Turbotax Deluxe Giveaway!

This giveaway has ended, congratulations to Karen and Susan whose names were randomly chosen to win. Thank you to everyone who took the time to enter.

Katy

I'm very particular about which companies I promote on the blog. I get daily offers from companies that want to partner with The Non-Consumer Advocate, and I turn down 99.99% of them. Because seriously, what kind of hypocrite would I be to write a blog about not buying new and unnecessary stuff and then turn around to stamp my name on endless consumer goods?

But I always feel good about lending my name to Intuit's TurboTax. My husband and I use them to prepare our taxes, and as much as I would love to not spend money on taxes, I do love schools, libraries, safe drinking water, paved roads, disaster relief, public transportation, and properly maintained infrastructure. (You know, the good things that our tax dollars pay for.)

And that's why I reached out to TurboTax to set up a giveaway. We used to hire an expensive accountant to do our taxes. This was leftover from when my husband ran his own commercial photo studio and needed to depreciate his equipment, and the job was over his head. But I finally convinced him to at least try doing our own taxes. We haven't looked back. Our taxes are complicated by my extra income (and expenses) from cleaning my mother's guest cottages and running a certain little blog. But that's made easy with TurboTax, which gently walks us through the finicky stuff.

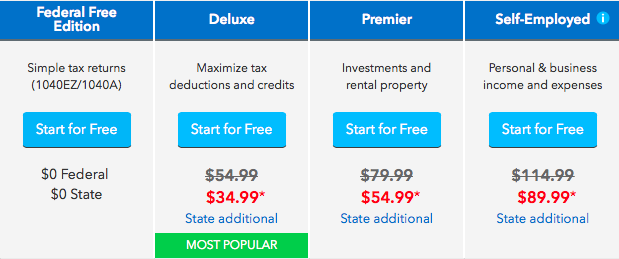

Today I have two online deluxe versions to give away, which include both the federal and state filing. (I know it says "State additional," but I've been assured that the state is included.)

To enter to win, all you have to do is write your name in the comments section of the blog. I will randomly choose the winners on Sunday, March 5th at 9 P.M. PST. Winners will be provided with product codes.

Good luck, and happy taxing! May your tax refunds be large and plentiful!

Katy Wolk-Stanley

"Use it up, wear it out, make it do or do without."

Click HERE to follow The Non-Consumer Advocate on Instagram.

Click HERE to join The Non-Consumer Advocate Facebook group.

Click HERE to follow The Non-Consumer Advocate on Pinterest.

Patsy Wilken

Shammi Whitaker

Mary DeMuth

Sally Curran

Julia Sirrine

Sarah Keil

Naomi Knoble

Patience Anders

Juhi Aggarwal

Sarah Davis

Allie Lunden

Karen Luks

Shannon Yates

Gayle Erwin

Deb Burtner

Lila Kline

Abbe Trent

Leslie Gould

Maria Reames

Diana

Melinda

Tracy Reeve

Jacinda Johnson

Betty Winslow

Zoey OConnor

Thank you for thinking of us!

Jackie Taylor

Jennifer Lutz

Beth Ann Bryant-Richards

My name is Mary and I would love to win! Turbotax is awesome!

Karen L

Debbie Ricks

Jacqueline Ferrara

Dale Emanuel

Ok, I'm not sure how Turbotax works (I'm a tiny bit of a Luddite I must admit). Can it be used year to year or do you buy it yearly? If you can use it year to year, I'd love to be included. If not then please don't include me because my taxes are done for the year.

Thanks, Pattilou

Turbotax changes every year to keep up with tax laws. You do your taxes on the website, and pay when you file (although I believe it's free if all you're filing is a 1099), so it's not something you can pay for once and keep using. There's usually a coupon code on RetailMeNot and similar sites. It does store your past years' tax info, so you don't have to re-enter all your information the next year. State taxes are an additional fee, but I use my state treasurer's website instead of Turbotax for those. I used to do my taxes by hand on paper, and Turbotax is extremely worth it for saving time, helping you make sure you take all the deductions you can and doing the math for you.

Thanks for the info Diane!

Trisha

Thank you!

pamela james

Tamara Watson

Morgan Willhite

Tammy Mahar

Busy Bee

Dana Werstler

Bonnie Pagel

Claudia Taupier

Sarah Mace

Sherrie Clarke

Maryanne Sivers

Karen

Ben Brewer

Hilary 🙂

meg jacobson

Linda Vance (though I really need Premier - I know I can upgrade.)

Thank you.

Susan Keene

Kate McTrusty

Sarah F

Meredith Brasher

Karen Gallo

Tabitha Watson

Sweta

Kasey B

Kim Davison

Holly Russell

Amanda Gibson

Denise Wall

Emilee

Jennifer

Here's hoping!!

Alicia

Amy Elsesser

Julie Hepworth

Katie Brower

Susan Bloom

Nancy Tallman

Kim Stewart

Jodie moody

Dawn ORowe

Yara Sellin

Jamie Jewell

Brenda Johnson-Asnicar

Melissa Braam

Danielle Jones

Kate

Amy Owen

Elissa Barnett

Deanna K.

Kathleen

Mimi Lising

Becky Narofsky

Becky Narofsky, not looking forward to taxes

Alicia Cole

Sarah Schneider

I already have my copy but I want to also talk about how easy it is to use the deluxe version. Turbo Tax has the ability to upload your data which makes it even easier to use, so I give it the thumbs up as well!

Beth Raymond

L. Bryant

Kate

Rosario Infante

Linda Jordan

Carolyn S.

Thanks for doing the giveaway!

Susan Jones

Roberta P.

Linda S

Elizabeth Iezzi

Amy Shein 🙂

Kat Herbison

Rissa Obcemea

Henria O.

sazzyfrazz at gmail dot com

Mary Ann Lasky

Mal.

Thanks for a great giveaway!

Gigi L.

Meaghan McGraw

Susan P. Thanks!

Victoria Kopp

Heather Ruark

Nicole Wilson

Betty Boudreaux 🙂

John R

Sarah G

Stacy Montero

Shelia O.

Lori C

Cheryl Braun

Jeana O'Connor

Amanda Moore Thanks for the opportunity!

I LOVE Turbo Tax! Already used it for this year. It makes things so much easier and simpler. A lot less tax-related fights around our house since we started using it. 🙂

Heather C

Nanci Quinn. Thanks!

Teresa Weber-Freeman. Would love it. Freelance graphics, now that I have so little business it's very expensive to hire my guy every year for over 20 years. And if not I'll look into it anyway.

A question though... My tax man uses software. Is it possible that he uses TurboTax or would that be only for individuals and not for professionals. He made a mistake last year and it caused a problem for me, so why not do it myself? But maybe too complicated.

Kathy Magee

Chari Crowdis

Cindy Barr

Lisbet Williams

anna chan

Kristie Lawrence

I've already done my taxes through TurboTax this year so I won't be entering the giveaway...but wanted to shout my praises for them! We have straight forward taxes that and it jut makes sense to spend $30ish on TurboTax rather than $150+ on a tax professional. Although, we do spend an extra $25 having one of my dad's employees do our city taxes...we have a RITA system and it so so over my head that I don't even want to bother!

Laurie Adkins

leticia jauregui maciel

Alex

Thanks

Elise C

Jennifer W.

Sheila Dowe

Anne Hinton

Lucinda Burton

I love Turbo tax. It makes a complex job so much less aggravating.

Mindy Moots

Thank You!

Sheila Lukenbill

Tara Huff

Jo Lynn Blankenship

Alison Barclay

Laura Peterie

Sharyn Fisher (Thank you for thinking of us!)

Alice

Mindy S

Joanna

Joanna G

Jody Parente

Theresa Palmer

Chris Wolfe

Glenda Rainbolt

Sarah Fredericks. Thanks for this great give way, Katy, and for the great blog!

We have tried other online tax software but not TurboTax yet; would love to try them - Thanks! Suz

Mary vu

Robert Walker

Kim A.

Jackie Brown

Rebecca Schleeper

Steven Laube

Diana Appel

Sandi Link