) and decor books (me) at Powell’s bookstore; ogled the couches at West Elm and Mitchell Gold + Bob Williams (me) and hunted through the clothing at Buffalo Exchange (him.)

We made a joint decision to check out the westside Goodwill and hailed another bus for the short yet uphill and wet journey. I picked up a few small things for my sister’s birthday and my son lamented that all the new looking Vans shoes were either too small or bizarrely overpriced.

The bus ride home ended with a long and chatty walk that included a detour through the holiday lighting of Peacock Lane and free slices of cake from a Walgreen’s grand opening. We were both good and tired by the time we staggered home, although I did load the dishwasher enough to run a single load. Our evening consisting of a couple of Buffy the Vampire Slayer episodes (me) and the newest Saturday Night Live (him.)

No laundry, no chores, just me staring at my son and holding him tightly.

And when my older son needed me to drive him far across town for a poker game, I did not whine about it. Even when he needed to picked up at 11:30 P.M.

For today I have these kids, and I will hold them tightly.

Katy Wolk-Stanley

“Use it up, wear it out, make it do or do without.”

Click

HERE to follow The Non-Consumer Advocate on

Twitter.

Click

HERE to join The Non-Consumer Advocate

Facebook group.

Click

HERE to follow The Non-Consumer Advocate on

Pinterest.Like this post? Then please share it with your friends!

Like this:

Like Loading...